This is Part 2 of a two-part article. Part 1 is here > JIM CHUONG: My lazy way to getting rich

Jim Chuong, 39. He is a private investor based in Mississauga, Canada, and has been interviewed in MoneySense magazine, The Globe and Mail, The Toronto Star, CP24, and Report on Business Television. His interviews can be found on his website at http://www.ticonline.com

He is not certified as a financial planner nor does he have a securities designation or business degree. The information provided by Jim Chuong is not to be construed as investment advice.

DIVERSIFICATION

Along with “asset allocation” and “rebalancing”, diversification is one of the top 3 ways to destroy wealth. It is arguably the best way to destroy wealth.

Diversification in investing is like starting 100 businesses in the hopes that one strikes it big to cover for the other 99 losers. It's just as likely that an individual will just end up with 100 losers.

I never much believed in diversification myself.

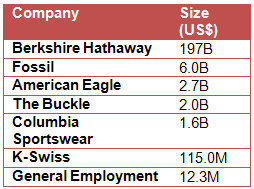

If I believed in diversification, I would want Tom and Kosta Kartsotis to sell their $1.5B stake in Fossil and Tim and Gertude Boyle to sell their $1B stake in Columbia Sportswear and invest it in oil/gas, healthcare, and financial services and in various countries around the world. Just thinking of that idea makes me laugh. I would rather that they keep it all in.

Others argue that diversification helps to minimize fluctuations and thus improve the safety of a portfolio. Minimizing fluctuations is not related to the safety of a portfolio. The equation that represents this idea is:

Increasing portfolio stability = reducing fluctuations = maximizing mediocrity

If an investor wanted the absolute minimal fluctuations, then they should pour every penny into a guaranteed investment certificate (GIC). There is virtually no other financial product that will minimize fluctuations better.

“Look at market fluctuations as your friend rather than your enemy; profit from folly rather than participate in it.” - Warren Buffett

I don't care if my portfolio fluctuates. Actually, my portfolio fluctuates a lot. That's irrelevant to me because my goal is to buy high quality businesses at fair prices to maximize my long-term return. Other people have different goals. If your goal is to “minimize fluctuations so that returns will be less than inflation” then you should diversify, asset allocate and rebalance.

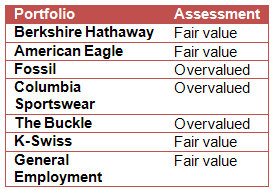

There is nothing new to say about these businesses. Sales at K-Swiss appear to be turning around, but because of the slow response of management, time will tell if the injury is terminal. In many ways, K-Swiss is like the former technology trend setter RIMM. They sat on their laurels for too long and became stale.

|

My rules for selecting stock include: 1. High insider ownership and/or buying (ideally 15-20% insider ownership) |

Once I have selected the stock, I need to wait for a price. I will attempt to buy at a price-to-earnings ratio of 10 (or less) and a price-to-book of 2 (or less). Sometimes this works out, many times, I get close and I settle. I will definitely not invest in a business that has a high price-to-earnings, but I have been known to buy into a business with a high price-to-book (e.g. 4) now and then.

The first part (screening) is relatively easy. Using Yahoo! Finance, I screen for criteria #1 and #3 within a few minutes. I then go to Morningstar.com in order to satisfy criteria #2. I put all these businesses into a list on Yahoo! Finance along with their P/E and P/B ratios and I wait. When the P/E and P/B ratios become interesting, I then dig into criteria #4, #5, and read a bit more into the business. After that, I then need to decide an appropriate action based on what is currently in my portfolio and how a new prospect compares to what I already own.

Once a new prospect matches favourably to everything in my portfolio, I need to decide how much to invest. Because I know that my timing is terrible, I deploy only 25% of what I wanted to invest; expecting to average down over the next few months. I continue to deploy 25% of my remaining capital. I usually don’t deploy capital more than 3-4 times over a period of a year before I stop buying.

The cycle of screening, listing, waiting, research and buying usually takes 3-5 years depending on the economic cycle. The act of waiting takes up 99% of those 3-5 years.

