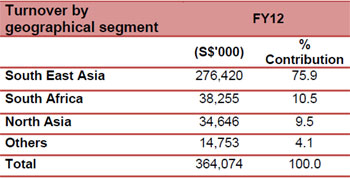

STAMFORD TYRES, one of Southeast Asia's largest independent tyre and wheel distributors, posted a revenue increase of 6.7% year-on-year to S$364.1 million in the year ended April 2012.

Net profit was S$9.8 million, down 27.4% due to higher inventory costs and foreign exchange losses.

Notably, South Africa contributed 10.5% to revenue and there was foreign exchange loss of S$2.9 million mainly due to the strengthening of the Sing dollar against the South Africa Rand.

Inventories were up 28.8% at S$122.5 million as at 30 April 2012 mainly due to higher tyre prices and the addition of a new range of earthmover radial tyres.

The good news is: The group declared a first and final dividend of 1.5 Singapore cents, unchanged from the previous year. That translates into a yield of 5% based on the recent stock price of 31 cents.

The dividend payout was 36.1% of earnings.

”It is the management’s policy to maintain a stable dividend quantum,” said CFO Conson Sia at an investor briefing on Friday morning.

Cash and cash equivalents were S$16.9 million, down 39.0% mainly due to higher inventory holdings.

Below is a summary of questions raised at the investor briefing and the management’s replies. Vice President John Ang (head of retail for Singapore), Snr VP Pat Berriman (sales & marketing), Snr VP Clare Law (supply chain management in North Asia) and Malaysia unit CEO SK Cham were also present at the meeting.

Q: Why did profitability suffer in FY2012?

In FY2011, tyre prices were going up and it was advantageous to hold stock as we could sell at better prices. This translated into better margins that year.

In comparison, there was downward pricing pressure in FY2012 due to the decline in rubber prices. Fortunately, the price decline was well managed by the car tyre manufacturers. Our 22% gross margin for FY2012 is about the long-term norm.

Q: Do declining commodity prices affect Stamford Tyres adversely?

Fortunately, manufacturers do not slash prices when cost of production comes down for them as this would affect their brand image. They also consider how pricing would affect distributors like us, who hold tyre inventory.

The manufacturers would adjust prices downward slightly, less than what they would save from the reduced cost of production. They also implement price adjustments gradually over a period of about 3 months, so that distributors like us have time to clear our inventory.

We are stockists. We are not traders who can react overnight. We hold inventory and make sure the supply and delivery is stable in the market where we operate. We pass on to customers any savings or costs but it is a gradual process that takes 3 months.

In an environment of declining prices, the challenge for us is to maintain adequate stock and not to overstock.

Q: Do you outsource the manufacturing of your proprietary brands?

Yes, we provide the mould and we negotiate how much we pay for raw materials.

Q: What is your sales breakdown by product category?

56% is from major brands, of which 40% is from Falken. 36% is from proprietary brands.

Q: Geographically, why is revenue contribution from China as small as 4% given it is such a large market?

Major tyre makers do not allocate an excessively large agency for tyre distribution in China as they have their own plants there. Neither can we ramp our production of proprietary brands there as 3rd party tyre makers only do contract manufacturing for export markets so that their turf is not encroached upon.

To grow in China, we need to build more distribution points in addition to Shanghai, Beijing and Guangzhou.

Q: Your retail business in Singapore is profitable. Do you have plans to open retail outlets outside Singapore, such as in South Africa or Hong Kong?

South Africa and China are not locations where we wish to open retail outlets. We are looking for suitable property in Malaysia to acquire. We not do wish to rent shop space as that may put us in a situation of not being able to renew the lease after 3 years when we have built up a pool of returning customers.

Or, we can work with a retail partner who is already established there. In Thailand, we supply SSW wheels and other tyres to Marubeni-unit B-Quik, which has 100 tyre retail outlets there.

The FY12 financial statement is available on the SGX website.

Related story: STAMFORD TYRES, DUTY FREE, JEL CORP: Latest Happenings....