WHEN SCIENTIFIC INSTRUMENT firm Techcomp dual-listed its shares eight months ago in Hong Kong to supplement its Singapore listing, investors were no doubt wary of the poor track record of companies following the same route.

However, Hong Kong-headquartered Techcomp's stock has been well received on the Hong Kong bourse, trading on higher volume and at a price premium to its Singapore-listed shares.

It now has a strong half to boost its case even further, management told a packed conference room in Hong Kong yesterday (Aug 14).

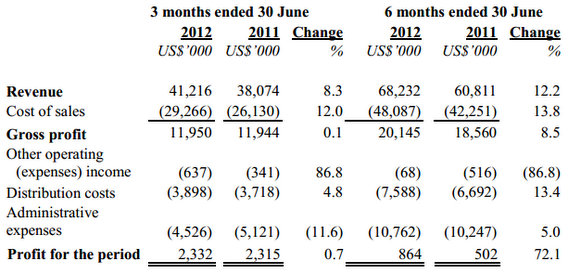

Despite a slumping global outlook and slower GDP numbers trickling in from the Mainland Chinese economic juggernaut, Techcomp managed to push its first half revenue up 12.2% year-on-year to 68.2 million usd.

Photo: Aries Consulting

This helped produce a net profit for the January-June period of 864,000 usd, up over 72% from a year earlier.

“We enjoyed solid growth performance both from our distribution and manufacturing businesses over the period,” said Techcomp President and CEO Richard Lo.

Speaking at an interim results briefing organized by Aries Consulting, Mr. Lo explained the dual-listed firm enjoyed much greater flexibility and growth potential due to its relatively unique yet balanced operational model.

“With a firm foundation in scientific production, our manufacturing operations are driven by both in-house R&D as well as key strategic acquisitions through our highly successful M&A campaign.

“But we are also a high-tech service firm with client-driven factors pushing our distribution business forward,” he said.

Indeed, the firm has managed to achieve a rare success of sorts in today’s topsy-turvy marketplace.

As for its performance on the stock market, Techcomp joins an elite and tiny membership that includes CapitaMalls among Singapore-listed firms that have performed well in additional capital markets.

In the first half, revenue from the distribution business rose 12.5% year-on-year to 45.8 million usd, while manufacturing sector revenue increased 11.4% to 22.4 million.

The company was able to edge up its revenue contribution from manufacturing operations to 32.8% of the total top line, up from 31.3% a year earlier.

“Now our contribution ratio to the top line measured by business segments is around three-to-two in favor of distribution operations. In five years, this will likely approach parity as growth for both remains strong in our main market, Mainland China,” Mr. Lo added.

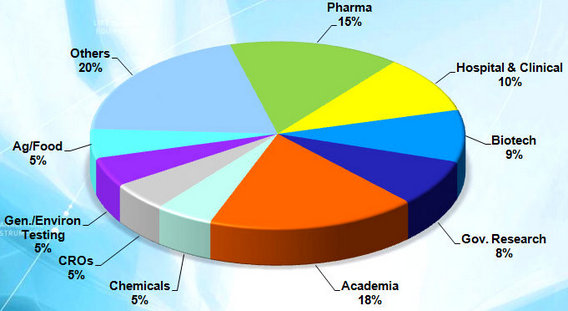

It was only natural that the world’s most populous country was also Techcomp’s biggest market for highly advanced scientific instruments, analytical instruments, life science equipment and laboratory instruments.

Photo: Andrew Vanburen

And it didn’t hurt the cause that Techcomp’s main production facilities were located in and around China’s commercial and financial capital of Shanghai.

“Mainland China will continue to be our top sales market. But as we diversify and broaden our geographic market reach and product offerings, the PRC will likely constitute a smaller percentage of the total going forward,” the CEO said.

Mainland China accounted for 76.9% of total sales in the first half, identical with the year-earlier percentage, with France and Switzerland a distant second place at around 6.4% each.

Recently, Techcomp’s growth has been leaning toward the “non-organic” variety, with a string of successful acquisitions recently added to its war chest.

During the first half, Techcomp acquired the remaining 20% interest in Zurich-based Precisa and a 56% stake in US-based IXRF.

“Recently, we have been targeting high-quality, brand name pickups. These acquisitions are expected to further strengthen our group’s global presence in the industry,” Mr. Lo said.

Following the new additions to Techcomp’s brand portfolio, the Hong Kong-based firm now manufactures equipment under the names Techcomp, Dynamica, Froilabo, Precisa and IXRF.

And its primary distribution customers are a veritable who’s who in the technology sector, including Hitachi, Horiba, UVP, Millrock, Tomy, Fujifilm and Siemens.

Mr. Lo said he was bullish on future prospects for analytical and scientific instruments demand, especially in its biggest sales market – China.

“The Chinese government continues to invest in science and technology, R&D and public healthcare. In addition, there is a growing number of industries supported by the 12th Five-year Plan with food safety concerns driving market demand for our products.”

See also:

Which Stock Has Performed Well After Dual-Listing? Ans: TECHCOMP

TECHCOMP is 'attractive', ADAMPAK target 36 cents

TECHCOMP: Record US$11.2 m profit in 2011 after adjusting for one-offs

My friends from hk are different. They buy on opportunities. If they lose money, they don't complain to govt. they just move on to the next stock.