Excerpts from latest analyst reports ....

CIMB-GK raises target price of ACTION ASIA to 40 cents

Analyst: Jonathan Ng

Reiterate BUY with higher TP. Action post a solid set of 1Q10 numbers, driven by higher shipments of portable DVD players to its major customer, Philips.

We believe the positive momentum will continue, underpinned by its continuous effort to deliver innovative consumer lifestyle entertainment products.

We have left our FY10-12 forecast unchanged for now. Action remains attractive, trading at less than 3x CY11 P/E and below its CY10 book value. We have raised our target price from S$0.31 to S$0.40, pegging Action at slightly below 6xCY11 P/E, offering 100% upside potential.

What we like:

• Robust yoy revenue growth of close to 100%, suggesting that demand for its innovative products via Philips remains strong.

• Gross margin expansion despite rising panel prices, reflecting the positive operating leverage.

• Strong free cash flow on the back of shorter cash cycle days vs.4Q09, enabling Action to return to marginal net cash position.W

What we dislike:

* Spike in other operating expenses due to greater R&D, distribution and selling, and warranty expenses as a result of the higher sales.

• Rise in inventories vs. 4Q09. However, this was due to anticipation of higher demand in the coming quarter.

Recent story: ACTION ASIA: On dividend cut, soaring growth prospects, etc

Standard & Poor's initiates coverage of CHINA NEW TOWN, forecasting RMB295 m profit in 2010

Analyst: Kah Ling Chan

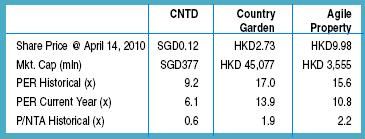

As the pioneer new town developer, CNTD offers investors unique entry into the Chinese property market, at the Tier-1 level, where raw land is carved into major townships and revenue is derived from sale of land to property developers.

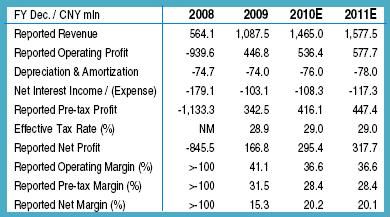

Earnings hinge on the sale of land, as more than 90% of CNTD’s revenue emanates from this division. With three projects currently in its stable, CNTD’s forward earnings are certain, if the land sale auctions are held consistently.

• Given the difficult in ascertaining the exact launch dates for land auctions, we have conservatively, kept to 2009’s sales schedule, which includes sales of two plots each in Wuxi and Shanghai respectively, but revenue is set to increase in our opinion, due to the higher sales prices that can be achieved when compared to 2008 selling prices.

• Going forward, CNTD needs to parlay its expertise into getting more projects for development.

As it is not building traditional brick and mortar projects, gestation from the first acquisition of the project to the launch of land sales can take five to seven years.

Management has indicated its desire to move inland, especially to second tier cities,which offer the most opportunities.

• Though we believe that there is near-term headwind given the current hot Chinese property market, we remain positive on the longer-term prospects. Rising income, coupled with further urbanization, will continue to bode well for the Chinese property market, and CNTD will be a key beneficiary.