|

AS THE market weakened further last week, several companies bought back shares and directors stepped in to scoop up shares for their own portfolio.

* Sunvic Chemical: It’s one of a rare few S-chips that have made share buybacks. Not only that, its cumulative purchases in the last three months have been significant, totalling 14.4 million shares.

In March, it announced uninspiring results: Its Q4FY09 was no turnaround story unlike the case for many companies. Sunvic reported a net loss of RMB17.7m, partly due to impairment of assets.

However, for Q1FY10, its net profit stood at RMB51.5 m, up 362% year-on-year.

* Roxy-Pacific: Emerging from a blackout period prior to its Q1 results announcement, three directors made purchases of the company's shares.

They were: executive chairman Teo Hong Lim, executive director Koh Seng Geok and independent director Tay Kay Poh.

Following the Q1 results, Standard & Poor’s maintained its forecast that Roxy would achieve a record $37.3 m in net profit this year, up from last year's record $27.9 m.

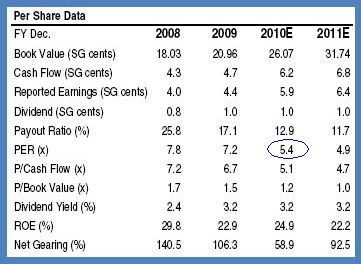

The forecast profit translated into a PE of 5.4X based on a recent stock price of 32 cents. (The stock closed on Friday at 29.5 cents).

For more on the Q1 results, read: ROXY-PACIFIC'S Q1 profit 'beat my expectations'

* Saizen REIT: Ms Yvonne Ho, spouse of executive director Raymond Wong, purchased 186,000 units on the open market on May 17 after the REIT announced its Q3 results.

Mr Wong, and the REIT's CEO and other directors have been accumulating the stock since last year.

For more info on the Q3 results, read: SAIZEN REIT: Out of woods and resuming cash distribution

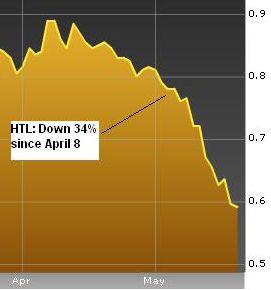

* HTL International: The company has bought back shares twice since announcing a $10 million net profit for Q1.

The stock has, however, fallen sharply as the crisis in Europe, which accounted for 57% of the Group’s revenue in 2009, continued to worsen.

Prior to that, though, HTL stock had done a spectacular run.

On 9 Apr 2009, during the global financial crisis, it closed at 13.5 cents.

On Apr 8 this year, HTL, one of the world’s leading leather tanners and sofa manufacturers, closed at 89 cents for a 559% rise.

This sizzling run was due to HTL’s strong recovery with a net profit of S$48.3 million in 2009 as compared to a net loss of S$20.3 million the year before.

|

Recent story: INSIDER BUYING in an uncertain market last week....