HEALTHWAY MEDICAL CORP posted a $1.9 million net profit in 1Q, up 24% year on year.

This adds credence to a market view that the company is on a path of sustainable growth under Lam Pin Woon, who took office as President and executive director in Jan 2011 after being headhunted from the CEO post at the Health Promotion Board.

Given the recurring nature of Healthway's business (and 1Q earnings), the $1.9 million profit could be used to extrapolate to a full year profit of about $8 million.

That would bring its PE down to about 22.

The standard caveat here is ‘barring any unforeseen circumstances”.

DMG & Partners re-initiated coverage of the stock on March 12 with a BUY recommendation and target price of 11.6 cents.

Healthway (market cap:S$180 million, based on 8.6 cent stock price) is Singapore's largest network of private medical centres and clinics. It offers quality healthcare services across the medical value chain in primary healthcare, dental and specialist services.

There are interesting kickers that could boost its profit, one of which is the S$1.4 million in management fees that Healthway (www.healthwaymedical.com) is set to collect sometime this year.

The amount was not booked in FY11 out of prudence, because of late billing after the year-end for management services that Healthway provided to 10 medical and dental centres in China.

In a meeting with the Healthway's Mr Lam, I learnt of a partnership, effective May 1, which Healthway crafted with NTUC but it didn’t quite get highlighted in the media.

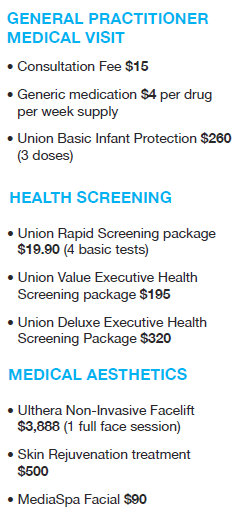

Healthway is offering a flat $15 consultation fee to NTUC members, a significant discount from the $22-30 usually charged to walk-in patients. There are also discounted deals for health screening, etc. Click here for more info.

Healthway's 2Q financial result would be scrutinized for the size of this initial contribution.

If the word gets around quickly among NTUC members, the revenue could be significant given that NTUC has over 500,000 members.

Mr Lam spoke about another lesser-known business of Healthway which it is determined to grow -- its mobile business, whereby it dispatches doctors to meet the 'anytime, anywhere' needs of corporate clients.

One of these clients is the Singapore Police Force, which would call on Healthway doctors to turn up at the scene of certain types of arrests.

Free distribution of HMD shares

There is another key aspect of Healthway that the market has not paid much attention to.

This has to do with the announced plan to distribute in specie shares of a company called Healthway Medical Development (HMD) to shareholders of Healthway (the listco).

The distribution, which will be free of charge, to Healthway shareholders will take place around the time HMD is listed on the Singapore Exchange within the next 12 months or so (ie, by June 2013).

Healthway the listco injected $1.25 million for a 25% stake of HMD. Of the 25% stake, Healthway will distribute in specie 10% and hold the remaining 15% for divestment eventually.

I have put together a fuller picture of HMD and its relevance to shareholders of Healthway:

1. HMD’s mission is to develop and acquire medical assets.

In its first acquisition, last year HMD acquired 50,000 sq ft of prime land within a few minutes’ walking distance of the KL City Centre and Petronas Twin Towers for RM100 million, as reported by Malaysian media.

Construction of a medical hub with serviced apartments will start at the end of this year and take about two years to complete.

Based on industry rates, the development cost is about RM120 million for about 300,000-400,000 sq ft of floor area.

2. HMD is busy working on other potential asset acquisitions, including medical operations that are already up and running in the region in countries such as China.

3. HMD has its own funding sources (from its shareholders and from borrowings) and does not tap the operating cashflow of Healthway (the listco).

4. The distribution in specie of HMD shares may be viewed as a dividend payout to the 10,000 or so shareholders of Healthway. This distribution enables HMD to achieve instantly a wide shareholder base. Subsequent to the listing of HMD, Healthway intends to divest its 15% stake in HMD at an opportune time.

5. Aside from Healthway, the shareholders of the remaining 75% of HMD include key figures from Healthway the listco:

a. Fan Kow Hin (executive chairman of Healthway and owner of a 24.4% deemed stake);

b. Dr Jong Hee Sen, (a non-executive & non-independent director of Healthway who owns a 6.7% direct and deemed interest in the listco). Dr Jong is also President of HMD; and

c. Aathar Ah Kong Andrew (a substantial shareholder of Healthway with a 9.87% direct and deemed interest).

6. One of the best things about HMD for Healthway is that the latter will have first right of refusal in managing the operations of HMD’s assets.

The synergies are all too clear -- and Healthway looks set to recover to the pink of health following a few years of dismal earnings after its IPO in July 2008 at 36 cents a share.

The clearness in your post is just excellent and i could assume you are an expert on this subject.

Well with your permission let me to grab your feed

to keep up to date with forthcoming post. Thanks a million and please

continue the rewarding work.