Excerpts from latest analyst reports....

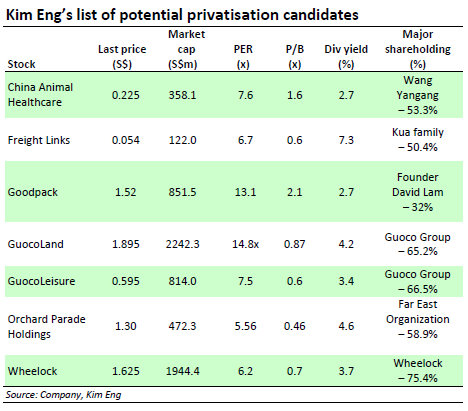

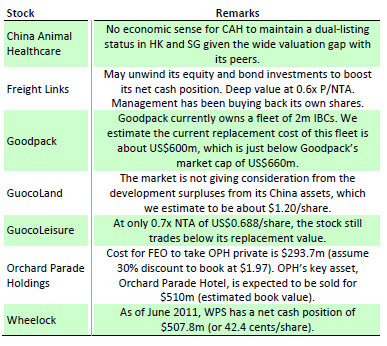

Kim Eng Research goes on hunt for privatisation possibilities

Valuations have come off in tandem with the recent market sell‐off. Could this herald a wave of privatisation and M&A deals?

In the first of a regular series, we apply the stock screener to search for potential outperformers. We have identified companies that may well emerge as takeover targets.

Recent story: Latest on Kim Eng Research's 'chilli pot' of hot stocks

Macquarie Equities Research sees 'deep value' in CHINA MINZHONG (90 cents)

Analysts: Jake Lynch & Jamie Zhou, CFA

For those value hunters looking to take advantage of the recent implosion in the China agri space, our pick is Minzhong. The stock is now in deep value territory with a P/Bk of 0.9x vs and ROE of 22% (and rising). 12m forward PER is 3.2x.

No debt on the balance sheet. We expect EBIT (earnings before income tax) to grow 40% this year.

It is difficult to say when the China agriculture space will stabilise (and thus stop exerting downward pressure on MINZ’s share price) and few seem willing to dare enter the space at this time.

However, we are confident that MINZ remains a quality company with strong earnings growth prospects. 12-month price target: S$2.35 based on a PER methodology.

OCBC Investment Research maintains 'buy' call on UNITED ENVIROTECH

Analyst: Carey Wong

United Envirotech Limited (UEL) has acquired another waste-water treatment project in China; this after exercising a call option to acquire the entire equity interest of Tongji Environmental (China) Pte Ltd (Tongji) for RMB34.03m.

Tongji is the holding company of Aton Environmental (Shenyang) Co, where the latter has a 30-year BOT (Build-Operate-Transfer) concession agreement with the municipal government to treat 50k m3 of wastewater daily.

According to management, the treatment facilities are valued at RMB69m, and are also located in Xinmin city, Liaoning Province, which is in close proximity to the group's existing treatment plants.

Maintain BUY with fair value estimate at S$0.53. But until we see a more sizable EPC project, we maintain our FY12 and FY13 estimates for now, as we have already assumed such contract wins in our assumptions. Hence our DCF-based fair value remains at S$0.53. Maintain BUY.

Recent story: SUNPOWER, UTD ENVIROTECH, OKP, BANKS: What analysts now say....