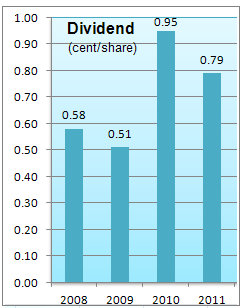

SERIAL SYSTEM has continued to deliver on its track record of dividends.

For the 1H, it will pay 0.22 cent a share (1H2011: 0.3 cent a share), which is a 3.8% yield on the recent stock price of 10.4 cents.

The stock has been trading between 10 cents and 13 cents this year.

It is all but a foregone conclusion that Serial System, given its track record, will propose a final dividend in about 6 months' time -- which will bump up further the dividend yield for the year.

For now, the 0.22 cent interim dividend will help keep shareholders stay loyal, as the dividend is many times higher than the interest rate paid by fixed deposit accounts.

Another attractive feature of the stock is its Net Tangible Assets of 14.45 cents a share.

1H2012 results

Revenue-wise, in 1H, Serial clocked S$400 million, which was 1% higher year-on-year.

The net profit, however, fell 32% to S$4.8 million, on higher expenses arising from increased staff costs to grow newer product lines and higher amortization of distribution rights.

Serial paid higher office rental expenses, staff related costs (staff insurance and housing fund), bank charges and various administrative expenses as the Group increased its resources to support expansion in newer product line growth.

In addition, its cash conversion cycle has continued to rise - from 70 days in FY11 to 76 days in 1H12.

Explaining, Serial chairman Derek Goh said this is in part because of Serial's rising sales to Taiwan customers, who typically enjoy 90 days credit from their suppliers.

Cashflow-wise, Serial System booked a healthy inflow of S$20.4 million from operations.

Its cash and cash equivalents stood at S$45.9 million.

For Serial System's powerpoint presentation, click here.

Recent story: STX OSV, SERIAL SYSTEM, SAMKO, CHASEN: Latest Happenings…

AFTER ACCELERATING its business in South Africa, Stamford Tyres has now set its sights on another populous market -- India.

One of South East Asia’s largest independent tyre and wheel distributors, Stamford Tyres has entered into an agreement with Sumitomo Rubber Asia (Tyre), a

subsidiary of Sumitomo Rubber Industries, to form a JV sales company to supply Falken tyres to India.

Falken Tyre India will have a registered local capital of 550 million Indian Rupee (approximately S$12.3 million).

Sumitomo will hold a 60% stake while Stamford Tyres, the remaining 40%.

Falken Tyre India will set up its corporate HQ in India with employees stationed across the country, and will commence operation from April 2013.

It will leverage on Sumitomo’s proprietary tyre technologies and Stamford’s distribution capability.

Yasutaka Ii, Director and Senior Executive Officer of Sumitomo Rubber Industries, said, “India is a market with huge potential. We are delighted to continue our partnership with Stamford Tyres which has a strong distribution track record.”

Mr Wee Kok Wah, President of Stamford Tyres, said: “At present, Stamford Tyres distributes Falken tyres in markets such as Singapore, Malaysia, Thailand, Indonesia and South Africa. This JV is another major milestone for Stamford Tyres and signifies the next step in our long-standing relationship with Sumitomo.

"Together, we are confident that our entry into the Indian replacement tyre market will generate long-term growth for both companies and possibly open up more opportunities for collaboration in the future.”

Recent story: STAMFORD TYRES: Revenue Up 6.7% At S$364m; Maintains 1.5-c dividend