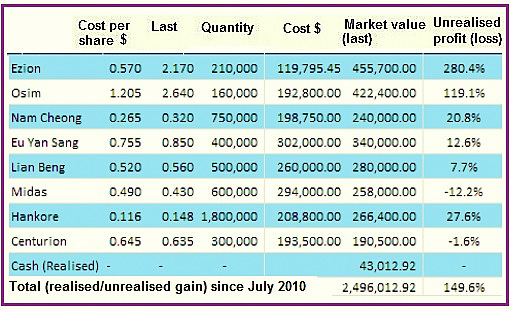

Terence Wong, head of research, OSK-DMG.My Model Portfolio did well over the past week, rising 1.9%.

Terence Wong, head of research, OSK-DMG.My Model Portfolio did well over the past week, rising 1.9%. Water treatment firm Hankore (BUY, TP SGD0.161) was once again the major contributor, jumping almost 9%.

Since it was purchased less than three weeks ago, it has appreciated by 28%, driven by a series of positive newsflow.

Hankore will be finalising the consideration for the deal to buy up China Everbright’s assets by the end of the month, and a definitive agreement will be made by the end of next month.

As we indicated in our initiation report, this deal is a game changer for the company.

♦ Liftboat specialist Ezion (BUY, TP SGD3.00) has seen its share price decline 12% since its peak in Jan.

Head of Regional Offshore & Marine Research Jason Saw thinks that it is a good time to accumulate on weakness.

He likes Ezion for its solid chartering backlog, leading market position in Asia and strong management track record (ditto).

Head of Regional Offshore & Marine Research Jason Saw thinks that it is a good time to accumulate on weakness.

He likes Ezion for its solid chartering backlog, leading market position in Asia and strong management track record (ditto).

♦ Key Change: I will be selling off Eu Yan Sang (BUY, SGD0.92), which retails and distributes traditional Chinese medicine, as it is flirting with our TP.

I will be hiving off all 400,000 shares at SGD0.85, walking away with gains of 13% over an 8-month holding period.

I will be hiving off all 400,000 shares at SGD0.85, walking away with gains of 13% over an 8-month holding period.

Since Terence started his model portfolio in July 2010, it has gained 150%.

Since Terence started his model portfolio in July 2010, it has gained 150%.

Nam Cheong is heavily recommended by analysts but I wonder why there is always a big road block to its share price.