Benjamin Chan

Benjamin Chan, 42, an actuary with an international reinsurer, owns shares in Man Wah Holdings.

On Wednesdary (Feb 11), he attended a briefing on the company's results (net profit for the third quarter ended 31 December 2008 grew 14.7% to HK$56.2 million), and filed the following notes and observations:

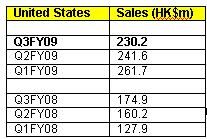

MAN WAH'S sales to the United States continued to trend down (though not sharply) from Q1, reflecting the ongoing housing problem there. Q3 sales were still 32% higher than last year, however.

Management said the growth (vs a year ago) is a combination

Source: Company

Management also acknowledged that some customers have slowed their order flow. However, overall, Man Wah is still guiding for continuing orders coming from the US.

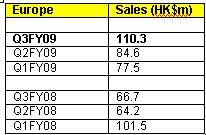

The pick up in sales from Europe was in line with management guidance during the previous results’ briefing.

I am glad management has once again delivered on their guidance.

Sales up as per management guidance previously.

Most of the new sales were from a few big new customers in UK and Spain despite the housing market problems there.

This higher level of sales is expected to continue in the future with these new customer acquisitions.

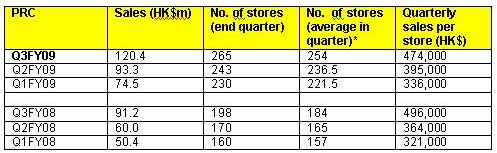

In the PRC, the sales per store were 4% lower than a year ago, reflecting lower consumer spending when the economic uncertainty was at its highest.

It is unlikely that Man Wah can achieve the number of stores target set for Mar 2009 but it will continue to focus on increasing sales per store. The government push for domestic spending should help.

* No of stores at end of Q4FY08 and Q4FY07 are 213 and 154, respectively

* No of stores at end of Q4FY08 and Q4FY07 are 213 and 154, respectively

Analyst briefing at Republic Plaza was well attended. Photo by Dave Tan

No major capex

The Average Selling Price (ASP) dropped slightly this quarter in line with the reduction in raw material costs. Price discount were given to promote sales in selective cases.

The ASP policy is determined by the costs of production and raw materials. Though gross margin is lower than in previous quarter, it should stay above 30% going forward.

Management expects Q4 top line to trend down with the continued reduction in ASP associated with a drop in raw material costs, while Q4 bottom line is expected to be maintained at current level.

Management did not disclose exact plant utilization level but indicated that it is at a level not too different from previous quarter’s (which is 60%+). No major capex is expected as guided previously. The increase in borrowing in Q3 is due to a commitment made earlier on fund drawdown for new show room and other plant building expenses.

Man Wah finance director Francis Lee at the company production line.

Loan level will drop as no new loan drawdown is expected in Q4. The slight increase in tax rate is as per guidance given in previous quarter. This is expected to trend to a sustainable level of 8% in future. Inventories were reduced mainly due to lower value of raw materials reflecting FIFO accounting.

This is NOT because of lower expectation of production. Order visibility is 2-3 months with production remains at current level. The high increase in admin expense compared to a year earlier is mainly due to the increase in manpower including professional expatriates (an example is Sam Contreras who joined Man Wah USA at end-2007 as VP of sales and marketing).

Comparing with the previous quarter, the admin expense actually dropped 14% from HK$30.3 m to HK$26.0 m. This resulted from a cost-streamlining exercise started in the quarter and which will continue into Q4.

Some office staff have been retrenched though production workers have not been affected as management does not foresee any significant reduction in orders. Management does not expect any bad debt problem either since most of the receivables are secured with factoring and trade insurance.

Notable positives

Management changed the depreciation policy for leasehold improvements from 5 to 2 years. Without this change, the net profit would have been higher by about HK$5.5 m (net of tax) to HK$61.7 m.

The increase in net profit would have been an even more respectable 26.0%! The company could have disclosed this higher number in its press release - the fact that they didn’t is another demonstration of good management.

Some of Man Wah’s export competitors are falling victim in this crisis and Man Wah is benefiting with their momentum to increase market share.

Its good track record has shown that its business model (low cost, good quality, PRC retail, export direct to big retailers) is working well.

According to the management, conditions are improving in the PRC and banks have started lending again. No doubt there are plenty of challenges ahead, but I believe the company is in a solid position to overcome this downturn and emerge even stronger.

Recent story: BENJAMIN CHAN: "I'm a focused investor"