Main reference: Story by Sinafinance market blogger

SOMETIMES WE CAN learn more from others' failures than their successes.

Below are three tales of PRC shareholders who nearly lost their shirts and, in one case, his home, playing the market.

Since the Chinese economic boom got off to a roaring start some three decades ago, one of the most common topics of conversation among friends sitting around living rooms or colleagues gathered around the water cooler has been housing – namely, the price of homes and how to try and make a buck or two from it all.

Monitoring one's fortunes: Chinese investors check out their stocks. Photo: nipicHowever, such idle chatter has gradually been dominated by stock market speculation and tip sharing these past couple years or so.

Monitoring one's fortunes: Chinese investors check out their stocks. Photo: nipicHowever, such idle chatter has gradually been dominated by stock market speculation and tip sharing these past couple years or so.

It's because there are far more people who have made it big in the bourses to ignore the topic any longer. So now, we get a lot of: “How’s your portfolio?” or “Any new tenants come knocking?”

Whether it be in my adopted hometown of Shenzhen where I work now, or in my birthplace village several hours away, it’s the same story, with everyone dreaming of making it big in the bourse.

In a way, share trading is the ultimate equalizer and an essentially egalitarian activity.

Anyone can make a fortune, though few do. Anyone can also go bust – and many sadly do.

The stories below I heard detailed in painful detail at such impromptu gatherings. Hopefully, they serve as reminders to us all of the inherent risks – and potential rewards -- in playing the market.

Story One

A Shenzhen lawyer surnamed Zhou handed over eight million yuan of his hard-earned money to a seasoned broker to do what he wanted with it.

Zhou trusted this man thanks to previous personal interchanges and on the good word of others.

Four years later, the advocate’s original investment had nearly dried up to nothing.

Chinese love talking about property investment opportunities.

Chinese love talking about property investment opportunities.

Photo: AgileLuckily, Zhou was able to continue drawing a sufficient salary over this period to compensate for the over one million usd in stock market losses.

“These past four years, I have been bleeding money in the stock market while working harder and harder at my day job to keep my head above water,” he said.

The hard lessons of his losing picks have left him without the nerve to check his portfolio every day.

“When I first started buying stocks in 2008, I would check several times a day. Now, I actually force myself to just check once a month.

“I don’t want to waste time anguishing over something I can’t change overnight,” he said.

Zhou’s hard work as a lawyer should be a guarantor of a better life ahead.

But sadly, working his fingers to the bone at the office is just to keep ahead of things financially, no thanks to some disastrous picks five years ago by his “ace” investment consultant.

Story Two

My college classmate, surnamed Zhang, has lost 60% of his capital over the past half decade.

At first, as Beijing was preparing to host its first Summer Games, Zhang’s original 40,000 yuan investment jumped 50% to 60,000.

“I got caught up in the whole hype and lost my sense of proportion. You’ll recall there was a lot of optimism and emotion in China at that time,” he said.

This prompted him to throw caution to the wind and increase his investment to 100,000 yuan.

Today, five years later, it’s shrunk by 60% to just 40,000 – back to its original level.

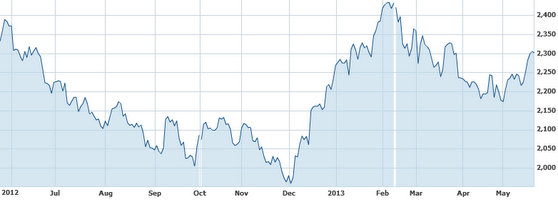

Recent China shares performance. Source: Yahoo Finance

Recent China shares performance. Source: Yahoo Finance

He said he was left with two simple conclusions from his failures.

“First, don’t believe the hype. It’s really not that easy to consistently make money in equities.

“Second, despite my losses, I still feel I would have lost it all without a little self-discipline. When things really started going sour in early 2009, I stopped all sharebuying activity, no matter how tempting a bargain looked.”

Zhang said this allowed him to keep his shirt – and his flat – despite an agonizingly strong temptation to look for diamonds in the rough to get him back in the black overnight.

Story Three

Our next hapless investor is a teacher from Hunan Province surnamed Zhao who took a high school job in Shenzhen in 2007.

He has been losing money in both stocks and properties for the past four years.

At the time, he sold a residential property in Hunan and used the 500,000 to buy what he thought were high-potential stocks.

He wanted to make a quick buck in A-shares, and then use the money to buy a bigger and better house in Shenzhen before inviting his wife and son to come join him.

He jumped into the market when it was breaching the 4,000-point level.

Today, it's struggling to stay above 2,000.

He did get one of his wishes – his wife and son now live with him in the southern Chinese boomtown of Shenzhen.

But they are squeezed into a one bedroom flat, and Zhao rents – not buys.