Venue: Mandarin Orchard Hotel

Venue: Mandarin Orchard Hotel

Date & time: 10 am, April 21

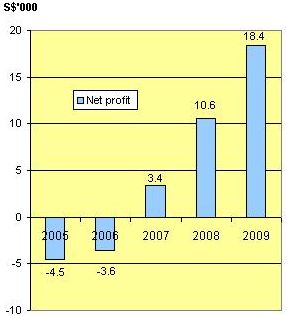

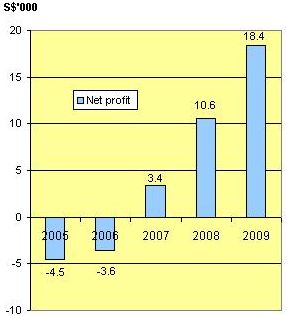

ACTION ASIA’s net profit soared 75% to $18.4 million in FY09 but it proposed a final dividend of 1.0 cent, down from 1.2 cents, a share in the previous year.

That made a shareholder yesterday question the cut at the company's AGM - even though the dividend yield stands at 5% based on a recent stock price of 20 cents.

The answer from the management was more than appeasing.

Dato' Lai Pin Yong, a non-executive director, said that the company had intended to pay a higher dividend but its effort to raise funds through a listing of its shares as TDRs in Taiwan did not materialize last year.

Action Asia (stock price 20 cts) trades at PE of 4.2X last year's earnings.

More significantly, after enjoying a surge in sales last year, the company is expecting strong growth to continue this year – and thus needs to set aside more working capital.

Its major customer, which accounts for over 90% of its revenue, is Philips, the global MNC, which gets up to 90 days to pay its bills.

Action Asia’s trade receivables as at the end of 2009 stood at about $90 million, compared to $25 million as at end-2008.

Asked to elaborate on the growth prospects, the Action Asia management said that last December, the company started trial runs in its new factory in Shenzhen, which has a production capacity of 10 million units, up from about 3 million in the previous rented factory.

Thus, the full effects of the new factory's enlarged production capacity will be felt from this year.

Action Asia expects the factory’s production volume this year to be 5 million units of “consumer lifestyle entertainment multimedia products”, such as portable DVD players, digital photo frames and home DVD players.

On top of that, its factory in Penang, Malaysia, became profitable last year (after a loss-making FY08) and continues to see higher orders for its in-car entertainment systems from customers in the US and Malaysia.

Asked about challenges facing the company, Dato' Lai noted that the cost of raw materials is rising. However, Action Asia’s R&D team is working to deliver a pipeline of innovations that will enable the company to maintain its profit margin.

Action Asia's new factory in Shenzhen has a production capacity of 10 m units of products, versus 3 m in the previous rented factory.

1Q net profit soars 104% to $5.3 m

AFTER THE market closed yesterday, Action Asia reported a 95% jump in revenue for 1Q this year to $68.9 million.

Net profit attributable to shareholders soared 193% to $5.3 million.

Net tangible assets per share stood at 20.42 cents a share, up from 18.9 cents at end-2009.

On 5 Mar, CIMB-GK’s seasoned technology analyst Jonathan Ng, who is the only analyst covering this stock, had issued a ‘buy’ recommendation and a target price of 31 cents for the stock.

The company's 1Q results statement is available here.

Venue: Mandarin Orchard Hotel

Venue: Mandarin Orchard Hotel

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors