THIS SPRAWLING SITE in Neijiang, about three hours’ drive from the city of Chengdu, is where one of the most ambitious plans for business expansion that we know of is being executed.

The cost: RMB5.6 billion (S$1.1 billion).

On the 2 sq km site which I visited last Thursday with several analysts and investors from Singapore, the largest privately-owned iron and steel company in Sichuan province is developing the infrastructure for producing a wide array of steel products.

The project will result in the company, WeiYuan Steel, being able to produce an additional 2.15 million tonnes of the products from 2013. In other words, its capacity goes up from 2.5 million tonnes to 4.658 million tonnes.

As far as Sapphire Corp, a Singapore-listed company, is concerned, the key benefits from the expansion are:

1) Vanadium slag: A sharp jump in Weiyuan's production of vanadium slag from 40,000 tonnes a year to 142,000 tonnes.

The slag is a by-product of the manufacture of steel from iron ore.

WeiYuan supplies vanadium slag to Sapphire's key subsidiary, Special Steel, which converts the slag into vanadium pentoxide.

Vanadium pentoxide is sold to other steel manufacturers for the manufacture of lightweight, high-tensile, corrosion resistant steel products.

Sapphire could double or triple its revenue and profit after 2013 if its supply of vanadium slag from WeiYuan is thus boosted.

2) WeiYuan IPO: Sapphire has an indirect 11.73% stake in WeiYuan (whose FY09 turnover was S$1.4 billion and net profit S$13 million) to whose current expansion it has contributed US$40 million in the form of a convertible loan.

Sapphire is looking to increase its take in WeiYuan, and is expected to enjoy an unlocking of the value of Weiyuan when the latter is listed in possibly HK and/or a foreign bourse such as London sometime before or after its expansion project is completed.

Sapphire’s growth story

The story is chiefly about the rising demand for vanadium and steel in China.

Steel is in high demand in China’s infrastructure boom with China’s steel production forecast to rise 60% between 2010 and 2020.

The price of vanadium has risen from RMB 75,000 per tonne in 2009 to RMB92,500 in January this year – a trend that is expected to continue with a rise in steel prices. The sale of vanadium pentoxide flakes brings in a gross profit margin of 33% for Sapphire, compared to 9% for its manufacture of rebars and hot rolled coils.

Sapphire is just outside the top 3 league of producers of vanadium but with the WeiYuan expansion, it would become No.3 via its stake in Special Steel, which currently has a production capacity of 5,000 tonnes a year of vanadium pentoxide flakes.

Special Steel is its key operating subsidiary which it holds a 70% stake in. Interestingly, Sapphire has appointed a Singaporean CFO to Special Steel.

Aside from Special Steel and WeiYuan, Sapphire holds a 9.2% stake in China Vandium Titano-Magnetite Mining (China VTM)., which supplies iron ore to WeiYuan.

The stake in China VTM was purchased in 2007 and has turned out to be a profitable move.

Based on its 22 Mar 2011 closing price of HK$3.12, Sapphire's 9.2% has a mark-to-market value of about S$ 97 million.

Altogether, Sapphire has stakes in four companies that form the supply chain starting with iron ore mines to steel and vanadium slag to the finished products of steel and vanadium pentoxide.

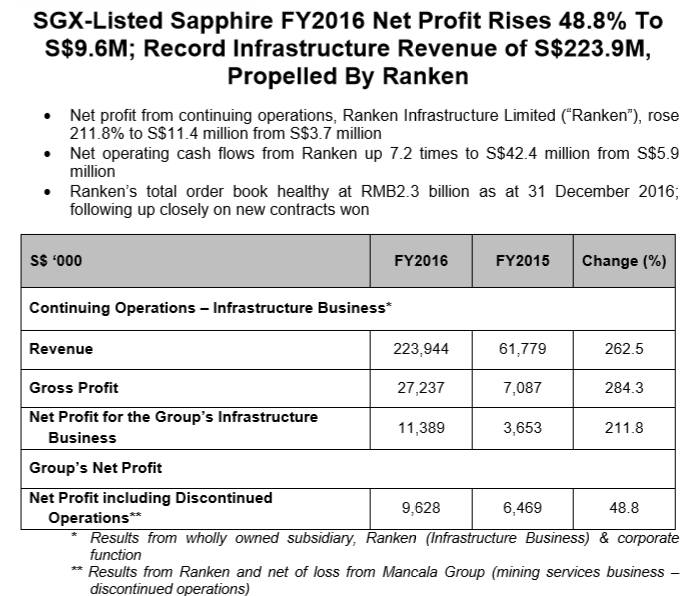

Sapphire's financials

Sapphire has a market capitalisation of S$275 million based on its recent stock price of 34 cents. It reported that its operating profit, excluding one-off items, grew by 89.8% from S$5.9m in FY09 to S$11.1m in FY10.

It also proposed a 1 cent a share final dividend.

Recent story: SAPPHIRE CORPORATION: 'Intrinsic value is 60 c,' says SIAS