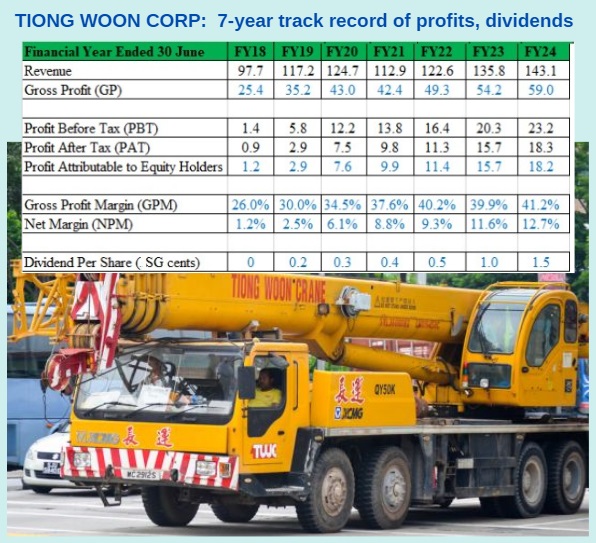

• Tiong Woon Corp, whose bright orange cranes are a familiar sight across Singapore, is entering its 27th year as a listed firm on the SGX. Longevity on the exchange, especially for a company serving the construction, oil and gas, and petrochemical industries, reflects a business that has successfully weathered more than one economic cycle. • For many years, investors were not attracted to this company (recent market cap: S$212 million), let alone accord it a respectable valuation. • More recently, the construction upturn in Singapore has boosted the company's share price more than 30% over the past year to about 80 cents. Last week, an initiation report from CGS International helped push it further, to around 91 cents. Read excerpts of CGS' report below .... |

Excerpts from CGS report

Analyst: Natalie Ong

■ TWC is trading at CY27F P/E of 6.7x, a 45% discount to regional peers despite its global ranking (#15 on IC100) and strong track record.

■ We view TWC as a beneficiary of construction-/infrastructure-focused nation building plans implemented by many SEA and Middle East countries. ■ Initiate coverage with an Add call. Re-rating catalysts include securing larger market share in its various geographies and a higher dividend payout ratio. |

|||||

| Undervalued regional one-stop heavy lift solutions provider |

Tiong Woon Corporation (TWC) is trading at a discount to peers despite its global ranking and track record.

TWC ranks #15 globally on IC100 2024/2025, an annual ranking published by International Cranes and Specialized Transport magazine, and competes for heavier‑tonnage work (up to 2,200 tonnes) yet trades around 0.6x CY26F P/BV, c.6.7x CFY27F P/E and 1.1x CY27F EV/EBITDA vs. peers’ 2.1x, 12.1x and 5.6x, respectively.

|

Metric |

Tiong Woon |

Peers’ average |

|

CY26F P/BV (x) |

0.6 |

2.1 |

|

CFY27F P/E (x) |

6.7 |

12.1 |

|

CY27F EV/EBITDA (x) |

1.1 |

5.6 |

| Late cycle beneficiary of construction boom, DC and O&G builds |

The majority of heavy lift and hauling services pertain to above-ground or superstructure work, which occurs after foundation/substructure work is largely completed.

Construction of mega projects Changi Airport Terminal 5 and Marina Bay Sands Integrated Resort 2 will run from 2025 till mid-2030F and are currently undergoing substructure works, with superstructure works likely to commence from 2027F onwards.

As at end-2025, contracts for the superstructure work for these two mega projects have not been tendered/awarded.

As such, we believe TWC’s revenue will grow and peak in FY28F.

| Vertically integrated with regional capabilities |

TWC’s fleet consists of 579 cranes, 359 haulage assets, 7 tugboats and 9 barges. It also has its own jetty located at its Pandan Crescent headquarters, allowing it to mobilise its cranes to capture overseas opportunities quickly.

With its haulage fleet, it provides transportation services (of cranes/counterweights) to and from the respective sites while its engineering know-how (mechanical and auxiliary engineering capabilities) enables it to offer project-specific lift plans, which we believe positions TWC as a one-stop heavy lift solutions provider.

We also believe its track record of data centre (DC), semiconductor, petrochemical and oil and gas (O&G) projects positions it as a strong contender for such projects, where safety and execution are critical to success.

|

→ The CGS report is here.

→ The CGS report is here.

→ See also: TIONG WOON: This company has done well in business. Now SIAS wants it to try harder at investor relations