• Jarick has considered the boardroom drama and all, and stuck to his "buy" call on the stock. |

Excerpts from Maybank KE's report

Analyst: Jarick Seet

SingPost

Patience to be rewarded

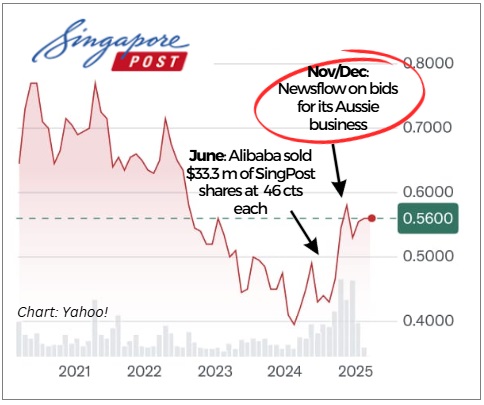

The company has also reiterated its unchanged strategy which is to divest non-core assets and to return value to shareholders. We are awaiting the circular for the EGM to approve the sale of the Australian business followed by approval from the Australian government as well as the sale of Famous Holdings. All in all, we expect the bulk of the sale proceeds to be distributed to shareholders as special dividends as part of its FY25 results in May. As a result, we believe patience will be rewarded and maintain BUY with an unchanged TP of SGD0.77. |

| Significant special dividends highly likely |

After paring down its Australia debt and coupled with the potential sale of Famous Holdings, we expect around SGD400-450m excess sales proceeds could be distributed as special dividends to shareholders.

|

SINGPOST |

|

|

Share price: |

Target: |

As of 30 Sep 2024, SingPost still holds about SGD428m of cash, hence we believe it will not need to keep so much cash from the sales proceeds on its balance sheet.

This works out to be around SGD0.17-0.20/share for potential special dividends.

Even without Famous, we expect the distribution to be around SGD0.12-0.15/share. Waiting to be sold: SingPost Centre in Eunos Road, a prominent mixed-use development valued at S$1.1 billion.

Waiting to be sold: SingPost Centre in Eunos Road, a prominent mixed-use development valued at S$1.1 billion.

| VALUE PROPOSITION SingPost is the 4th-largest logistics player in Australia. Significantly undervalued with net assets worth an estimated SGD0.90/share. Profitability and dividends likely to surge in next few years. Asset monetisation will return significant value to shareholders. Beneficiary of higher e-commerce volume. |

Singapore business will need more right-sizing

We believe that the local postage business will likely still experience a drop in volume and more right-sizing of costs and outlets will likely be needed.

We also expect postal rates to be raised down the road amid declines in volumes and users.

|

Ship stabilising, be patient |

Full report here.

See also: SINGPOST: Ignore The Noise, say analysts. Special Dividends Loom as This Company Monetises Non-Core Assets