Excerpts from latest analyst reports….

DMG & Partners initiates coverage of OCEANUS (38.5 cts) with 53-ct target price

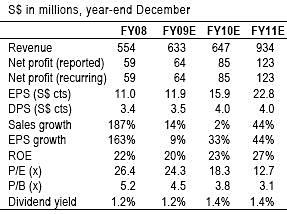

Analysts - Tan Chee How and Terence Wong: Oceanus, the largest land-based abalone producer, is gunning to be the first vertically integrated abalone group. Its tie-up with renowned restaurant chain, HK-based Ah Yat Abalone Group, is particularly exciting.

With plans for 170 stores by FY11, the JV may be able to rake in as much as RMB100m in earnings. If it were to list by then, it should be able to easily dwarf all restaurant groups in Singapore. Organically, its production business continues to thrive and we expect stronger sales in FY10.

Attractive vis-à-vis peers. We expect Oceanus’ PATMI (profit after tax and minority interest) to rise 46% and 25% for FY09F and FY10F respectively on the back of growing number of profitable retail outlets and the contribution from the processing business.

Our target price of S$0.520 is based on a 30% discount to the peers’ P/E relative to their respective indices (15.6x FY09 and12.2x FY10 P/E). The implied PE of the target price is 12.2X FY10 earnings.

JP Morgan raises HYFLUX’s ($3.02) target price to $3.80

Analyst - Ying-Jian Chan: The recent MOU for global collaboration with the Japan Bank for International Cooperation (JBIC) on water projects could kick-start a wave of new projects from China, where a large number of contracts are up for tender following the Rmb4 trillion stimulus package rolled out by the Chinese government.

This could help boost Hyflux’s S$952 million EPC order book. We believe the joint-venture structure of the JBIC collaboration should be finalized in the next few months.

Capital recycling accelerated: The collaboration could also potentially see an acceleration of the capital recycling process, as we believe a platform is now available to create an infrastructure investment fund that will help unlock the bottleneck for growth. Some of the outstanding BOT order backlog may also be divested into the JV company with Japanese investors, such that Hyflux may be able to monetize its investment sooner, and subsequently pursue the cash-flow-positive business model like in MENA for future China BOT projects.

Maintain Overweight, and raise Jun-2010 PT to S$3.80 as we raise the P/E applied to China EPC in our SOTP valuation from 6x to 12x (in line with peers) on the back of the higher probability of order wins with the JBIC collaboration. Our revised PT implies an FY10E/FY11E P/E of 24x/17x.

The stock traded mostly above 30x P/E during 2007 on the back of a slew of China BOT contract wins, and we believe (1) the greater order book visibility now, (2) cash flow positive project structure, and (3) potential set-up of infrastructure fund with Japanese investors will create imminent re-rating catalysts.

Citigroup reiterates ‘buy’ on SPH ($3.75)

Analyst – Rigan Wong: We reiterate our Buy (1L) rating on SPH. The investment thesis we put forth in our July 22 report remains largely intact, and we think SPH remains a good proxy to Singapore’s V-shaped economic recovery.

SPH’s core media P/E tends to trade at a premium to the STI, but our S$4.20 TP (target price) is based on a conservative 18.4x FY10E core media P/E (or 0.5 s.d. below mean) and a ~15% discount to the latest external valuation for Paragon, implying upside risk to our TP. SPH is a Singapore top pick.

Recent story: OCEANUS: Looking forward to better Q3, Q4