• Few -- very few -- S-chips have the longevity, as a listco, of China Sunsine as well as the consistent ability to generate large cashflow. China Sunsine listed 17 years ago on the Singapore Exchange. • And it has been generating cash while increasingly focused on shareholder returns. On top of frequent share buybacks (total treasury shares to date: 28.4 million), China Sunsine has been upping its dividend payouts in recent years:

Note: In FY19, China Sunsine carried out a share split where 1 share became 2. Possible reasons: 1) Lack of analyst coverage 2) General under-exposure to investors 3) Fall in profit in 2023 (but 14% 1H2024 pre-tax profit growth) along with a subdued outlook admidst competition in the industry. |

Excerpts from CGS-CIMB report

Analyst: Kenneth Tan & Ong Khang Chuen, CFA

■ Sunsine’s 1H24 net profit (-8% yoy) was largely in line, with stronger-than-expected GPM expansion (+1% pt yoy) offset by higher taxes (+91% yoy).

■ Reiterate Add with an unchanged TP of S$0.47. Decent FY24F yield of 6.5% and ramp-up in share buybacks should cap downside risk, in our view. |

|||||

| Healthy sales volume growth and GPM expansion |

China Sunsine’s (Sunsine) 1H24 core net profit of Rmb189m (+6% hoh, -8% yoy) was largely in line at 50% of our FY24F estimate.

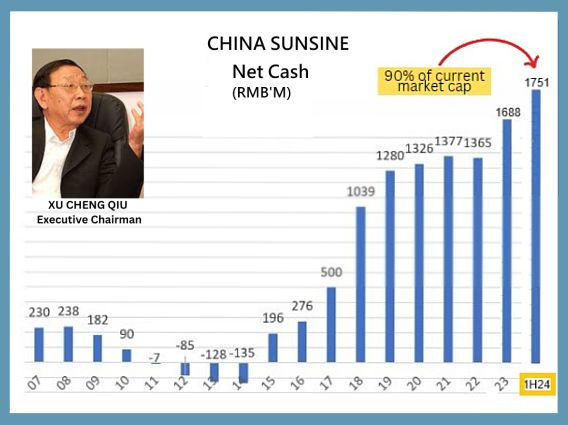

| 90% cash |

| "Balance sheet remains healthy, with net cash rising to Rmb1.7bn (c.90% of current market cap) at end-2Q24." -- CGS-CIMB |

Rubber chemical sales volumes came in healthy (+6% yoy), mostly led by strong rubber accelerator demand from tyre manufacturers based in Southeast Asia, partially offset by weaker domestic demand.

GPM surprised positively at 24.8% (+1% pt yoy), which we attribute to higher-margin sales mix.

However, tax expenses jumped substantially (+91% yoy) due to expiry of the group’s hightech enterprise status (accords lower concessionary taxes).

| ASPs remained firm in 3Q24, while raw material prices declined |

According to commodity market information service provider sci99.com, average rubber accelerator ASPs in Jul-Aug 24 were flat to slightly lower compared to average ASPs in 2Q24.

Average aniline prices in Jul-Aug 24 were down c.10% compared to 2Q24 average prices.

We think GPM should sustain yoy in 2H24F at c.22%, as risks from intensifying industry competition are offset by cost savings achieved from ramp-up of new MBT products in 3Q24F.

| Continued sales volume growth ahead |

We believe Sunsine should maintain healthy sales volume growth ahead, underpinned by

| 1) recovery in domestic tyre manufacturer utilisation rates, 2) ramp-up in sales to Southeast Asia, and 3) favourable government policies supporting automotive demand (e.g. increased subsidies on vehicle trade-ins). |

As shared in its 1H24 outlook statement, management still sees stiff competition persisting in China and continues to implement flexible pricing strategy to defend its market share.

Balance sheet remains healthy, with net cash rising to Rmb1.7bn (c.90% of current market cap) at end-2Q24.

|

Full report here

See also: CHINA SUNSINE: This stock's 5 key metrics have grown 6-8X in 15 years