Excerpts from latest analyst reports...

OCBC says Roxy-Pacific is trading at less than the value of its hotel asset

Analyst: Eli Lee

Roxy-Pacific Holdings (ROXY) reported 3Q11 PATMI of S$13.4m (up 50.5% YoY) which came in above our expectations, mostly due to a S$9.6m fair value gain from reclassifying Kovan Centre to a development property.

We believe the market would be neutral on its 3Q11 results. Looking forward, the focus would continue to stay on the execution and sales at new projects - Nottinghill Suites (17% sold) and the newly launched Wis@Changi (18% sold). Centropod@Changi (80 Changi Rd) and Treescape (Telok Kurau) are also expected to launch by year end.

At the current market cap of S$258m, Roxy Pacific Holdings is trading less than the independent valuation of its hotel asset alone (GMRH) at S$331m or ~S$590K per room.

Excluding GMRH, there is an additional net equity of S$128m on its balance sheet.

Despite uncertainty ahead, we expect earnings to be buffered by S$519m of unbilled progress billings at mostly sold-out projects and recurring income from its hotel segment (53% of 9M11 gross profit).

We update assumptions and our fair value estimate dips marginally to S$0.47 (30% discount to RNAV) versus S$0.48 previously. Maintain BUY.

Recent story: ROXY-PACIFIC, LIAN BENG: What analysts now say....

OCBC maintains 'buy' call on UNITED ENVIROTECH

Analyst: Carey Wong

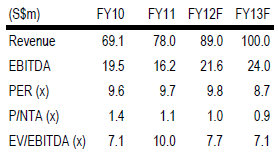

United Envirotech Limited reported its 2QFY12 results, with revenue climbing 9.6% YoY to S$25.2m; this largely aided by higher treatment revenue, which grew 54.5%, due to the additions of Hegang 50k m3/day treatment plant and Nansha industrial treatment plant.

But net profit tumbled 38.7% YoY to S$3.7m, hit by labor cost, interest cost and taxes.

But on a sequential basis, the group showed a pretty good performance, with revenue rising 21.3% and earnings 4.9%.

For 1HFY12, revenue grew 1.4% to S$46.0m, meeting 51.7% of full-year estimate, while net profit fell 29.5% to 7.3m, or 41.8% of our FY12 forecast.

Paring fair value to S$0.42. While 1HFY12 revenue was largely in line, higher cost pressures have depressed earnings. As such, we are using slightly lower margin assumptions and our earnings estimates for both FY12 and 13 drop by 8.4%.

And because of the increased volatility in the market, our DCFbased fair value also correspondingly drops to S$0.42, but we maintain BUY for a potential upside of 30%.

Recent story: Kim Eng's privatisation list; CHINA MINZHONG is deep value; UTD ENVIROTECH is a buy

BNP Paribas lowers target for CHINA MINZHONG to $1.45

Analyst: Brenda Lee

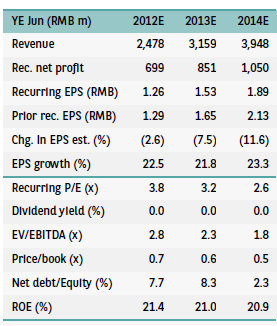

The stock (96 cents) is trading at 3.8x FY12E PER and 0.7x PBR, in line with the depressed China agriculture industry valuation despite its higher earnings quality and entry barriers. We believe the negatives are overdone.

We are changing our valuation methodology from market-discounted PER to DCF valuation based on 2.1x beta, 18% WACC and 4.5% terminal growth rate. We change our methodology due to the current uncertain economic and market environment.

Our new TP of SGD1.45 translates to 6x FY12E PER and 1.1x PBR, which we reckon reasonable. We maintain our BUY rating.

Recent story: Kim Eng's privatisation list; CHINA MINZHONG is deep value; UTD ENVIROTECH is a buy