• A second broker has initiated coverage of Nordic Group, with a BUY rating and a target price of S$0.63 calculated using the Discounted Cashflow valuation method.  Chang Yeh Hong, Executive Chairman, Nordic Group• This follows from an OCBC Group Research BUY call with a fair value of S$0.59 a fortnight ago amid a broadening of investor interest in Singapore small-mid caps since last year. See: NORDIC: This stock finally attracts analyst coverage -- first time in umpteen years Chang Yeh Hong, Executive Chairman, Nordic Group• This follows from an OCBC Group Research BUY call with a fair value of S$0.59 a fortnight ago amid a broadening of investor interest in Singapore small-mid caps since last year. See: NORDIC: This stock finally attracts analyst coverage -- first time in umpteen years• What makes Nordic a compelling story to Phillip Securities? The main drivers include:

|

Excerpts from Phillip Securities report

Analyst: Hashim Osman

• Customer capex is accelerating across Nordic’s markets such as marine, defence, and infrastructure. The book-to-bill ratio is increasing consecutively: 0.71x (FY23), 1.09x (FY24), and 1.45x (FY25e).

Orders are growing faster than billings, signaling expanding backlog and future revenue growth. |

||||

| Investment thesis |

Customer capex upcycle across core markets. Customer capex increased in industries such as marine, engineering services, and environmental engineering.

The book-to-bill ratio, which measures order momentum and provides forward revenue visibility, has grown, indicating orders are won faster than billings for the year - (FY23: 0.71, FY24: 1.09, FY25e: 1.45).

Nordic Flow Control secured c. S$30mn in vessel orders and is delivering on the P84 and P85 FPSOs contract.

The scaffolding, insulation and petrochemical segment secured a S$19.8mn, 3-year contract to replace vibrating conveyors and perform boiler maintenance at Tuas South Incineration plant.

It also won a S$5.8mn boiler overhaul contract from Keppel Seghers Waste to Energy plant. Envipure has won an S$18mn contract from Micron for plant expansion and hookup services.

The pipeline remains strong for the company - P86 and P87 FPSOs tenders, the relocation of Paya Lebar Air Base to Tengah and Changi Air bases, and Starburst’s pipeline will continue to sustain earnings.

| Higher-margin maintenance services orderbook is increasing |

Maintenance services generated 20% net margin in FY24 versus 8% for project services, with the gap widening as maintenance margins expand while project margins compress due to competitive bidding pressures.

The maintenance order book increased 16% as of Sep 2025 compared to FY24 and now represents 65% of total order book (Figure 1).

High maintenance margins are supported by 20+ year vessel lifespans (Nordic Flow Control), long-tail shooting range contracts (Starburst), and non-discretionary plant maintenance requirements.

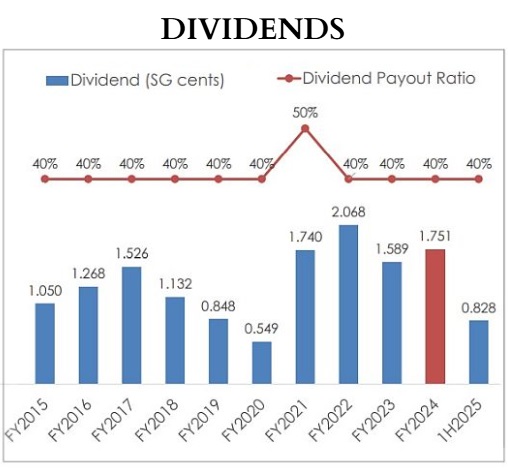

Net profit margin is expected to improve as maintenance continues expanding its order book share while delivering superior margins compared to project services. Nordic has had a consistent 40% payout ratio, so its dividend fluctuations were a proxy for its EPS movements.

Nordic has had a consistent 40% payout ratio, so its dividend fluctuations were a proxy for its EPS movements.

Early acquisitions (2011-2017) were dilutive as Nordic diversified away from O&G concentration, but recent deals were accretive, with Nordic acquiring businesses at 4.8x - 6.6x P/E based on targets’ standalone earnings while trading at 11.5x - 13.0x. (Figure 2). With improved balance sheet capacity and proven execution capabilities, management would likely acquire targets in sectors such as renewables, EV or data centre infrastructure services as a continued earnings accretion lever. |

→ The Phillip Securities report is here.

→ The Phillip Securities report is here.

→ See also: NORDIC: This Company Has Shifted From Delisting Thoughts to Re-Rating Aspirations