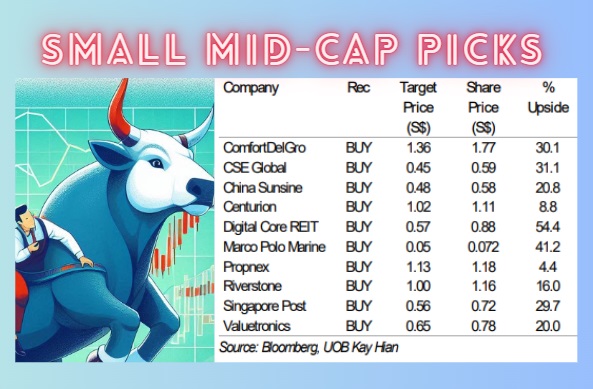

• If small and mid-cap stocks are the target categories of stocks for purchase by a S$5 billion MAS initiative, what might some of them be? UOB Kay Hian ventured its selection. Its criteria: trading liquidity, P/B and PE ratios.  • The potentially biggest upside (54%) in its selection is Digital Core REIT, a beneficiary of robust demand for data centres with attractive valuations vs peers. • There's also a stock that can't wait to prove its worth: China Sunsine. China Sunsine (market cap: S$425 million) trades at only 2X PE ex-cash, has a dividend yield of 5%, and a growth story in 2025, according to UOB KH. • And then there's Propnex, which makes you wonder why it made the list when its upside is ... merely 4.4%. Surely, there's more to it. Read more below .... |

Excerpts from UOB KH report

| Identifying Stocks That Could Benefit From MAS’ S$5b Liquidity Boost |

| On 21 Feb 25, the MAS equities market review group revealed a S$5b investment initiative to be channelled to asset managers with a focus on Singapore-listed equities. Our screening of small mid cap stocks based on trading liquidity, P/B and PE ratios has identified 37 stocks that could benefit. Our top picks in the small mid cap space include ComfortDelgro, CSE Global, China Sunsine, Centurion, Digital Core REIT, Marco Polo Marine, Propnex, Riverstone, Singapore Post and Valuetronics. |

WHAT’S NEW

• MAS equities market review group announces S$5b investment initiative to enhance market liquidity; expect small mid cap stocks to be the biggest beneficiaries.

On 21 Feb 25, the Monetary Authority of Singapore’s (MAS) equities market review group (which was set up in Aug 24), announced a S$5b investment initiative aimed at boosting liquidity for Singapore’s capital market.

The strategies will be actively managed and diversified across various counters, rather than solely focusing on index component stocks.

As a result, we think the small mid cap stocks in Singapore will be the biggest beneficiaries of this measure.

The initiative will channel the funds to asset managers with a “strong investment track record” and a focus on Singapore-listed equities.

Funded through its investment portfolio and the Financial Sector Development Fund, the programme aims to enhance market liquidity and support Singapore’s fund management ecosystem.

MAS will begin evaluating eligible fund managers and strategies in the coming months.

• Screening for small mid cap stocks that could benefit from MAS measures.

We conducted a screening of small mid cap stocks in the market cap range of S$200m-2b, based on the following criteria:

a) three-month average daily traded value (ADTV) of at least S$0.3m,

b) P/B ratio of less than 1.0x, and

c) trailing 12 months (TTM) PE ratio of below 20x.

This screening exercise has identified 37 small mid cap stocks (shown on the next page) that could benefit from MAS measures, as small mid cap stocks with decent liquidity that are trading at compelling valuation should garner more attention. SingPost Centre: "Focus on monetisation, not earnings," says Maybank Kim Eng

SingPost Centre: "Focus on monetisation, not earnings," says Maybank Kim Eng

| • Our top picks in the small mid cap space include: |

| a) ComfortDelgro (expect strong acquisition-led earnings growth in 2024 and 2025), b) CSE Global (healthy performance backed by strong orderbook and attractive dividend yield of c.6%), c) China Sunsine (global leader in rubber accelerators and attractive dividend yield of c.6%, net cash c.70% of market cap), d) Centurion (solid volume and rental growth in 2025), e) Digital Core REIT (beneficiary of robust demand for data centre with attractive valuations vs peers), f) Marco Polo Marine (earnings boost from new fleet of vessels and shipyard expansion from Apr 25), g) Propnex (beneficiary of tailwinds in the residential property industry and potential special dividends), h) Riverstone (global leader in high-end cleanroom gloves with dividend yield of c.7%), i) Singapore Post (value unlocking and cost rationalisation initiatives to enhance shareholders’ value), and j) Valuetronics (contributions from GPU leasing business and attractive dividend yield of c.7.5%, net cash c.70% of market cap). |

Full report here.