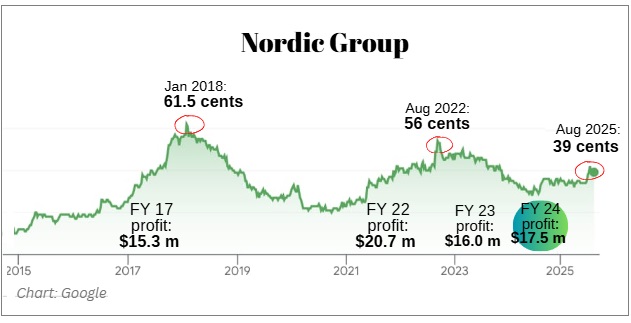

| For years, Nordic Group has performed steadily, and its 1HFY25 update signals a promising upturn particularly in its services to the marine and defense sectors. Shareholders, however, lament -- as does Nordic management -- that its stock hasn't been getting much attention (aka trading liquidity). Likely this stems from it being a small-cap (S$155 million), which deters big funds.  Nordic stock hit a high of 61.5 cents in Jan 2018 on strong FY17 profit. Nordic stock hit a high of 61.5 cents in Jan 2018 on strong FY17 profit.The stock last week traded at 39 cents. Small caps, however, are having a roaring time this year, fuelled by retail investors and maybe small funds, spurred by the Monetary Authority of Singapore's planned injection of S$5 billion into non-big cap equities. This momentum has prompted analysts to issue positive notes on small-mid-caps, especially those with robust trading liquidity plus fundamentals, of course. Without any analyst coverage, Nordic, whose stock is +11% year-to-date with an average daily trading value of ~S$50,000 in the past 3 months, hasn't quite found love. |

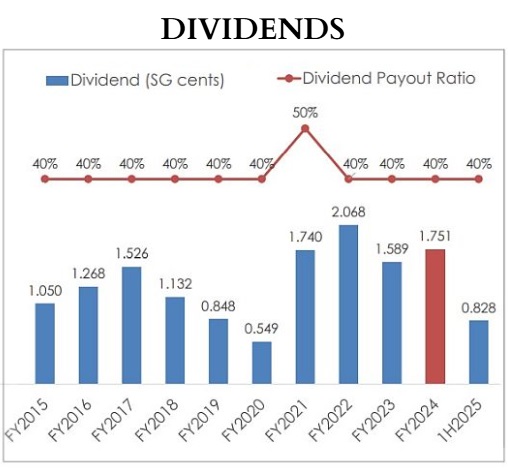

Data: FY2024 annual report

Data: FY2024 annual report

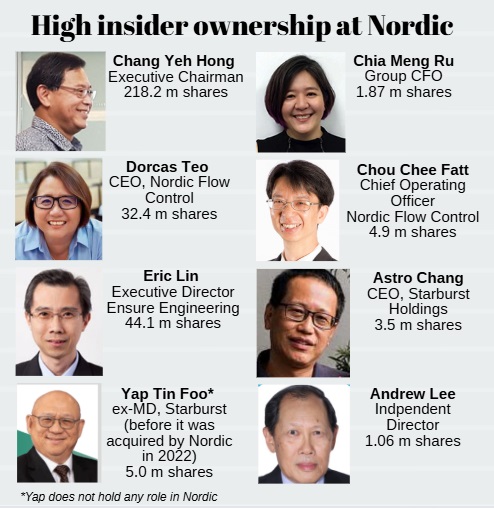

The key management of Nordic, it should be noted, has plenty of skin in the game, as the graphic above illustrates.

That, however, also poses a problem.

At close to 78%, their combined stake leaves little room for big new investors, especially when minority shareholders are reluctant to sell at current price levels.

Nordic in its past quarterly results briefings have acknowledged the issue and, last week, was asked if it had found a way around it.

Management's reply was, yes, there are textbook solutions such as bonus issues, stock splits, rights issues .... but ....

Long story short, management is looking closely at every possible solution.

| Financial Performance: Stability Despite Forex Challenges |

Nordic reported that its 1H2025 net profit dipped slightly (3%) due to forex losses, but its underlying operations showed resilience.