FOSSIL

Some have noticed that the bulk of my gains have come from one stock, namely, Fossil. It is also no coincidence that Fossil is one of my oldest holdings. Considering the benefits of compound investing, when comparing two equally strong businesses purchased at the same price, the one that is owned for the longer period of time will generate the bulk of my return. This becomes especially pronounced the longer the time difference between purchases. If I purchase 100 shares of stock A 10 years ago, and I purchase 100 shares of stock B today (assuming similar initial dollar amount purchases), stock A will have had 10 years to compound and likely overwhelm any contribution from stock B.

This is not to say that I shouldn't bother with buying stock B. The second company may be extremely attractive, and be a significant holding 10 years going forward.

The methodology I've employed by looking for businesses with significant insider ownership, no debt and a long history of profitability does not guarantee success. However, I believe that it slants the odds in my favour - I have a small chance of running into a big winner, a small chance of running into a big loser and large chance of running into a small group of satisfactory businesses.

|

When investing, there are only two ways to make money: 1) informational advantage or 2) emotional advantage. An informational advantage includes individuals who work within a business or industry or a trading firm that has direct access to the exchange (also known as a technology advantage).  I have an emotional advantage. For whatever reason, my wiring for greed and fear are backwards from general society. When society becomes greedy and eager to buy, I become fearful and look to sell. When society becomes fearful and eager to sell, I become greedy and look to buy. I believe that this emotional advantage, coupled with my methodology of selecting stocks (i.e. “the rich get richer”) enhances my likelihood of success. |

PHOENIX, ARIZONA

After buying what I wanted to buy in the stock market in 2008, I resumed waiting. The stock market rebounded very strongly in 2009 and 2010 and prices were far higher than I was willing to pay. However, I couldn’t help but notice the negative press concerning the U.S. real estate market which took a dive in mid-2006.

As an investor, I pay attention when the news is bad. Really bad news is really interesting.

Recognizing that the stock market usually takes 1-2 years to recover (with the exception of the Great Depression), whereas the real estate market would take at least 5, I thought that 2010 was a good time to focus my attention on U.S. real estate.

My goal was cash flow (as opposed to capital gains) and I thought that U.S. real estate had been beaten up long enough where I could gain some experience buying property in the states. Prices were already so low that I thought that it would be a cheap way to learn.

I decided that I was only interested in buying property to use as rental properties. I was not interested in vacation rentals. For cash flow, a vacation rental doesn’t cash flow well (if at all). There is no way I could make any money by wintering in my investment and since the point of buying U.S. property was for cash flow, I decided to focus on pure rentals.

For better or worse, I had some prejudices against Florida because of its humidity and potential for the extra cost of buying hurricane insurance. More costs means less profit. Places like Naples, Boca and such were also snowbird destinations. I wanted a “real” city with people who lived there year ‘round - people who signed 1 year leases, worked, lived and raised their families. Also, everybody and their brother were looking at Florida so Florida was out.

California was too expensive and Hawaii was too far. I considered Las Vegas but found it relatively difficult to get crime statistics on the various zip codes so I focused on Phoenix.

WOW THAT’S PRETTY CHEAP

The last time I purchased investment property was in Toronto in the late 90s after the city went through its real estate downturn. Toronto hasn’t seen a real estate downturn for almost 2 decades now and I think my generation believes that downturns don’t happen anymore. I've always had my eye on Toronto real estate and it’s been frustrating to wait for so long, but what can I do? I saw prices climb from $250 per sq ft to $350 per sq ft to $550 per sq ft and higher. I wrote the city off.

I focused on zip codes in Phoenix that have none, or the lowest levels, of property and violent crime. Crime is my primary screen, my secondary screen is financial. Obviously if you go to areas with higher rates of property/violent crime the prices are lower. For example I could buy in 85032, but that would just give me headaches that I don’t want.

The following link to Phoenix property crime and violent crime maps. Green is good. Red is not so good.

http://phoenix.gov/police/cristat_maps.html

Areas of low crime have “A” and “B” class areas. As you can imagine, “A” class areas are more expensive, offer lower rental yields, but have higher “potential appreciation”. “B” class areas are cheaper, offer higher rental yields, but have lower “potential appreciation”. Not to beat a dead horse, but I wanted cash flow, so for me, I looked at “B” class areas. Other people have different goals.

I decided to focus on buying 830 sq ft, 2 bed 2 bath condos. 1 bed 1 bath condos have higher margins, but are harder to rent.

Condos in Phoenix are different than Toronto. Instead of building straight up in a tower dozens of levels high, condos in Phoenix are mostly 1 or 2 stories because of the difficulty and expense of pushing air conditioned air upwards in the hot climate.

Monthly costs are $175/mo for condo (HOA) fees, $40/mo home insurance, $55/mo property management, $450/yr property taxes. Include whatever else you would normally expense (e.g. extra maintenance above and beyond the monthly condo/HOA fees, legal, accounting etc.). This was a total of approximately $310 a month in fixed costs. Again, this figure excludes legal, accounting, and any maintenance above and beyond the HOA dues.

These types of condos rent for $700 a month and sell for $40,000 or $50 per sq ft. This is about 10% of a similar place in Toronto. That’s pretty cheap.

I have bought with vacant possession and we have also bought with tenant already in place (ie. turn-key). I prefer vacant possession.

Due to the costs of fixing up the unit and vacancies, it make take a year to start generating a profit. That is fine for me.

Once you buy a property in Phoenix, it is important to visit the Maricopa County Assessor's web site at:

http://www.maricopa.gov/Assessor/ParcelApplication/Default.aspx

I use the 3rd line "By Name & Street". Enter your "Last Name" and the "Street" that your property is located. Make sure your property tax bill is being sent to the correct address and that your payments are up to date. Americans are sometimes confused with our "weird" postal codes and don't understand that they're alpha-numeric and may change the letters into numbers to match their idea of a zip code. This would cause your property tax bill to fall into a black hole - not something that you want.

Canadians also need to fill out a Form W-7 to get their Individual Taxpayer Identification Number (ITIN) to pay their share of U.S. taxes. An accountant familiar with the Canadian-U.S. Tax Treaty should be able to help you out. I use an accountant who is able to file both Canadian and U.S. taxes. For more information on the ITIN, go here:

http://www.irs.gov/individuals/article/0,,id=96287,00.html

You would seek to file a U.S. tax return in order to avoid withholding tax on your gross rent.

Keep in mind that the identification that you submit along with your Form W-7 needs to be Notarized by an American attorney at the U.S. Consulate. I used my passport. If you are married you need to make 1 appointment for yourself and another appointment for your spouse. Also remember that no cellphones or cameras are allowed in the Consulate - they will refuse you entry if you have a cellphone or camera. Use the following link to book an appointment to get your identification Notarized:

https://evisaforms.state.gov/acs/default.asp?postcode=TRT&appcode=1

If you're renting your property out make sure you have the proper Residential Property Classification. As a property owner that will be using a property for investment it is your responsibility to notify the tax assessor's office that the property is a class 4 residential property (rental) as opposed to class 3 (residential). If your property is not properly classified you will be subject to fines and penalties. Your property manager should be able to help you out with this.

Fifth, if you own 6 or more lots or homes within a subdivision you need to file a disclosure document when you plan to sell, with material information about the development and surrounding area. As an investor, if you purchase 6 or more lots, homes, condos, town homes (etc.) within a single subdivision, when you go to sell even 1 of these properties, you will be subject to the rules governing public reporting. In other words, you have to provide the buyer a copy of a current and valid public report. Failure to do so may allow the buyer to rescind their purchase contract for up to 3 years after the sale and get their money back. That is huge. To bypass the issues around the last point, just buy 5 units or less within the subdivision and move on.

Although I did not set up a Cross Border Trust (CBT), you can order a free book outlining the features and benefits of setting up a CBT here:

http://www.altrolaw.com/media-resources/book-order-form/

I read the book and there is currently no benefit for me to set up a CBT. I hold title as Community Property With Rights Of Survivorship.