Excerpts from Phillips Securities report

Analyst: Eric Li

Oriental Watch Holdings Limited (398.HK)

HK operation outperformed the market, Conservative spending on high-end luxury goods become a concern |

Oriental Watch Holdings Limited (Oriental Watch), founded in 1961, has developed an extensive retail shop network in the Greater China area, and has become one of the largest watch retailers. Company carries around a hundred prestigious brands, in particular, famous Swiss brands such as Rolex, Tudor, Piaget, Vacheron Constantin, IWC, Jaeger-LeCoultre, Girard Perregaux, Longines, Omega, etc.

Company operates a total of 12 shops in HK SAR and Macau SAR, including Oriental Watch Company, La Suisse Watch Company, Rolex and Tudor Boutique and Breitling Boutique. In 2004, company expanded its watch retail business to Mainland China. Since then, company has opened a number of outlets and boutiques covering various cities in Mainland, China. Subsequently, company has further expanded its businesses to Taiwan region. As at 30 September 2022, company operates 44 retail points (including associate retail stores) in the Greater China region, and 1 online store in each of the Mainland China and HK respectively.

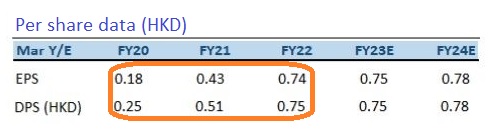

Oriental Watch's dividends have high yields (~16%) with payout ratios exceeding 100% in the past 3 years. See table below.

Oriental Watch's dividends have high yields (~16%) with payout ratios exceeding 100% in the past 3 years. See table below.

HK operation outperformed the market with revenue increased by 6.1%

|

Stock price

|

HK$4.52

|

|

52-week

range

|

HK$3.25 – HK$4.91

|

|

PE (ttm)

|

6.4

|

|

Market cap

|

HK$2.2 b

|

|

Shares outstanding

|

487 m

|

|

Dividend

yield (ttm)

|

16%

|

|

1-year return

|

4.4%

|

|

Source: Yahoo!

|

In 1HFY2023 (for the six months ended 30 September 2022), company's revenue decreased by 10.0% yoy to HK$1,674 million, which was mainly attributable to the decrease in revenue in the Mainland China market as a result of business interruptions due to such lockdown policy and restrictions.

In line with the decrease in revenue, gross profit decreased by 6.9% to HK$537 million, with gross profit margin increased by 1.1 percentage points to 32.1%, and profit attributable to owners of the company decreased by 9.6% to HK$151 million. Basic EPS were 31.03 HK cents, down 9.2% yoy.

Interim dividend of 7.8 HK cents per share (1HFY2022: 8.6 HK cents per share) and a special dividend of 23.5 HK cents per share (1HFY2022: 25.8 HK cents per share).

|

Oriental Watch

|

|

Share price:

HK$4.52

|

Target:

HK$5.14

|

During the Period, the company's aggregated expenses related to leases increased slightly by 5.3% to HK$80 million, accounting for 23.1% of the overall operating expenses (1HFY2022: 22.2%). The increase was mainly due to the lease renewal of retail stores which command a relatively higher rental rate.

In Hong Kong, the COVID-19 pandemic situation has been under control since the first quarter of 2022. Yet, clouded by market uncertainty, the market sentiment remained cautious with the value of total retail sales decreased by 1.3% yoy during the first nine months of the year.

However, sales of jewelry, watches and clocks, and valuable gifts recorded a slight increase of 0.2% during the same period. Despite the uncertain retail market sentiment, Hong Kong operation still outperformed the market with revenue increased by 6.1% to HK$504 million for the period, accounting for 30.1% of the overall revenue, segment profit increased by 81.8% to HK$42.75 million.

According to the National Bureau of Statistics, the PRC`s gross domestic product (GDP) has recorded a 0.4% yoy growth and 3.9% yoy growth in the second and third quarter respectively, which grew at a softer pace compared with the same period of last year. The slowdown of economic growth was attributable to the widespread lockdown as well as the weakening market sentiment. Sales of gold, silver and jewelry also recorded a decrease of 0.8% yoy from April to September 2022.

According to the Federation of the Swiss Watch Industry FH, the Swiss watch exports to the PRC during the Period decreased 13.7% yoy to CHF1,267.3 million, showcasing the country`s conservative sentiment on purchasing luxury watches.

Due to the economic condition as well as the temporary business suspension mentioned above, revenue from Mainland China operation decreased by 15.4% to HK$1,101 million, accounting for 65.8% of the overall revenue, segment profit decreased by 23% to HK$189.86 million.

Investment Thesis

Looking ahead, although China and Hong Kong have entered the road to normal after the epidemic, with the uncertainty from the increase in interest rate, and the management also expects consumers to become more conservative in consumption, especially on purchasing of high-end luxury goods.

Hence, the business will be under some pressure over the upcoming periods.

We expect FY2023-FY2024 EPS to be 74.62 HK cents and 78.10 HK cents respectively, with PT of HKD5.14, implies a FY2023E P/B of 1.21x (~1-yrs historical average plus 1 SD).

Our investment rating is “Accumulate”. |

Risk factors

1) Economic recovery momentum is slowing down;

2) Operating costs are higher than expected;

3) Luxury goods consumption is lower than expected.