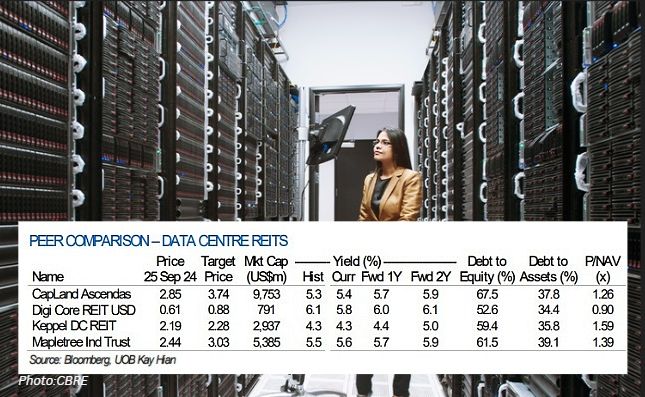

• It's likely not an overstatment that Artificial Intelligence (AI) represents a generational shift with the potential to profoundly alter human society. As AI reshapes industries and catalyse big advancements in fields such as healthcare and transportation, its rise requires substantial computational power and storage, which in turn fuels the demand for data centers. • Data center owners include REITS, which earn revenue from, for example, large enterprises and hyperscale clients (such as cloud service providers) that lease significant amounts of space and resources. On the Singapore Exchange are a handful of such REITs. UOB Kay Hian gives its take on these in the table below.  • Maybank has put out its own report on data centre plays. Its picks are not necessarily REITs but Malaysian and Singapore companies with several business segments (like ST Engineering), including exposure to certain aspects of the data centre boom.  • The Maybank report is here while excerpts of the UOB report are below... |

Excerpts from UOB KH report

Analyst: Jonathan Koh, CFA, MSc Econ

Data Centre REITs – Stellar Growth And Tight Vacancies In Singapore And The US

| Core hubs in Northern Virginia and Silicon Valley benefit from rising AI demand and average asking rents have increased 7% to US$174/kW/month across North America in 1H24. Our preferred BUYs are DCREIT (Target: US$0.88) and MINT (Target: S$3.03) for their focus on the US market. Vacancy is tight in Singapore after a three-year moratorium on new construction. KDCREIT (Target: S$2.28) benefits from the government’s plan to double capacity for international subsea cables. |

- WHAT’S NEW

• Singapore is the most power-constrained data centre market in the world with an extremely tight vacancy rate of 1.0%. We attribute the shortage to the government’s strict adherence to climate change commitments and the resultant three-year moratorium on building of new data centres in 2019-22.

The moratorium was only recently lifted but new supply is expected to come on stream from 2026 onwards. Thus, capacity is expected to remain tight with rents on an upward trend in 2H24 and 2025.

• Singapore expanding data centre capacity by one third. The Infocomm Media Development Authority (IMDA) has launched the Green Data Centre Roadmap, which provides capacity of 300MW to support sustainable growth of data centres.

Additional capacity of 200MW will be made available to operators using green energy. The combined new supply of 500MW represents a one-third expansion to existing capacity of 1,400MW.

To date, IMDA has awarded four data centre operators, namely AirTrunk-ByteDance Consortium, Equinix, GDS and Microsoft, with total capacity of 80MW in Jul 23.

IMDA aims to reduce power usage effectiveness for all data centres to below 1.3 over the next 10 years.

• Singapore remains the preeminent hub in Southeast Asia. Singapore is the preferred data centre hub, being the dominant financial hub within Asia.

It is also a connectivity hub linking Southeast Asia to the global network through its 26 subsea cables and three landing sites. It has a well-educated workforce, excellent infrastructure and political stability.

• SG+ creates unified data centre ecosystem for Southeast Asia. SG+ strategy positions data centres in Singapore as the regional control tower and taps on complementary strengths and capacities of scalable data centres in Johor and Batam.• Singapore staying ahead of competition. Singapore targets investments of at least S$10b to double its capacity for international subsea cables and landing sites over the next decade to support the widespread usage of new AI applications.

The domestic infrastructure will be upgraded to provide broadband speed of 10Gbps over the next five years.

The government is working with the private sector and research institutions to scale the usage of autonomous systems using new technology, such as low-earth orbit satellite.

Data centres in Singapore are more suited to mission-critical and low latency (time sensitive) applications, such as financial services and AI inference applications.

Data centres in Johor and Batam cater to AI machine learning applications, which require lots of physical data centre space and consume huge quantity of electricity and water.

|

ACTION |

Full reporthere

See also Maybank Kim Eng's report on data centre plays.