It's burn, burn, burn: China stocks listed in Singapore and in China have tumbled.

IN THE wake of last month’s (March) meltdown of Singapore-listed China stocks, China plays have seemingly lost favour with investors. With many having had their fingers burnt one too many times, would the latest selling frenzy mean an end tothe glossy appeal of Chinese counters?

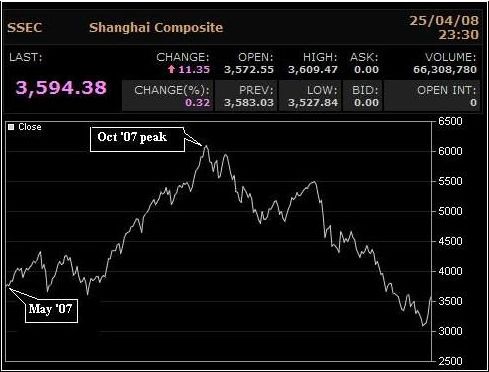

Singapore-listed China stocks – commonly referred to as S shares– have taken a pounding since they peaked in October with many stocks losing more than half of their value. Spooked by inflation worries on the mainland and the wobbling global economy, investors have embarked on a flight to quality.

Things reached a boil on March 5 when China’s January inflation figure, which hit a precarious 7.1 per cent, caused S-shares to go into a free fall with the key FTSE STChina Index (FTCI) slumping to an 18-month low.

Many have begun to fear that the Chinese government is in a losing battle to fight inflation as surging commodity prices - exacerbated by an acute supply-demand imbalance - is threatening to undo its economic expansion.

As it is over the years, investors have had a roller-coaster relationship with Chinese counters – now totaling 141 on the Singapore Exchange (SGX). Keen to ride on China’s economic rise, SGX has been successfully wooing China originated companies with the local bourse notably witnessing a sudden surgein China IPOs (initial public offerings) in 2003 to 2004.

Then, China companies became the hot topic when an impressive total of 55 companies were listed, accounting for about 70 per cent of all company listings during that period.

But the infamous financial scandal in2004 involving China Aviation Oil (CAO), where the company accumulated over US$550 million losses in derivative trading and its management convicted for various criminal irregularities, led investors to shy away from China plays for a good while.

But with an economy that has experienced double-digit growth for the best part of the last 20 years, China remains the endearing story in global economics. Such unprecedented growth meant that investors could not resist for too long before putting their bets on China stocks, most of which have the knack to outperform the broader market.

A hard landing

Prior to the recent sell-off of S-shares last month, the FTCI had in fact impressively risen 10.2 per cent in February compared to the 4 per cent gain made by the benchmark Straits Times Index (STI).

But the rally proved to be a double-edged sword for investors as the ensuing selldown hit China stocks the worse. As of March 14, the index had fallen 41 per cent year-to-date (YTD) to 420.9 points – its lowest level since September 2006. In comparison, the STI chalked up a more benign fall of 11 per cent YTD.

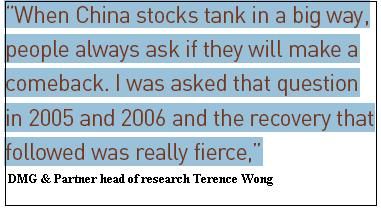

Indeed, the large volatility of S-shares is one of its dominant features.“For China companies which are generally in the growth stage, you will see that their beta is higher which means that the risk profile is higher. So if the market goes up, the stock goes up higher and if the market goes down, it tanks faster too,” explains DMG & Partners’ head of research Terence Wong.

Beta is a measure of a stock’s volatility in relation to the market and higher beta stocks tend to deviate more from the general movement of the market. The volatility of S-shares is thus more intense and coupled with the fact that most are growth companies without the benefit of a long track record, the market inevitably slaps a huge premium on these stocks.

The meltdown of S-shares at the beginning of March hit local investors hard, especially as some had taken out huge loans to invest. In fact, the pullback was made worse as many dealers had to force sell shares of clients who could not meet margin calls to cover loan shortfalls. A measure of the carnage is evident from the battering that blue chip China shares have endured.

The biggest of which, Cosco Corp, saw its market capitalisation slashed a whopping $2 billion to $6.6 billion over a two-week period from March 3 to 17. The China-based shipyard was dispatched with by investors who fear rising steel prices and labour costs, plus the fact that Cosco’scontracts are priced in US dollars, would invariably put pressure on the company’s profit margins.

Problems likely to persist

As with the broader market, S-shares have been exposed to the fear and uncertainty that has gripped financial markets in recent months. And it is well possible that the bloodletting seen thus far may go on for a while yet.

“It is unlikely that China plays have bottomed as markets will still beaffected by more write downs in the US in the coming months,” says PrimePartners’ research manager Lim Keng Soon. He reveals that the Prime PartnersChina Index (PPCI), which tracks the performance of 25 Singapore-listed China stocks, is down 41 per cent YTD as of March 17.

In a research report last month, CIMBGK’s head of research Kenneth Ng highlighted that China stocks have been significantly de-rated after the latest earnings season for fourth quarter 2007 (4Q07), as a host of S-shares fell considerably short of earnings estimates.

