The following was published by DMG & Parrtners' head of research Terence Wong on Monday (Sept 6).

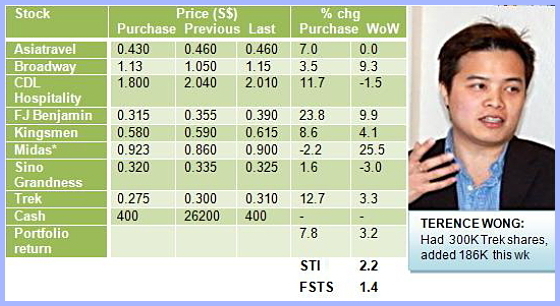

My portfolio surged 3.2% over the week, one of the best weekly performance since the start of the fund. Since inception, the portfolio has gone up by 7.8%, favourably compared against the STI’s 2.0% and Small Cap Index’s 0.6%.

The last seven weeks have seen pretty decent returns from the eight stocks. With the exception of Midas, all are in the black. In fact, three have seen gains of over 10%, including FJ Benjamin (+23.8%), CDL Hospitality Trusts (11.7%) and Trek2000 (+12.7%).

The good... The two best stocks in the portfolio – retailer FJ Benjamin (+9.9%) and tech manufacturer Broadway Industrial (+9.3%) - both flirted with double digit gains.

FJ Benjamin came to life in the middle of the week after it snagged a controlling stake in Arcangel, a brand development and design company owned by one of London’s hottest designers, Catherine Deane.

Broadway also saw heavy volume towards the end of the week, resulting in one of the best weekly performance in months. Adding more Midas to the fund at the start of last week proved to be a good move, as it appreciated by 4.6%.

The bad... Only two stocks were in the red over the week. Sino Grandness, a vegetable canner, came off by 3.0% on little newsflow. This is typical of the small caps but once it manages to garner the interest of some funds, the stock should steadily appreciate. CDL Hospitality Trusts shot up at the start of the week, but gave up all its gains to end with a 1.5% loss.

I have taken the opportunity to take some profits on Broadway after last week’s surge.

While the counter still presents one of the best value among the tech plays, I think that the market will start to take notice of Trek once its new invention FluCard hits the market.

Recent story: TREK 2000 shares soar 37% in a week

Terence Wong's article on inception of portfolio: TERENCE WONG: 'What I would buy with $1 m'