• For years, Nordic Group has been a "quiet achiever" that lacked trading liquidity and investor hype. Quietly, managment entertained thoughts of delisting.  Chang Yeh Hong, Executive Chairman, Nordic Group• However, with a broadening of investor interest in Singapore small-midcaps since last year -- and now an initiation report by OCBC Group Research -- Nordic is likely to attract greater traction in the market. Chang Yeh Hong, Executive Chairman, Nordic Group• However, with a broadening of investor interest in Singapore small-midcaps since last year -- and now an initiation report by OCBC Group Research -- Nordic is likely to attract greater traction in the market.• OCBC issued a BUY rating with a fair value of SGD 0.59 — representing a massive 37% upside from its current price. • What makes Nordic a compelling story to OCBC? Read on ..... |

Excerpts from OCBC Group Research report

Analyst: Bryan Goh

• Contract wins of SGD70m in Dec 2025 provide revenue visibility

• Strategic acquisitions into promising industries such as defence and sustainability offer improved long-term stability • Initiate with BUY rating and potential price upside of 37% to our estimated fair value of SGD0.59. FY26 estimated dividend yield is also attractive at 4.9%. |

||||

| Investment thesis |

Nordic Group (Nordic) is a global engineering solutions provider focused on areas including precision engineering, systems integration, environmental engineering, and maintenance.  The continued resilience of Asian economies amidst current global macroeconomic uncertainties, Singapore’s capital market reforms and Nordic’s exposure to secular growth trends in tech, defence, and sustainability will also act as enablers for Nordic’s growth in the longer term, making it an attractive investment opportunity.

The continued resilience of Asian economies amidst current global macroeconomic uncertainties, Singapore’s capital market reforms and Nordic’s exposure to secular growth trends in tech, defence, and sustainability will also act as enablers for Nordic’s growth in the longer term, making it an attractive investment opportunity.

| Investment summary |

• Active strategic acquisitions and broadening of revenue base – As part of its growth strategy, Nordic has acquired seven companies since listing in 2010.

Retroactively, Nordic’s revenue compound annual growth rate (CAGR) of 9.3% from 2010 to 2024 suggests that acquisitions have had meaningful long-term impact on topline growth.

The additions also provide strategic risk diversification benefits by securing distinct sources of revenue, with subsidiaries like Starburst and Envipure providing exposure to less correlated sectors like defence and sustainability.

Consequently, such acquisitions stabilise revenue streams for more sustained returns in the long term.

|

Nordic Group’s M&A history |

||||||

|

2011 |

2015 |

2017 |

2019 |

2022 |

2022 |

2023 |

|

$29 m |

$26 m |

$17 m |

$14.8 m |

$59.1 m |

$10 m |

$5 m |

|

All are 100% acquisitions paid for in cash. |

||||||

Nordic’s ability to drive inorganic growth opportunities has been supported by its strong balance sheet. Its net gearing ratio stood at 13% as at end-FY24, and declined to a low level of 3% as at 30 September 2025.

• Contract wins of SGD70.3m in Dec 2025 – Nordic has pivoted its revenue towards more stable avenues in maintenance services from project services, with the latter falling from 73.1% of revenue to 50.4% from FY15 to FY24, while the latter increased from 26.9% to 49.6% in the same period.

Its order book strengthened to SGD209.2m (as at 30 September 2025) from SGD201.6m (as at end-FY24), and this was buttressed by a jump in maintenance contracts that provide increased revenue visibility to the group.

Nordic subsequently announced SGD70.3m worth of contract wins in early December 2025 from new and repeat customers.

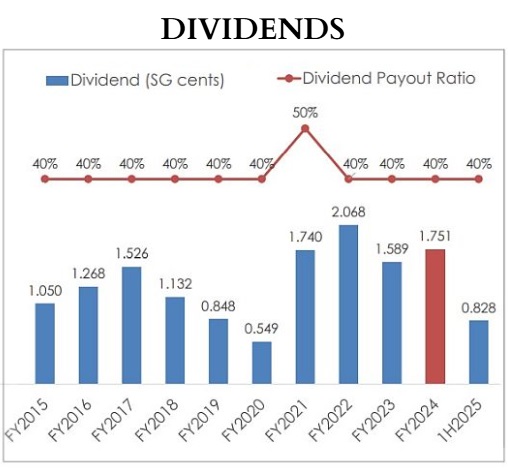

From a sector viewpoint, we believe Nordic’s exposure to defence and sustainability provides fundamental strength to their revenue base, as these sectors are part of the Singapore government’s long-term initiatives, which saw spending in defence and sustainability increasing 59.1% and 97.7% to SGD20.9b and SGD3.3b respectively, from 2015 to 2024, according to data from SingStat. Nordic had a consistent 40% payout ratio, so its dividend fluctuations were a proxy for its EPS movements.

Nordic had a consistent 40% payout ratio, so its dividend fluctuations were a proxy for its EPS movements.

• Nordic’s financials bottomed after interest rates peaked in 2024 – Nordic’s revenue came under pressure in FY23 and FY24, declining 1.3% to SGD160.6m and by 1.4% to SGD158.4m respectively, due to project delays and higher labour costs.

Nordic has cited rising interest rates and inflationary pressures as difficulties during this period, which were consistent with a sharp decline in Singapore’s industrial production that registered an average year-on-year (YoY) growth of -4.4% per month from October 2022 to October 2023.

Inflationary pressures also prompted cost of sales to surge 6.2% in FY23, eroding its gross profit margin from 28% in FY22 to 23% in FY23.

FY24’s gross profit margin held firm at 23% notwithstanding cost pressures and softer business sentiment.

Furthermore, its FY24 PATMI recovered by 9.6% YoY due in part to lower marketing and distribution costs as well as administrative expenses.

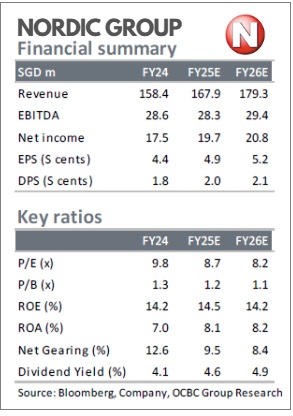

Looking ahead, we forecast revenue to grow by 5.0% and 7.6% in FY25 and FY26 respectively, underpinned by an expected recovery in project wins and continued growth in maintenance services due to a rebound in the industrials sector.

Initiate coverage on Nordic with a BUY rating and fair value (FV) estimate of SGD0.59

We apply a target P/E multiple of 11.3x, which is in-line with Nordic’s 10Y historical trailing 12-month average P/E multiple, to our forecasted FY26 earnings per share (EPS) of 5.24 Singapore cents and thus derive a FV estimate of SGD0.59. |

→ The full OCBC report is here.

→ The full OCBC report is here.

→ See also: NORDIC: This Company Has Shifted From Delisting Thoughts to Re-Rating Aspirations