This article was recently published on Silly Investor's blog and is republished with permission.

THIS IS not an inspirational post, rather it is more of a negative example. My journey thus far, the highs or lack of, and the lows....

When I was doing my National Service, I seldom went out with my platoon mates during nights off. I simply enjoyed a meal at Changi Village, and took a slow walk back to camp, usually alone.

I managed to save almost $10k after the 2 years of NS.

|

|

I next signed a contract with my employer when I was studying in university. I was given an allowance while studying. I managed to save more than $20 k during my university years.

I played with shares. I knew nuts about financial numbers. What is ROE, what is equity, receivables? I knew nothing.

When September 11 happened, I bought SIA shares. It became a 100% gain. This emboldened me to buy more blue chips.

It was the turning of bear to bull years, and I made more than $5k. Then I took all the profits and ploughed it into China Aviation Oil, whose subsequent scandal wiped out almost all of my savings!

I was so happy to get back $4k when they managed to restructure the company. I remembered the money coming in very handy when I had to pay for my marriage expenses. Furniture, property, honey moon etc.

In my first 2 years of work, my savings were gone in a snap of an eye when I got married.

Then we welcomed our first car, followed very shortly by our first baby. Savings were wiped out again. In fact, there were months I survived on past savings and needed my bonuses to clear my expenses.

It was a very different lifestyle I was used to. My wife was not as frugal as me. I felt highly insecure without monthly savings. I quarrelled with her over money.

As I climbed the corporate ladder, my pay increased but so did my expenses. I hired a maid, and there were things like taxes, year-end holidays etc, which meant I was hardly able to save the bulk of my bonuses.

I learned to invest, but there were many a time when I needed to liquidate my counters to pay for some expenses.

It was painful, demoralizing. Especially when I read about blogger x who is y years old and had amassed a portfolio of z value.

Given my character, when I can't beat them, I start to delude myself. I tell myself what a lot of joy I have with my family and it cannot be measured with money. A lot of time has been spent with the family, a lot of luxury activities enjoyed. I am a generous husband and father and perhaps also son and son-in-law.

Deep down inside, I know I want some financial muscle. I know there are other people with debt issues. But most of my peers have more than 1 property. Ouch!

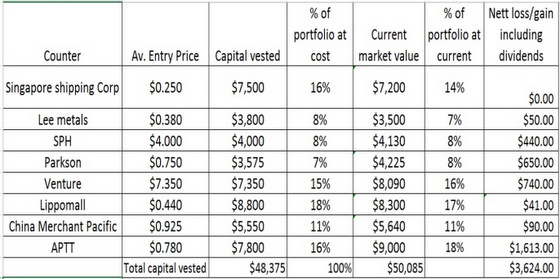

I remember a Bangladeshi ahead of me in a queue for the ATM. When it was my turn, I saw an ATM receipt but I was not sure if the receipt belonged to him. The cash balance was $100k. Wow, I told that to my friends. They reacted in amazement: Huh? You mean you do not even have $100k after working for so many years? Ouch ouch.  Investor's portfolio as of 19 Aug 2014. He had earlier divested Yangzijiang for a 30% return and Golden Agri Resources without loss or gain.

Investor's portfolio as of 19 Aug 2014. He had earlier divested Yangzijiang for a 30% return and Golden Agri Resources without loss or gain.

|

Financial freedom in retirement -- or driving a taxi? The one solution I have -- work till I drop. No need for retirement fund. LOL. To delude myself further, I tell myself if I do have a second property, or when I have the half a million investable fund, I will have other problems. I might be missing on finer things. It made the "ouch" moments bearable. To delude myself further, I even appeal to the rational thinking part of me. I would have to survive with $2 plus K a month 25 years later. With inflation eating away purchasing power, it is a highly depressing number, isn't it? So how to bridge the gap? Drive taxi or work as security guard perhaps? Of course, the above projection assumes zero cash savings and capital injection into the investment fund in the next 25 years, which is almost impossible unless I lose my job. So I have just described a worst case scenario, and my days, in a monetary sense, should be much better. Delusion in process 1. Anyway, even if monetarily I am less well off, it could be made up by a fulfilling emotional and social or perhaps even spiritual life, isn't it? Delusion in process 2. Anyway, will Singapore still be around in 25 years? Will its economy still be as vibrant? Will I stop being healthy? Appreciate the present! Delusion in process 3. There are plenty of opportunities that can be opened with money and I am not talking about just pleasure-seeking ones but also in terms of security. But perhaps, options or too many of them bring more anguish. Delusion in process 4. Grasshopper or the ant? A story I fondly remembered fromSMOL. I think I am the hardworking grasshopper, working hard, enjoying hard. Until the next ant or grasshopper passes by, and is amazed at my neither ant nor grasshopper life. Ouch. I know it will hurt, comparison is inevitable, but I know it will just hurt a while until I jump off to immerse myself in the next playground or workplace. When asked what is my greatest asset, I always say: 1) Contentment (to my lecturer and academic friends). 2) Shameless (to my Ah Beng friends) 3) Delusional ability (to my blogging friends) But effectively, the three assets are the same thing. Just different packaging LOL. I just hope old age doesn't make my greatest asset disappear. |

Previous article: Investor: My 2 big misses -- STRACO and UMS

http://paullowinvestmentjourney.blogspot.sg/

Most pple end up losers because they dont follow their conviction. They dont buy deeply and hold long enough.

To win, most dont know that all they dont really need to identify winners but rather avoud losers ie companies with poor fundamentals.

it's a well known fact that stock prices volatility has *fat tails* i.e. big negatives or big positives (more on the negatives in the tail i'd think), i'd guess 1'd be more careful and consider the potential (larger) losses 1 could incur say based on a buy-n-hold approach.

'multi-baggers' (stocks rising in multiples of original prices) are *rare* & requires true skills to identify them well ahead of them becoming 'multi-baggers'.

i tend to use FA (value investing) for that, and occasionally i managed to identify a *gem*, but as it stands they are *rare* (but they *exists*, & is a worthy goal to identify & get into them at the right valuations)