Stock trading volumes have risen on the SGX as a bull market takes hold.

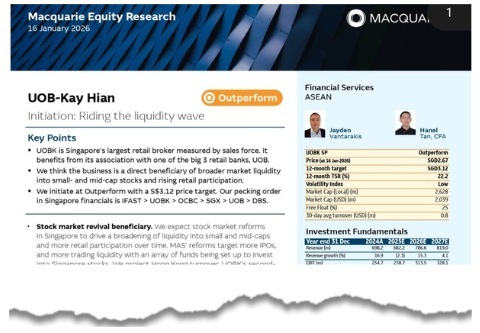

UOB Kay Hian stock has shot up 82% in the past 12 months, reaching $3.10 this week. It's +27% since our Nov 2025 article UOB KAY HIAN: Time to Re-Rate Further? Still Looks Attractively Priced Macquarie Equity Research's target price in its Jan 16 initiation coverage is $3.12, and it identified the brokerage as a prime beneficiary of a revitalised Singapore stock market. |

||||

The central thesis of the initiation is that UOBKH stands to gain from structural reforms driven by the Monetary Authority of Singapore (MAS). These reforms aim to boost Initial Public Offerings (IPOs) and deepen trading liquidity, specifically targeting small- and mid-cap stocks.

These reforms aim to boost Initial Public Offerings (IPOs) and deepen trading liquidity, specifically targeting small- and mid-cap stocks.

Macquarie argues that as Singapore’s largest retail broker by sales force, UOBKH is the most direct play on this thematic shift.

"UOBK has a strong brand and position in retail brokerage, and benefits as one of few listed direct plays on the thematic in Singapore. The company is a beneficiary of Singapore’s stock market reform and higher activity in small- and mid-caps."

In its 1H25 results, UOBKH reported a 24.5% increase in commission income to S$206.7 million, signaling that the core brokerage business is gaining momentum even if lower interest income temporarily weighed on total profit before tax.

With a massive network of over 3,200 professionals and more than 80 branches in Asia mainly, the firm possesses the scale to capture rising retail participation.

Macquarie’s specific pecking order for Singapore financials places UOBKH second, ranking it above major banks like OCBC, UOB, and DBS, and trailing only iFAST.

| Regional Strength: Beyond Singapore |

While the Singapore reform narrative is central, UOBKH’s exposure to other key Asian markets provides additional growth engines.

The brokerage operates across 10 markets, including established presences in Hong Kong, Thailand, and Malaysia.

- Malaysia: Macquarie identifies Malaysia as their "preferred market in ASEAN," seeing upside to the KLCI index which benefits UOBKH’s operations there.

- Hong Kong: As UOBKH’s second-largest market, Hong Kong is projected to benefit from a resurgence in IPOs and robust investment in Artificial Intelligence (AI).

| Financial Outlook and Valuation |

Macquarie forecasts earnings per share (EPS) of S$0.28 for FY26e and FY27e, with Return on Equity (ROE) improving from 9% to 10%.

Macquarie’s valuation methodology sets a target P/E of 10.5x for 2027e.

This figure is derived as the mid-point between local listed financial services peers (trading at 13.1x) and the stock’s historical trading average.

With a strong balance sheet boasting a Net Tangible Asset (NTA) value of S$2.1 billion and the backing of the UOB Group, UOBKH offers stability alongside growth potential. |

→ Check out iFast Gains from MAS EQDP -- But Its Peer UOB KH Shines on Value and Yield → Check out iFast Gains from MAS EQDP -- But Its Peer UOB KH Shines on Value and Yield

|