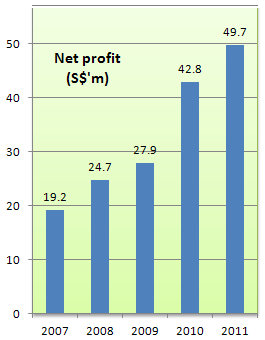

COMING OUT OF a year of record profit in 2011, Roxy-Pacific Holdings has reason to view its future with optimism and a good dose of certainty even though government measures have been introduced to rein in runaway prices in Singapore's property market.

As a result of pre-sales of 12 of its projects in recent times, Roxy-Pacific has progress billings of $598.6 million to recognize from 1Q this year through to 2015.

Those progress billings, or order book, are as of Feb 15, and don’t include revenue to be booked for four other projects that Roxy-Pacific will launch by 2Q of this year.

Here's why the $598.6 million is a big deal: It is more than four times the revenue ($132.6 million) that Roxy-Pacific booked in its property development segment in 2011.

To put it another way, even if Roxy-Pacific doesn’t sell another property unit from today, its annual revenue from property development over the next four years would, on average, be similar to last year’s.

Property development is the key contributor of revenue to Roxy-Pacific: Last year, it accounted for 72% of revenue.

Accordingly, the profit from the $598.6 million in progress billings will be significant.

Assume a 20% net profit margin, said its CFO and executive director, Koh Seng Geok, when asked at a briefing on Friday.

That would translate into about $120 million in net profit, or 19 cents a share, he said.

This projected earnings per share lifts the RNAV of Roxy-Pacific to about $1.06, which is sharply higher than the RNAV of 86.87 cents stated in its latest financial statements.

The latter figure mainly reflects the market value of Roxy-Pacific’s hotel (the Grand Mercure Roxy Hotel opposite Parkway Parade), and its ownership of Roxy Square Shopping Centre nearby.

Whichever RNAV you consider, it is substantially higher than the stock price, which last closed at 44 cents.

There is another way of expressing the under-valuation of the business by the stock market, which analysts have pointed out.

It is that Roxy-Pacific in its entirety has a market capitalisation of $271 million currently -- but its hotel alone was independently valued at $401.5 million last year-end.

The hotel, which makes up Roxy-Pacific's other core business segment, contributed $48.4 million, or 26%, to group revenue last year.

Like many hotels in Singapore, the Grand Mercure Roxy Hotel had a good party last year as tourist arrivals into Singapore hit a record high.

The hotel's average occupancy rate rose from 94.2% in 2010 to 94.6% last year. Its average room rate rose 13.2% to $188.30 while revenue per available room rose 13.7% to $178.10.

The following are highlights of the Q&A session at Roxy-Pacific's briefing last Friday for investors and analysts.

Q: Given the high profit margin and high average occupancy rate, do you plan to expand your hotel portfolio?

Chris Teo (Executive Director and Managing Director): We added 11 rooms to our hotel last year – we have more or less maxed out our potential capacity in this hotel.

We have been looking for opportunities over the past couple of years. We tendered for them but were not successful. We are still looking.

Teo Hong Lim (Executive Chairman and CEO): As a developer, we look at every area, except that now we are not doing industrial projects because we are not comfortable with that.

Every day we are combing for deals – we want to find the right deal.

Q: Can you comment on residential sales, especially after the government measures in December targeting investment demand, which is more on the smaller-sized units?

Teo Hong Lim: When the measures came out, the outlook was very negative. But the market is different from during the Lehman crisis. Singapore’s economy is still growing and there is a lot of liquidity in the market.

And many investors and end-users are concerned they may be left behind and they want to buy a property.

With clever marketing, a couple of projects recently sold hundreds of units at prices that are not low – some units in Watertown in Punggol, for example, sold at $1,600 psf.

When the news broke, buyers started coming back into the market.

However, with the big supply coming along, we need to finetune our products, we have to work harder, we have to go the right property agents.

Our projects are still selling. We have one in Toh Tuck called Nottinghill Suites. Initially, we sold 10%. As per last report, it’s over 50%.

Another example: 2 weeks ago, we launched Treescape in Telok Kurau – a 30-unit project which we have sold about 70%. The pricing is at more than $1,400 psf.

Q: What’s your reason for holding a lot of cash in hand?

Teo Hong Lim: We keep cash for opportunities. We are cautious but when the right deal comes along, we will snap it.

If you look at the four projects we have yet to launch, our land cost is manageable. For example, our land cost for the former Singapura Theatre site was only $700 psf.

This rate is nearly unheard of now for freehold properties.

Not to mention, retail shops are very hot now, selling at $2,000, $3,000 and even $4,000 psf.

As for our Hillview project, after amalgamation of some drainage area, we have brought the land cost down to around $600 psf. That is in a freehold location.

We may eventually get into the Government Land Sales programme, and our cash will come in handy. Last year, we actually bid for an executive condo project in Choa Chu Kang - we were No.3. This project was recently launched as The Rainforest.

Q: What are the challenges to landbanking?

Teo Hong Lim: A couple of issues: We have to pick sites well. Reasonable pricing, good location, we need to see what is the view, the demographics? It should have something that stands out.

Q: What is the outlook for your hotel room rates this year?

Chris Teo: They should be quite similar to last year's. After the increase last year, we should stabilize this year -- we don’t see a big jump in RevPar (revenue per available room).

Recent stories:

ROXY at less than hotel value, ENVIROTECH has 30% upside, MINZHONG target $1.45

ROXY-PACIFIC, LIAN BENG: What analysts now say....