Translated by Andrew Vanburen from a Chinese-language piece in Sinafinance

"CHINA'S LADY BUFFETT" is enjoying a "Chinese Buffet" of her own, picking from a wide variety of bargains on the Hong Kong Stock Exchange.

Liu Yang, nicknamed the local version of the famous Nebraska-based investor, has gained great fame and respect for her fabulous success in the regional capital markets, and says her sentiment is just fine, thank you very much.

That's despite currently being in possession of some seriously underpriced shares that need to add alot of value before Liu even hopes to break even on them.

Ms. Liu says she adds to her portfolio daily, and has already spent 2.3 billion hkd buying shares in Hong Kong this year alone.

“I buy shares every day. The lower they go, the more I buy,” she said.

Despite the benchmark Shanghai Composite Index in China being down nearly 20% from a year earlier, and Hong Kong’s Hang Seng Index not doing much better, “China’s Lady Buffett” says she is “confident and not intimidated” amid the current market downturn.

She said that recently, the Hang Seng benchmark index fell by 153 points but the big funds didn’t jump in right away.

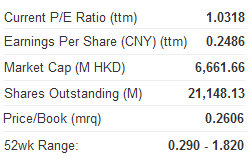

This left her free to patiently wait on the sidelines as the share price in one of her favorite counters -- Renhe Commercial Holdings Co Ltd (HK: 1387) – a developer of underground shopping centers in China converted from underground civil defense shelters – fell another 11%.

“I watched the price fall lower and lower, and all I could think was... ‘Buy!” she said.

As of Tuesday at market opening, the Hang Seng Index had fallen for eight straight sessions but with the surprise on the upside for Germany’s macro data – the EU’s largest economy – Hong Kong shares jumped by nearly 1%.

Once again, “China’s Lady Buffett” had outmaneuvered the market and jumped in headfirst at just the right time.

But she better find a comfortable chair because the property developer's shares have already fallen over 62% so far this year and it will be a long haul before Liu reclaims her investment.

Liu’s Atlantis Investment Management now holds 6% of Renhe Commercial, a fitting shopping play for a master shopper.

However, she was adamant in a phone interview that she was a long-term shopper, in this case.

“Many people say I’m about to dump Renhe shares. Why would I sell? I definitely won’t sell. I’m still buying Renhe shares,” she remonstrated.

She emphasized that she felt that Renhe Commercial was fundamentally sound and was in her opinion was the best bargain in the real estate sector.

Reaffirming her oft-repeated pledge that she is oblivious to market rumors when making buying and selling decisions, Liu said: “I am fully confident on this decision. Therefore, I can tell you with firm resolve that since January first of this year, I have already put 300 mln usd into the market. In fact, I add to my portfolio every day, buying more with each price drop.”

That being said, “China’s Lady Buffett” may have to wait a bit longer to enjoy the fruits of her shopping spree labors.

That is because the firm she runs -- Atlantis Investment Management -- as of May 14 has a return on investment performance of (-10.8%).

Her accumulation of Renhe Commercial has been the biggest drag on Atlantis Investment’s year-to-date performance.

Other major anchors pullling down Atlantis' performance of late have been coal play Hao Tian Resources (HK: 474) and tech consulancy Hi Sun (HK: 818), both of which are major possessions of Liu and which have fallen by 67.3% and 49.1%, respectively, since the start of the year.

But knowing what we do of Liu’s shopping expertise, the decision by “China’s Lady Buffett” to stock up on shopping counter Renhe's shares may end up once again surprising us bystanders down the road.

See also:

CHINA’S LADY BUFFETT: Liu Yang Making Splash In Hong Kong

'CHINA’S LADY BUFFETT' Dumps 12 Stocks... Sign Of The Times?

BUFFETT Says China May Already Have Its Coke

Our Visit To Warren Buffett's Berkshire AGM: Wow!