“China stocks have longer-term prospects but with many struggling to cope with inflation, we believe there is cause for short-term concern,” he remarked.

Resiliency factor

What is worth noting is that S-shares have proven their resilience in bouncing back each time a setback occurs. After the CAO scandal in 2004, subsequent years saw China stocks having to deal with the Chinese Securities Regulatory Commission’s (CSRC) restrictions on Chinese companies listing overseas; aswell as persistent talks of the overheating of the Chinese

economy.

“When China stocks tank in a big way,people always ask if they will make a comeback. I was asked that question in 2005 and 2006 and the recovery that followed was really fierce,” observes DMG & Partners’ Mr Wong.

So as China plays have a penchant for making spectacular comebacks, what would be the trigger this time around?

Revaluation of currency is key

Firstly, there has been a marked shift in Chinese monetary policy in recent months. In a bid to dampen imported inflation from commodities, authorities have shown a willingness to sharply increase the value of the Chinese Renminbi (RMB), resulting in a six percent rise since September 2007. Analysts are predicting a 10 to 15 per cent appreciation in the Chinese currency by the year’s end.

While it may be a dampener for export-oriented companies in the immediate term, such aggressive rebalancing of the currency over a period of time is likely to bear fruits in the medium term.

“If we get through the first half of the year, the markets would have discounted far more of what’s going on in the US and would also begin to see the current policy starting to have an effect on inflation across the region. And I think that’s going to be the key trigger for markets to start re-rating again and reflect the excellent long-term picture for China and Asia as a whole,” saysHenderson Global Investors’ director of Pacific equities, Andrew Beal.

Mr Lim of Prime Partners predicts that China companies would see better margins as the RMB revaluation will likely outstrip potential gains in the Singapore Dollar. “China companies would enjoy higher profits when they are translated to Singapore dollar and I think these translational gains may be seen in upcoming quarters.”

A second factor to boost S-shares is the recent government-to-government agreement that allows Chinese commercial banks to invest in Singapore stocks and funds under the Qualified Domestic Institutional Investor (QDII) scheme.

According to OCBC Investment Research, this long-awaited move frees up an estimated $23.2 billion pool of fundst hat could potentially be pumped into locally listed stocks. Singapore is only the third investment destination after Hong Kong and Britain to be opened to mainland China banks.

As these banks would be more familiar with their own Chinese companies, Singapore-listed China stocks clearly stand to benefit the most. Many analysts concur that this development would undoubtedly serve as a short-term catalyst for the S-share market.

Where to position

While most S-shares may not appeal forshort-term trading, it is beginning to offer decent value for those looking to pick up bargains with a medium to long term investment view.

According to Thomson Financial, the FTSE ST China Index is currently trading at a P/E of 8x, with several blue chips hovering at a P/E of 3 to 4x – something not often heard with China stocks. In comparison, China’s A-share and Hong Kong’s H-share market, where some of these stocks are also traded, have a significantly higher P/E of 32x and 15x, respectively.

Considering the steep revaluation of the RMB which is underway, Mr Beal of Henderson Global Investors feels that investors would do well to deviate from export-driven companies.

“You want to be orientated away from companies with a big overseas component in their sales, apart from one or two selective areas, oil services being one of those. And you want to be very firmly focused on companies with exposure to the domestice conomy,” he says.

OCBC Investment Research likewise prefers stocks in the Chinese consumer sector for its ability to leverage on China’s strong consumption growth –near-term inflation notwithstanding. They include Cacola Furniture International, which mainly designs and sells its furniture products in China, and China Sports International which distributes its sports apparel under their YELI brand.

CIMB-GK on the other hand has picked sports accessories manufacturer China Hongxing in this space. In recent weeks, the stock has also received “buy”calls from both UOB Kay Hian and DBS Vickers Securities.

On a different note, Prime Partners’ Mr Lim is sanguine about the upside potential of agricultural stocks considering the huge and tight demand for food in China. He leans towards China XLX Fertilizer and farming machinery supplier, China Farm Equipment, in this sector.

At the same time, he also remains buoyant about the prospects of China Oilfield in light of high crude oil prices.The China bubble in the Singapore market may have been pricked numerous times but China plays have never laid low for long.

No doubt, the next few weeks would remain a volatile period for S-shares in general. But with the appreciating RMB and funds from QDII Chinese banks, along with the Olympic Games that will increase the brand equity of many Chinese firms, the “sexy” China story is bound to attract its fair share of admirers once more.

This article was recently published in Smart Investor magazine and is reproduced here as part of a special collaboration between the magazine and NextInsight.

This article was recently published in Smart Investor magazine and is reproduced here as part of a special collaboration between the magazine and NextInsight.

See NextInsight's archives for lots of stories on China stocks (S-chips)

April 27 (Bloomberg) -- Investor Jim Rogers is buying Chinese shares, among the world's worst performers this year, as the market has bottomed, and he's focusing on agriculture, tourism, airlines and education. Full report, here.