|

• At Maybank Kim Eng, Jarick Seet is research head for small-mid cap stocks. He has put out, notably, 6 reports in the past 6 months on SingPost.

That's way more than any one else.

• Now he has a 7th report, not flinching from his message that it's good to hold on to SingPost stock for special dividends.

In the past 6 months or so, SingPost has attracted investor attention in multiple ways, embarking on a strategic review and making moves to sell large assets -- and firing its CEO and CFO.

• Jarick has considered the boardroom drama and all, and stuck to his "buy" call on the stock.

Will he be proven right? The time is coming -- whatever dividends there may be will finally be known when SingPost releases its FY2025 (ended March) results next Thursday (15 May).

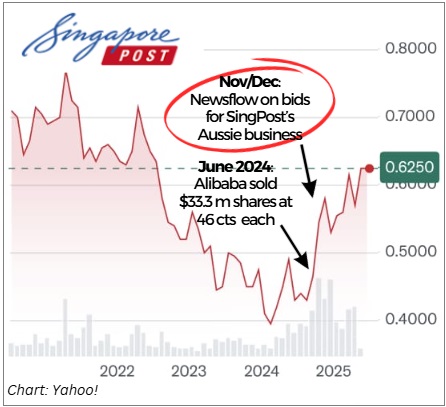

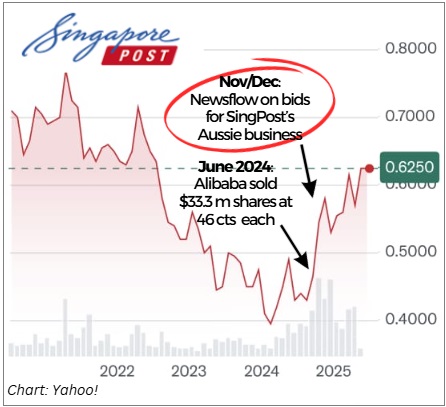

Jarick is expecting at least 10 cents of special dividends. Investors seem to have come around to the possibility of special dividends, with the stock having moved up from 52 cents four weeks ago to 62.5 cents.

• Maybank's target price is 77 cents. CGS International and UOB Kayhian have similar target prices: 74 cents and 72 cents, respectively.

• However, OCBC Investment Research's Feb 2025 report is more tempered, with a fair value estimate of 56 cents for now.

OCBC’s analyst, Ada Lim, points out that selling the Australia business will give the company more financial flexibility, but it was also a major revenue driver (almost 58% of revenue in the first half of FY25). Without a clear new growth plan, she’s keeping a “hold” rating.

• But maybe the real story is about unlocking value from asset sales and paying out dividends. Read more below ....

|

Excerpts from Maybank KE's report

Analyst: Jarick Seet

SingPost

Special dividends incoming

| Maintain BUY and TP of SGD0.77 |

SingPost will announce FY25E results on 15 May and we expect special dividends to reward and return cash to shareholders following the sale of its business in Australia and the unwinding of QSI minority crossshareholdings, which would bring a further cash inflow of SGD55.9m.

We expect special dividends of at least SGD0.10 per share and further asset sales now that the election is over, such as its post offices and SingPost Centre, as well as the ongoing sale of its freight-forwarding business. |

| Election over - more asset sale incoming |

With the election over, we believe SingPost will now hasten efforts to size down its postal network branches to reduce cost and it’s likely to sell some of these properties at the same time.

|

SINGPOST

|

|

Share price:

62 c

|

Target:

77 c

|

SingPost Centre is also another key asset that has been earmarked for sale to unlock value for shareholders.

Its freight-forwarding business, which is in the process of being sold, will also add to the divestment proceed.

Waiting to be sold: SingPost Centre in Eunos Road, a prominent mixed-use development valued at S$1.1 billion.

Waiting to be sold: SingPost Centre in Eunos Road, a prominent mixed-use development valued at S$1.1 billion.

New business model needs to be forged

Within its mail business, the postal network is expensive to maintain but serves only 20% of total mail volume.

With growing digitalisation of its services, post offices have become less relevant and financially unsustainable.

SingPost is discussing with the government to forge a new business model to address this issue.

As there are new directors coming on the board, a new Group CEO has to be hired if SingPost does decide to invest in a new business.

As for now, we understand the process is ongoing and no group CEO/business have been identified yet.

FY25 likely weak - value lies in assets monetisation

|

We expect SingPost’s upcoming results to be weak due to challenges faced by the international business and the high costs of the local postal network amid lower demand.

However, we believe the focus should be on asset monetisation and dividends rather than earnings.

|

Full report here.

See also: SINGPOST: Ignore The Noise, say analysts. Special Dividends Loom as This Company Monetises Non-Core Assets

Waiting to be sold: SingPost Centre in Eunos Road, a prominent mixed-use development valued at S$1.1 billion.

Waiting to be sold: SingPost Centre in Eunos Road, a prominent mixed-use development valued at S$1.1 billion.