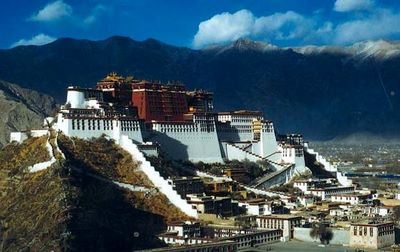

Photo: Tibet Tourism Bureau

Translated by Andrew Vanburen from a Chinese-language blog in Sinafinance

SO FAR THIS YEAR, the Shanghai Composite Index -- the benchmark tracker of China-listed A- and B-shares -- has risen a respectable 8.3%.

But if three things in particular were to take place, then the country's two stock markets in Shanghai and Shenzhen would be the envy of the region.

The past few days of performance by the Shanghai Composite Index can be quite instructional for our purposes.

We have seen the Index move somewhat erratically, albeit rangebound, over the past five trading days, jumping back and forth within the 2,300-2,400 point range.

And despite the good news on the macroeconomic front over the weekend – namely, the lowering of the reserve requirement ratio by half a percentage point – the Index still failed to break through the psychologically significant 2,400 threshold level.

So even with the prospect of cheaper credit circulating through the economy (this latest RRR adjustment frees up a staggering 400 billion yuan in lendable cash!) – it seems like something is holding back the full potential of the bourse.

I would argue that it is a lack of long-term confidence due to a lack of beacons pointing the way towards long-term stability.

By this I mean that China has been trumpeting the benefits of selling to Chinese themselves – rather than continue with a glaring overreliance on foreign consumers – for nearly a decade.

But an honest assessment of the efficacy of this campaign cannot be overly praiseworthy.

China is still blindly hardwired to export its way to growth, and its “investment-led” GDP still focuses far too much attention on the export sector rather than the domestic infrastructure and market building projects that would truly take the country on its first baby steps toward tapping the PRC consumer.

If local government officials would join hands with economic regulators and effectuate a true and concerted campaign to build up the central and western regions, which are far richer in natural resources than their more developed maritime province peers – but far less advanced infrastructure wise – then not only would China’s economy be less subject to external shocks, but the gap between the coasts and the hinterlands would be narrowed significantly.

Monday’s market vacillations were case in point about how investors are looking for long-term stable bets, with the Index all over the place in both sessions with no “theme” or “counter” seeming to take the proverbial baton and run with it for the duration of the trading day.

If investors knew for a fact that there was a long-term, concretized and actionable plan in place to invest in the development of the interior provinces, then it is a given that listed firms with heavy exposure to the delivery and installation of infrastructural assets to these regions would be the new “hot picks” on the bourses for a long time to come.

And fortunately, there are initiatives being taken to shift the economy in this brave new direction.

In short, “Go West” would bring untold opportunities to far more companies than would a dogged continuation of the old, worn-out strategy of producing nearly everything for export to “The West.”

The State Council just said it approves of the NDRC’s plan to enshrine the “Go West” development plan in the Five-year Plan.

This aspect to the politically and economically significant Plan will certainly bring tremendous growth potential to a variety of industries with ‘dogs in this fight’, especially railway operators, tourist plays, airports, construction firms and retailers.

If any industries standing to benefit were left out of this short list, that is because it is perhaps better to leave it blank.

Because the sky is the limit as to who will prosper from a concerted effort to develop around two thirds of China’s land mass, and the only thing stopping listed firms from throwing their hat in this enticing ring is a lack of initiative.

If all this pans out, then look for the Shanghai Composite’s days of tentative gains followed by afternoon profit-taking to be a thing of the past.

The “Go West” development campaign is perhaps the single biggest potential igniter of a sustained, significant bull run in Shanghai and Shenzhen.

But that doesn’t mean it’s the only potential locomotive.

China’s Vice President just returned from the US and Europe.

If requests by the latter for more bailout funds begin to be heeded by Beijing, the world’s second largest economy in China will see a boost of confidence which will transfer into the stock markets.

After all, investors like long-term stability and no market would cheer an even larger meltdown in the EU.

Finally, A- and B-shares will certainly benefit long term from a shift from short-term profit-seeking mentalities to longer positions being held.

But long-term confidence, which inspires long positions, can only come about when things are relatively stable at home and abroad – and when there are long-term investment opportunities worth foraging for.

And that is why the first potential locomotive – “Go West” – is so crucial.

See also:

CHINA MARKET: Unraveling The A-Share Ascent

Just As In Gambling, Self-Control Equals To Research For Investors

ALEX WONG: Don’t Let Gyrations Make Gamblers Of Us