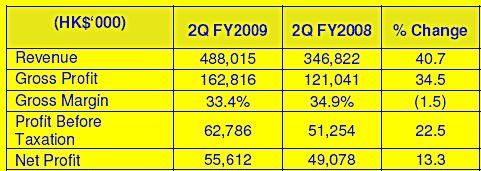

Man Wah's EPS increased 13.3 % from 7.37 HK cents to 8.35 HK cts.

Ben Chan

Benjamin Chan, 42, is an actuary in an international reinsurer, and is a shareholder of Man Wah Holdings. He has posted lots of thoughts and insights into the business in our forum, which gave us the idea of asking him to share his response to the company's Q2 results.

I ATTENDED Man Wah Holdings' briefing at Republic Plaza yesterday on its Q2 (ended Sept) results. Overall, as a shareholder, I am pleased with the result.

I expect the top line growth to continue into Q3 and Q4. If the raw material costs stay at current level, I would expect the profit margin to increase further.

Here’s my analysis of the company's performance in various markets where it exports its sofas:

| PRC | Sales (HK$m) | Stores (end of quarter) | Stores (average in quarter*) | Quarterly sales per store (HK$) |

2QFY09 | 93.3 | 243 | 236.5 | 395,000 |

| 1QFY09 | 74.5 | 230 | 221.5 | 336,000 |

| 2QFY08 | 60.0 | 170 | 165 | 364,000 |

| 1QFY08 | 50.4 | 160 | 157 | 321,000 |

* Number of stores at end of 4QFY08 and 4QFY07 were 213 and 154, respectively

- The PRC sales performance improved as seen in the growth of the sales per store from 1Q to 2Q.

- Management said while they still aim to achieve around 300 stores by Mar 09, their priority is on the quality of stores rather than the number. The sales per store still has margin to grow.

- It was reported that some retailers in the PRC are slashing prices to survive but management hasn’t seen and doesn’t expect any significant impact on Man Wah. The reason is the strong brand name Cheers enjoys in the PRC.

- Some of the store rentals may be reviewed downwards under the current economic environment. This is positive on margin.

- Sales are on cash terms in PRC, so the company does not have an issue with receivables.

| United States | Sales (HK$m) |

2QFY09 | 241.6 |

| 1QFY09 | 261.7 |

| 2QFY08 | 160.2 |

| 1QFY08 | 127.9 |

- US sales are considered good in this current environment. According to management, there has been no cancellation of order to date.

- Management said the crisis gives Man Wah a very strong position in the market since the sofa buyers now insist on buying from reputable manufacturers. These retailers don’t want to lose their deposits to financially weak manufactures.

Apart from offering good value for money, Man Wah's size, long export history, consistent efforts in trade shows in the last few years, and SGX listing status all give it a strong position to attract new customers in the US (and Europe).

- The company has a very strict credit policy: With very few exceptions, it will accept orders only if it comes with credit insurance or similar guarantee. So there is no worry on trade receivables.

Europe | Sales (HK$m) |

| 2QFY09 | 84.6 |

| 1QFY09 | 77.5 |

| 2QFY08 | 64.2 |

| 1QFY08 | 101.5 |

- Europe sales have picked up and management expects the momentum to be maintained into the second half.

- The lower sales in 1Q were due to the internal re-organisation of a major UK customer. That issue has been resolved and Man Wah has also managed to attract a few big customers in Europe in 2Q.

- Its strict credit policy applies to Europe too.

General

- The Average Selling Price (ASP) was quite stable in 2Q so the sales growth was due to growth in unit sales. The drop in gross margin in 2Q is mainly due to the high raw material costs. For example, the price of oil was at US$147 a barrel in July.

- Management expects the benefits of raw material costs reduction occurring in the last couple of months to be felt in the Q3 and Q4. ASP is expected to be maintained, so gross margins are expected to increase.

Man Wah motion sofa chair. Photo by Sim Kih

- Their plant is operating at 60%+ utilization based on full 500,000 capacity. They don’t expect any significant capex in the next 2 quarters. Capex are 49m YTD and I would expect this to be around 80m for full year.

- To a question on their cash being lower than short term borrowings, CFO Francis Lee said short term borrowings are being repaid in a scheduled and orderly manner. There is no refinancing issue at all. My opinion is that with the expected positive free cash flow in the coming 2 quarters, there is no reason to doubt this.

- While the export profits are exempted, the PRC profits are subject to tax. With some of the subsidiaries’ tax holiday going off, the expected tax rate will be around 8% assuming the current mix of PRC and overseas stay unchanged.

- The famous bedding acquisition is currently under SGX review. Management expects the Special General Meeting to be held in December.

- Although the dividend payout ratio has been 25% in the last couple of years, under the current economic environment, management thinks it is prudent to hold more reserves. A lower but still decent payout ratio of 15% is used for the interim dividend of HK$0.0266 per share (compared to split-adjusted HK$0.03265 previously).

Man Wah stock is down 49% from a year ago.

If the company continues to perform in Q3 and Q4, and if the economic environment improves, there is reason to believe management may maintain the full-year payout ratio at 25%.

Recent story: MAN WAH: Surprise! Sales of sofa to US are booming!

Also, BENJAMIN CHAN, forumer of the month

You are welcomed to post a comment or question at our forum.