- Posts: 809

- Thank you received: 25

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Teckwah Industries

16 years 6 months ago #1714

by Mel

Replied by Mel on topic Re:Teck Wah Industries - Undervalued Shares

many types of cashflow. cashflow from operations of the business. cashflow from investing. cashflow from financing. then at the end of it all, there is free cashflow which is the cash from the business after deducting everything, incl capex. if someone offers to buy yr business for, say, $1 m when yr biz generates $1 m operating cashflow a year - is that a good buy? hard to answer, until u know other things like ... what\'s the cash in the bank already, what\'s the debt (if any), will the biz make more profit in future, or it is a dying biz.

Please Log in to join the conversation.

16 years 6 months ago #1715

by yandaolee

Replied by yandaolee on topic Re:Teck Wah Industries - Undervalued Shares

thanks for answering my doubts..learnt something from your replies..tks:)

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

16 years 6 months ago #1719

by Dongdaemun

Replied by Dongdaemun on topic Re:Teck Wah Industries - Undervalued Shares

to all who want to know more abt Techwah - i found a BT article (but it\'s from 2004). Still... (2004-03-31) Teckwah sees need to add value By Daniel Buenas TECKWAH Industrial Corp is a high-tech player in a traditional industry, and even as operating costs here rise, Teckwah has no plans to move its manufacturing activities elsewhere, says Thomas Chua, Teckwah\'s chairman and managing director. Teckwah began its existence as a family-run paper box manufacturer in a house along Carpmael Road. It is a heartland born enterprise that has outgrown its simple roots to become an international company providing a broad spectrum of services. These services include printing and packaging, third-party logistics and, more recently, online gaming. However, even as Teckwah moves away from becoming a pure packaging manufacturer, Mr Chua insists that printing and packaging remain the company\'s core competency and strength. Manufacturing activities accounted for 38 per cent of Teckwah\'s $121.5 million revenues for FY2003. Forty-eight per cent of the manufacturing revenues came from its printing and packaging activities in Singapore. Its manufacturing facilities in Singapore are the largest in the group, although the company does outsource its production when it sets up packaging ventures overseas. Some might find this surprising, but Mr Chua explains that printing and packaging is a capital intensive business that requires a certain level of technical expertise. \'I do agree that the product itself is not high-end, but the machines and technology for the printing of packaging material are all very high-tech,\' he says. \'You can say that a box is low-tech, but there is a lot of knowledge that is being used to produce print material. We are a high-tech player, it\'s just that we\'re in a traditional industry.\' Mr Chua notes that Singapore was where Teckwah started, and it is only natural for it to maintain its roots here. Teckwah has also set up facilities outside of Singapore\'s shores to supply value-chain management services, in response to a shift of some of its customers to lower-cost countries. It expanded into Malaysia, China and Indonesia in the early to mid-90s, and moved into Shanghai in 2000, all to ensure that it could continue to service its customers whenever they moved. Mr Chua explains that Teckwah has acted mainly as a supporting player to the large MNCs that base themselves here, and that this is generally true for most players in the print and packaging industry. \'As a supporting industry for MNCs, we have to position ourselves as a regional supporting partner,\' he says. \'We should develop a kind of continuity, so that when they move (to other countries), we should continue our relationship and move together with them in the region.\' Typically, when the company moves overseas, it will outsource its printing needs to local print manufacturers. Thus, its manufacturing facilities in Singapore cater almost entirely to its local customers, as Mr Chua says that it is not practical to manufacture packaging materials here for shipment to overseas packaging plants. \'Outsourcing is more effective and more efficient than doing it myself,\' says Mr Chua. \'However, maintaining the packaging, printing and manufacturing facilities in Singapore is still critical, so that we can always upgrade ourselves in terms of knowledge within the industry.\' So even as Teckwah ventures overseas, it plans to continue investing in Singapore, although Mr Chua does admit that manufacturers here face a number of challenges. \'Costs in Singapore are getting higher and higher, so although you started out as a production-oriented company, you must also add some value-added services to your manufacturing activity,\' says Mr Chua. \'As a manufacturer in Singapore, you have to realise that times have changed, and you have to think out of the box to see what you can do to remain competitive and maintain your relationship with your customer.\' Another important step for manufacturers, Mr Chua says, is that they must become more regional, and not just focus on Singapore. \'The more manufacturers want to maintain Singapore as a base, the more they should develop their regional network,\' he says. \'You need this regional network to cover, or to leverage, your Singapore business.\' This, he adds, will help businesses be more flexible and provide them with more than one location for developing and testing new products. However, Mr Chua does see the need to move beyond being just a manufacturer. \'You have to be driven not just by capacity, but by capability. Cost is an important factor, but not the most decisive, as we can automate and use computer systems to manage our operations,\' he says. \'But to add value and stay relevant, we must add on non-print activities. We can\'t just produce boxes and manuals for our customers any more, we have to provide them with complete solutions.\' Teckwah\'s non-printing businesses, including its third-party logistic services, reverse logistics and online distribution for its most recent financial year comprised about 5 per cent of its turnover. This is excluding its online gaming business, which came onboard just last year. However, as Mr Chua points out, not every player in the print and packaging business will be able to transition beyond their core industries, and Teckwah has no intention to forgo its print business. \'We will not grow (our print business) in terms of size, but we would like to grow in terms of the value and in terms of the quality,\' he says. \'As long as Singapore still has manufacturing activities, my industry, the packaging industry, will still be around, but I have to add value to my business.\' The Business Times

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

16 years 5 months ago #1752

by Dongdaemun

Replied by Dongdaemun on topic Re:Teck Wah Industries - Undervalued Shares

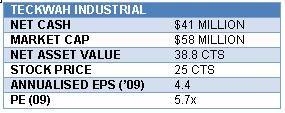

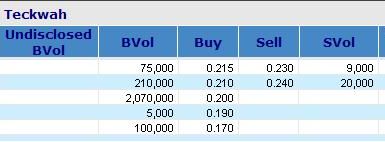

With 448,000 shares done so far today, Teckwah could be the target of value investors who have now discovered the stock. Stock price now up 1.5 cents to 24.5 cents The business, as erelaton posted earlier, has S$$40 m in cash!

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

16 years 5 months ago #1758

by Dongdaemun

Replied by Dongdaemun on topic Re:Teck Wah Industries - Undervalued Shares

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

16 years 3 months ago #1809

by Dongdaemun

Replied by Dongdaemun on topic Re:Teck Wah Industries - Undervalued Shares

Please Log in to join the conversation.

Time to create page: 0.223 seconds