Excerpts from latest analyst reports.....

Core Pacific – Yamaichi International (H.K.)* says Techcomp's valuation is attractive

Analysts: Felix Kwok & Eugene Mak

Transferring shares to Hong Kong Market. Techcomp listed in Hong Kong by introduction in Nov 2011 and is currently dual listed in Hong Kong Exchange and Singapore Exchange (SGX) (stock code: TCH SP).

As no new shares were issued when listing in Hong Kong and very few shares were transferred to Hong Kong Market, there is a 25% premium to Singapore share price.

In our opinion, more Singapore investors will convert their shares over to Hong Kong improving liquidity in Hong Kong.

Current valuation has significant discount over peers. Techcomp is trading at 11x FY11 PER (8.8x for TCH SP) and 1.5x FY11 PBR (1.2x for TCH SP).

For the peers, the top 10 scientific equipment producers and other peers with similar market cap are trading at 18.4x FY11 PER (excluding Perkinelmer) and 17.9x FY11 PER, respectively.

Including the factor of 40% industrial sector premium on FY11 PER for Japanese and the U.S. over HK market, the current valuation still has a significant discount over the peers.

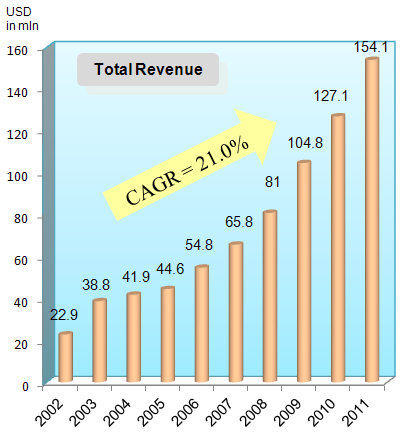

Taking out the one-off listing expenses of US$2.8mn, the net income for FY11 was US$11.2mn, up 6.6% yoy, accounting for 7.3% net profit margin, which beat the peers with similar market cap.

Given the story of stable top-line growth with improving margin, we believe the current valuation is attractive.

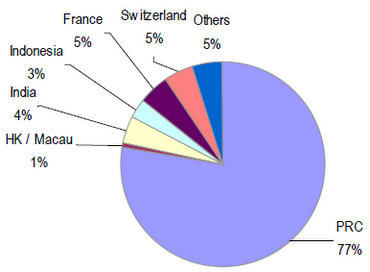

Downside risks: (1) Policy changes in PRC; (2) Austerity reforms in Europe are stricter than expected; and (3) Wage and raw materials inflation is more than expected.

* Core Pacific – Yamaichi International (H.K.) is an investment banking specialist with deep roots in the Greater China region.

Recent story: TECHCOMP: Record US$11.2 m profit in 2011 after adjusting for one-offs

DMG maintains 'buy' and 36-cent target price for Adampak

Analysts: Edison Chen & Terence Wong CFA

Adampak posted its 4Q11 results with a net loss of US$0.2m which is in line with our estimates.

Taking away the one-off impairment charges, full year core PATMI fell 30.0% YoY to US$6.5m mainly attributable to the reduction in sales as a result of the Thai flood disruption.

Full year dividends of 2.0S¢ is also in line with expectation.

Moving on, we expect the group to restore its production capability in Thailand by April, in time for its customer’s recovery.

Subsequently, we expect the group’s second half performance to be strong and the full year dividend to recover back to 3.0S¢.

Maintain BUY with an unchanged TP of S$0.36 based on our Discount Dividend Model (Key assumptions: WACC: 9.7%, Terminal growth rate: 0.0%).

Comments

I asked my HK friends to check and they said Core Pacific is a instit house. So funds are expected to buy soon.