A RECENT article on Man Wah Holdings got me interested in this company which delisted from Singapore in late 2009 and relisted in Hong Kong.

So I decided to study this business to see why is it possible for it rebound quickly after the Lehman crisis in the US and property slowdown in China. Man Wah has a very simple business. Its sells reclining sofas and mattresses. It is not exactly a furniture company per se as it focuses mainly on these 2 products and outsources the purchase of other furnishing products.

This is a crucial point because the scope of the furniture business is very wide. There are great difficulties in creating a common brand for all the furniture items that fall into this category (unless you are IKEA) Man Wah’s CHEERS brand of reclining sofa is the No.1 leader in China’s reclining sofa industry (16.2% market share) and ranked 8th largest (2.6%) in the US market.

In the US, it is positioned as a mid-tier value for money brand (US$500-1000 per set), while in China, it is a slightly upper-middle market brand (RMB10,900 per set) In China, Man Wah has a strong distribution network. At the end of 1H2010, the company had 225 stores run by distributors and 71 self-operated stores across 20 provinces in China.

The company said in its IPO prospects that it expects to add another 70 self-operated stores in FY2011.

Sales in China is growing more rapdily than its ODM exports. The management expects to boost PRC sales to 35% as a percentage of total sales by FY2012. Currently, the Company’s domestic sales accounted for 25% of total sales. Man Wah's ENLANDA mattress division accounts for 8% of sales. It has 213 stores handled by distributors and 50 Self-Owned stores. ENLANDA is positioned in the mid-high end niche market.

Why I like the company

Track record

Man Wah has been growing since it listed in Singapore back in 2004. There was a slight hiccup in profit growth the subsequent year to the IPO due to a rise in leather prices but the management has proved that they can grow the business in crisis and boom years. This is a track record that deserves some attention.

The global reclining sofa industry remains dominated by American brands that continue to be produced mainly in the US. Man Wah is the ONLY Chinese brand in the top 10 of the N.American recliner sofa market and is clearly gaining market share rapidly.

The Company said that this is because it combined lower costs (China production and scale) together with good quality, comparable to the US brands like La-Z-Boy, and sells at a discount to them (around 25% cheaper than La-Z-Boy).

I generally believe that this cost competitive factor has been overly inflated.

Quite a big chunk of production also goes to Vietnam where the Americans have a better control over the local authority. The fact that Man Wah is the only Chinese brand among the top 10 North American recliner sofa brand makes me sit up and want to know more about this Company. It is never easy selling to the Americans who demand cheap products yet with high stringent quality checks.

So this fact shows that the quality of Man Wah’s products is certified. And they have managed to get cost-quality balance right. This is not easy. Many Singapore manufacturing companies have failed this test. They emphasize too much on quality and check controls and got squeezed on the margins.

China domestic consumption story

People who go to China to live and not travel as tourists will know that it is a booming market now. While there are millions without jobs, there are also hundreds of millionaires being created weekly due to the floatation of their companies on stock exchanges, selling of mines, or even doing JV with foreign companies.These people don’t just want comfortable furniture. They want something unique and impressive so that they can show off to their friends and relatives. Man Wah’s recliner sofa fits that bill.

Euromonitor said that CHEERS is the largest recliner sofa brand in China with a 16.2% market share. Currently, the penetration rate of recliners in China is very low. The entire market is projected to sell only 315k sets in 2010, or 1 in every 1,320 Chinese households. While not every household will buy an American style sofa, you have to realise that there is a very big untapped market in China.

In this area, Man Wah is doing its part in raising awareness for its type of recliner sofa by increasing its marketing and promotion efforts. It retains Sun Hong Lie, PRC leading movie star, as the brand spokesman and have signed Ogilvy & Mather to help to create a world-class PRC brand. In terms of distribution channel – Most of the distributor’s stores are in 30 to 40 tier 2 and tier 3 cities.

The Self-owned/Retail stores are more focused on Tier 1 cities (to date limited to 14 cities). This geographical expansion strategy explains the strong performance the Self-owned stores are showing in units sold per store. The Company said in the prospectus that the nationwide coverage is a key step in achieving the scale needed to cement the current dominant position. I fully agreed with that. Most of the S-chip companies listed in Singapore are regional players.

They are very strong in their own provinces but once they step out of this comfort zone to penetrate other provinces, they lose out badly. Man Wah has already established its presence in key tier 1 cities and is expanding into tier-2 cities. This is a good sign that they are preparing for the nationwide strategy.

Financials

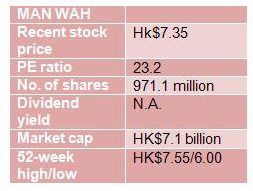

Financially, the Company is in a net cash position after the HK listing. Their FY2010 results should be coming out soon as their financial year is March 31. I would elaborate more after seeing their FY10 results.

The author has taken a small position in the company after studying the company’s prospectus. He will study the upcoming results before deciding whether to increase his position.