Translated by Andrew Vanburen from

資金流入上游工業股 (中文翻譯, 請看下面)

THE BENCHMARK Hang Seng Index has been enjoying a sustained surge of late, with big gains last week, and industrial sector shares such as railway plays and upcoming IPOs are largely responsible for the bullish sentiment.

The important thing to keep in mind is that, generally speaking, most shares listed in Hong Kong are currently at levels below their longer-term averages, so there are definitely bargains to be found.

Worth watching are industrial shares.

Heavy engineering firms and upstream producers are attracting major attention from the big funds of late.

The Hang Seng Industrial Sub-Index hit a two-month high last Thursday, and is trending higher than the overall market.

I would point to the following as interesting cases worthy of consideration.

CSR Corp (HK: 1766), the country’s top producer of high-speed rail carriages, has been getting a lot of good publicity from Beijing’s repeated emphasis on the importance of developing such a transportation network linking most if not all major urban areas in the PRC.

The fact that CSR recently said it would allocate nearly 8 bln yuan this year in fixed asset investment, with 40% dedicated to developing bullet trains and 30% for subway and inter-city rail projects, also has helped push up the company’s share value.

Zhuzhou CSR Times Electric Co Ltd (HK: 3898), a major producer of electrical systems for rail networks, is also being driven by the same market bullishness.

Other firms on my radar are tire maker Xingda International Holdings Ltd (HK: 1899), battery firm Leoch International Technology Ltd (HK: 842), coal equipment play International Mining Machinery Ltd (HK: 1683) and Sany Heavy Equipment International Holdings Co Ltd (HK: 631).

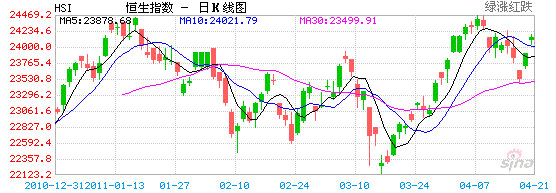

After falling 2.03% in the first two trading days last week, Hong Kong's benchmark Hang Seng Index bounced back the final two days of a holiday-shortened trading week to cap off a very volatile four-day period.

Analysts point to several reasons for the topsy-turvy nature of trading in Hong Kong this month, including actual or anticipated rate moves and reserve requirement hikes from Beijing, the ongoing Greek debt crisis and S&P’s recent downgrading of US debt.

The 10- and 20-day moving averages are both in positive territory at the moment, suggesting that the above developments have either been absorbed or written off by investors.

But for many small-time investors, a lot of the upside of late has been from big institutional funds entering the market, especially industrial counters, and this has made retail investor somewhat skittish about jumping in head first.

It should be noted that such cycles have frequently been witnessed over the past six months, but post-cycle market behavior shows no distinguishable patterns.

If anything can be inferred from these undulations, it is that the institutional investors buy in early in the cycle, the small-time retail investors jump onboard, and the institutional investors then sell off their inflated holdings en masse, leaving the latter in the lurch.

This can also explain some of the instability in individual valuations of late, as well as the lack of staying power nor any evidence of a sustained yet gradual climb in the benchmark index.

So the challenge for smaller market players has been avoiding these traps and recognizing true value over cyclical manipulations.

I would recommend occasionally focusing on individual stocks, or at least individual sectors, and trying to interpret valuation legitimacy outside the context of the various moving averages.

This allows a more sober, clinical and logical assessment of a company’s worth at any given time.

That being said, it would be unwise to completely ignore the overall market trend.

Furthermore, I think the recent run on the Hang Seng should see some correction in late April, with last week’s moves in Hong Kong to tighten mortgage controls likely to prove a major drag on sentiment.

As far as fundamentals are concerned, expect the markets to see little near future impact from PRC-led policy shifts as investors are already braced for continued monetary tightening from Beijing.

However, the ongoing European debt crisis and turmoil in the Middle East and North Africa are definitely worth monitoring as they are far less predictable and potentially far more volatile than anything the People’s Bank of China can announce on a late Friday afternoon.

See also: COMTEC SOLAR: HK Wafer Listco Gets 1.2 Bln Hkd From TPG Capital

資金流入上游工業股 (文: 涂國彬, 永豐金融集團研究部主管)

港股上周大幅波動,借內地調高存款準備金、希臘債務危機升溫及標普下調美國信貸評級展望,恆指於周一(18日))及周二(19日)急挫,累跌487點或2.03%,即市曾跌穿23500點關口,低見23468點;但於周三(20日)及周四(24日),市場的風險胃納卻突然回升,金融市場快速消化不利消息,恆指大幅反彈逾600點,重上二萬四關之上,全面收復失地。

大市跌穿10天及20天線,轉眼又回到其上,在跌市中沽貨的投資者難免感到不值,認為是大戶震倉的把戲。但值得留意的是,類似的走勢在過去半年經常發生,而每次反彈後的走勢不一,未見明顯的啟示;事實上,大市於過去半年主要呈大型上落市,主要用於顯示趨勢的平均線系統,效用亦被大打折扣,容易成為技術陷阱。

面對短期的技術指標混亂,退一步從周線圖及月線圖看,往往能夠看得更清楚。而從中線走勢而言,恆指日前雖擺脫了去年11月開始形成的下降軌,但仍受制於月線圖保歷加上軌約24400點的水平,按保歷加上軌現時上移的速度,預期在第二季末可升至近25000點,相信屆時恆指在技術上較具條件向上突破去年底的高位,在此之前,則較大機會維持於22500至25000點的大型上落市。

按恆指現時企於二萬四關口上計,上升空間相對不大,值得一提的是,恆指MACD周二發出沽貨訊號,預期大市須更長時間或更多下跌空間以消化技術沽壓,投資者宜持審慎態度。

就基本面而言,近期市場對內地政策的預期變化不大,繼續收緊銀根已是共識;倒是歐債危機情況反覆,中東及北非局勢變化亦是潛在的風險因素,需要繼續關注。但總體而言,中港股市現時估值均低於長期平均值,假如大市因外圍風險而大幅回落,反倒是趁低吸納的時機。其中,港股於上月底基金換馬時約處於23000點水平,應可作為入市參考。

另外,值得留意的是,最近的調整其實主要見諸於大型股,中小型股其實未受影響,反映近期的外圍風險因素主要對指數和市場情緒有影響,但並未影響市場資金充裕的情況。相反,資金更從大型股轉戰小型股,是風險胃納進一步上升的表現。

至於行業表現方面,受惠於保障房政策的建材股強勢盡現,而部份投資者已開始留意受惠新居入伙的家電及傢俬股等;而黃金周概念股當中,除濠賭股受業績支持外,其他零售股等炒作已見放緩。

值得一提的是,上游工業股近日再次有資金流入的跡象,恆生工業製品行業指數早前未有隨大市調整,但在大市反彈時則順勢抽升,周四(21日)創兩個月新高,走勢強於大市。而從其成份股表現看,鐵路概念股如中國南車(1766)及南車時代(3898),汽車相關股如興達國際(1899)及理士國際(0842),以及採煤機械如國際煤機(1683)及三一重裝(0631)等,均屬表現較強的行業,可予留意。

請閱讀: 地緣政治因素漸反映,港股短期波幅收窄