Excluding interest income, interest expense and forex loss (S$1.4 million), operating profit actually went up 14%, as shown in the table below:

|

Profit excluding interest income, finance costs, and FX loss/gain, grew 14%, reflecting growth in the core operating businesses |

|||

|

S$’m |

H1 2025 Value |

H1 2024 Value |

Change (%) |

|

Net Profit after Tax Attributable to Equity Holders |

8.3M |

8.5M |

(3%) |

|

- Interest Income |

0.4M |

0.6M |

(39%) |

|

- Finance Costs |

(0.9)M |

(2.0)M |

(53%) |

|

- Foreign exchange (losses) / gains |

(1.4)M |

0.9M |

n.m. |

|

Operating Profits, Net of Tax |

10.3M |

9.0M |

14% |

|

S$ million |

H1 2025 |

H1 2024 |

Change (%) |

Comments |

|

Revenue |

84.8M |

76.2M |

11% |

Driven by 24% increase in Project Services revenue |

|

Gross Profit |

19.2M |

17.6M |

9% |

Revenue growth driven by a 24% increase in Project Services revenue. |

|

Gross Profit Margin |

22.6% |

23.1% |

(0.5 pts) |

GP margin dipped due to a higher contribution from Project Services, which has lower margins than Maintenance Services. |

|

EBITDA |

8.3M |

14.1M |

(8%) |

|

|

EBITDA Margin |

15.3% |

18.5% |

(3.2 pts) |

|

|

Net Profit after Tax Attributable to Equity Holders |

8.3M |

8.5M |

(3%) |

Net profit and margin declined due to higher forex losses (USD weakened against SGD). |

|

Net Profit Margin |

9.8% |

11.2% |

(1.4 pts) |

The order book stood strong at S$184.9 million, providing visibility into future revenues—over 50% each from maintenance and project services.

Net debt improved to S$5 million by July, with ongoing loan repayments.

The company continues share buybacks, averaging 34.89 cents per share in August.

| Marine Division: Riding the Shipbuilding Wave |

The marine division (Nordic Flow Control) emerged as a standout.

It is a systems integration solutions provider specializing in flow automation, navigation, and control systems for the marine, offshore, oil, and gas industries.

It offers solutions, including valve and actuator systems, to enhance vessel and platform operations.

Nordic Flow Control CEO Dorcas Teo reported an order book for work on 86 vessels worth S$16 million, spanning 2025-2027 deliveries.

Pipeline bids from Nordic cover 67 more vessels valued at S$43 million, she said.

With China's shipbuilding dominance, Ms Teo sees sustained demand, especially from international ship owners who want assurance of quality of systems.

On recurring revenue, this Nordic division provides vessel MRO (maintenance, repair and overhaul) for installed systems in over 1,600 vessels.

As they have a lifespan of some 30 years, the recurring business is long-term.

| Starburst/Avon: Defense and Aviation Growth |

Starburst is progressing to complete a military range in Singapore by 1Q2026, and separately anticipates a tender in 4Q this year from a law enforcement agency.

Middle East bids, including an Abu Dhabi project, are nearing awards, said Starburst CEO Astro Chang.

Middle East projects involve on-site supervision, preserving margins through Singapore-based production. Starburst was acquired in January 2024 for $59.1 million by Nordic.

Starburst was acquired in January 2024 for $59.1 million by Nordic.

As for Avon, a Starburst subsidiary, "we are progressing on jet fuel management systems and anticipate further tenders through 2027-2028."

This refers to Avon's business opportunities during air base relocations in Singapore.

| Resilience & Undervaluation With stable maintenance revenues (50% of order book) and booming marine/defense pipelines, expect incremental growth. In the meantime, here's a comparison between Nordic and Singapore peers Hiap Seng Industries, PEC and Hai Leck, all of which are much more narrowly focused on clients in the oil & gas industry.

• Nordic's similar market cap to Hiap Seng but superior net profit, lower multiples, and dividend yield make it look attractively undervalued. • Fair value for Nordic would likely be a PE multiple closer to PEC's exit level; instead, Nordic trades at a sharp discount. |

Nordic's 1HFY25 PowerPoint deck is here.