Dr Ng Cher Yew, chairman, Oceanus. File photo by NextInsight

ON THE FACE of it, Q2 ended June 30 wasn’t a great quarter for Oceanus with sales down 44% year-on-year to RMB 73.5 million.

Net profit came in at RMB 79.5 million, down quarter-on-quarter from RMB 107.6 million in Q1 of this year.

OCBC Investment Research analyst Lee Wen Ching described the Q2 results as being “uninspiring” but Dr Ng Cher Yew, executive chairman of Oceanus, sought to put things into perspective when he briefed analysts on Tuesday.

”There’s a difference between what we can control and what we can’t. What hit us were prices and valuation, rather than quantity and sales,” he said.

In other words, market prices (which Oceanus couldn't control) for abalones went down (10-15% year-on-year) as the economic crisis pulled down consumer spending on abalones, and the valuation of Oceanus’ abalone population went down with the fall in market price.

However, in tonnage terms, Oceanus achieved better sales: 311.5 tonnes of abalone in Q2 compared to 270 tonnes in Q1, and 581.5 tonnes in 1H09 versus 569.2 tonnes in 1H08.

And sales could have been higher in Q2 if not for RMB 23 million worth of abalones that were processed to become canned abalones and which were accounted for as inventory to be sold later to customers. There was no processing and canning prior to this year.

Abalone-based dish at Ah Yat Tiax Xia. Photo: www.ahyattianxia.cn

Moving on, Dr Ng reckons that the consumer sentiment is picking up, which could translate into better market prices for abalones.

”I don’t think prices will go down. It has stabilised. It’s just that it’ll take some time for it to come up. Next year will be a good time.”

An analyst asked: What needs to happen for prices to move up?

Dr Ng’s reply: “There should not be panic among restaurant owners. They had offered promotional discounts and pressurized everybody else. Consumer confidence needs to come back, and prices will rise. For bigger abalones, you have to compare with Australian and South African abalones. They have dropped substantially – 50% - they took the market down.”

Aside from stable prices, Q3 and Q4 results are expected to be boosted by Oceanus' business cycle. In the current Q3 and subsequent Q4, a large number of abalones in Oceanus' farms will reach nine months to a year old and will be transferred to cages.

From then on, they will be included in the valuation of the company's biological assets, which will show a rise in Q3 and Q4, assuming market prices don't fall. A rise in the fair value gain would directly boost Oceanus' bottomline.

What DBS Vickers and OCBC say

DBS Vickers analyst Patrick Xu yesterday (July 29), in a note to investors, said that “Oceanus is in a fast growing ramp-up period, and we expect its 2H09 earnings to be substantially higher than 1H09."

He said the execution of the growth strategies so far has been in line with his expectations, and Oceanus' recent issue of S$73.5m debt with warrants will fulfill most of its remaining capex for FY09 and at least 1H10.

He made no change to his earnings forecast, maintaining a ‘hold’ rating but raising the target price to S$0.38. That's based on 8x FY10 adjusted EPS, as he rolled over to FY09 &10 blended adjusted EPS.

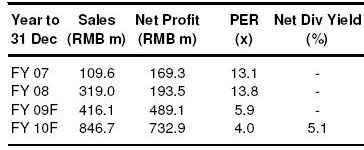

OCBC Investment Research's forecast of Oceanus' performance.

”We believe the current share price has fairly priced in most of its growth potential, as compared with its peers. Downside risk lies in the execution of the growth strategies.”

OCBC Investment Research’s Lee Wen Ching, in her report yesterday also, said that Oceanus' restaurant business, Ah Yat Tiax Xia, would figure increasingly strongly in Oceanus' financial results.

“We expect Ah Yat Tian Xia to drive the group's growth as the chain gains critical mass and reaps economies of scale. Further driving Oceanus' downstream integration is its new processing plant, which is on track for completion in 3Q09.

”The plant will fully automate processes that are currently manual, and could lift capacity by 10-fold over the next two years. Overall, Oceanus remains on track with its long term growth plans. As such, we maintain our BUY rating and S$0.40 fair value estimate on the stock.”

Recent story: OCEANUS: My awe-inspiring visit to its farms