* Saizen REIT, which owns 166 properties located in 13 regional cities in Japan, has just reported a 4.8 billion yen loss for FY09 (ended June), mainly from a fair value loss on its investment properties amounting to 6.5 billion yen.

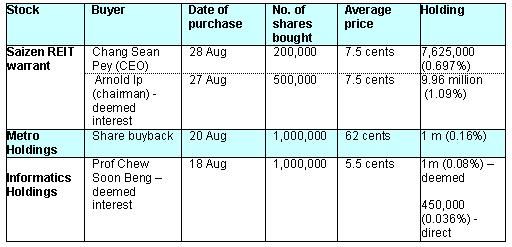

Just hours after the announcement, Starich Resources bought 500,000 Saizen warrants at 7.5 cents each.

Saizen chairman Arnold Ip is one of the beneficiaries of a trust which indirectly owns Starich.

The next day, Saizen CEO Chang Sean Pay bought 200,000 warrants at 7.5 cents each. Early this year also, the management of Saizen had actively accumulated units of the REIT.

Looking beyond the FY09 bottomline loss, you will note that Saizen’s net property income for FY09 rose 17.2% to 2.9 billion yen, which means that its operations are intact.

Another attractive point of Saizen is that its Net Asset Value is 40 cents, sharply higher than the 16.5 cents that Saizen units recently traded at.

Saizen, however, faces a major challenge refinancing a big loan (S$121 million) coming due in Dec 2009. It has also not declared a dividend in order to conserve cash.

Saizen’s FY09 results announcement is here.

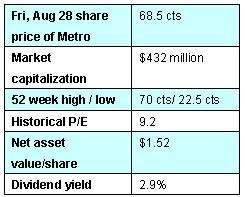

* Metro Holdings: Metro’s share buyback is an eye-opener.

The Aug 20 purchase of 1 million shares was at 62 cents apiece – compared to the 35 cents that the company bought back its shares in November-December 2008.

For more on this, see an excellent report that appeared in Business Times here.

* Informatics Education: The spouses of two independent director of Informatics seem to see value in the stock.

The spouse of Prof Chew Soon Beng – the latter is with the Nanyang Technological University – bought shares on Aug 15.

In May, the spouse of another director, Ung Gim Sei (a partner of Singapore law firm KhattarWong), had similarly bought 1 m shares at the same price of 5.5 cents – which, by the way, shows that the stock has lagged behind in the stunning market rally.

These shares are all the Informatics shares they have currently.