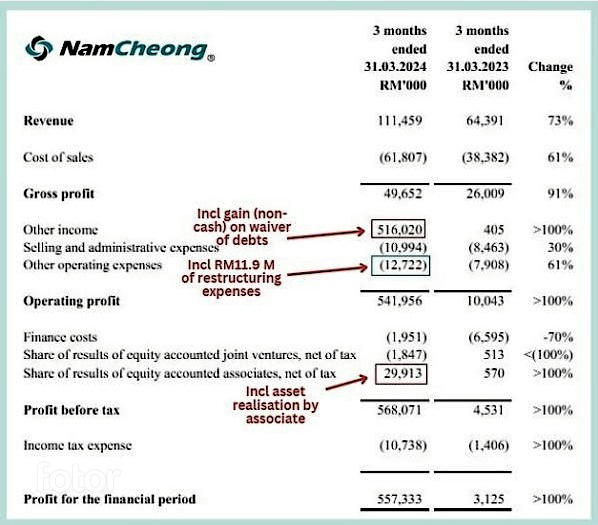

Nam Cheong charters its vessels to support offshore activities of the oil & gas industry in Malaysian waters. It's riding on strong charter rates, not unlike its peer Marco Polo Marine which also underwent a massive debt restructuring and has seen its stock rise 100+% over the past 2 years. Nam Cheong charters its vessels to support offshore activities of the oil & gas industry in Malaysian waters. It's riding on strong charter rates, not unlike its peer Marco Polo Marine which also underwent a massive debt restructuring and has seen its stock rise 100+% over the past 2 years. Nam Cheong Ltd's stock is up 50+% in the past 2 weeks or so, from 12 cents to 18+ cents. The catalyst is likely its strong 1Q results which made the stock look attractive. Even after the stock run-up, the implied annualised PE is approximately 3X for FY2024 (after putting aside one-off gains and restructuring expenses).  That likely awakened the market to this stock which had been suspended for the past 4 years as it restructured its massive debt. The stock resumed trading two months ago (March 2024). Heavy selling by RHB Bank, a creditor which exchanged some debt for Nam Cheong shares, quickly took the stock down from its pre-suspension price of 40 cents. Then the 1Q results came. It's a comeback story from when, at Nam Cheong's AGM in 2020, a shareholder stood up and said "The Company is clearly quite sick and some may even say it is in critical condition" before asking what it planned to do to get back to health. It was weighed down by outstanding debt amounting to RM1.84 billion as of May 2017, following which it successfully restructured its debt. |

Then came that black swan event -- the Covid pandemic -- in 2020 accompanied by a slump in oil prices.

Nam Cheong's business activities came to a halt, it no longer could continue any repayment -- and needed another debt restructuring.

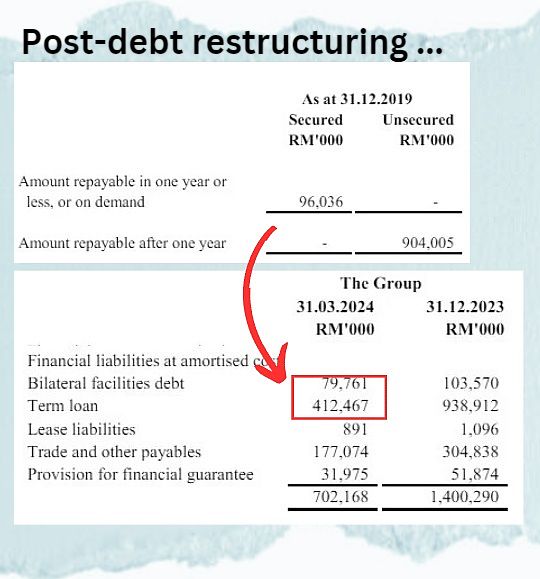

This was completed in March 2024 with a chunk of debt exchanged for equity and another chunk forgiven. Creditors include DBS, Maybank, OCBC and CIMB.

All Nam Cheong shareholders, including management, paid a hefty price too due to a 100-to-1 share consolidation.

Bottomline, this is how much Nam Cheong's debt was shrunk:

In a filing on the SGX, Nam Cheong gave responses to shareholder questions ahead of its AGM this Thursday.

It shed light on its financial health, operational status, and strategic outlook. Here are key takeaways:

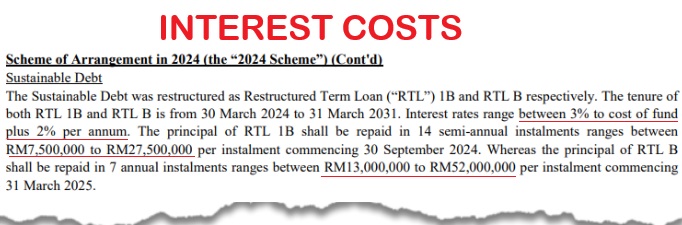

• Debt Repayment and Dividend Policy

Q: During the 7-year period of debt repayment, is there any scope for dividend payments to Nam Cheong shareholders?

Nam Cheong said it prioritises the repayment of its loans using cash generated from its vessel chartering business.

Dividends will only be considered once these loans are fully settled.

The company also indicated that prepayment of these loans is allowed, which could potentially expedite the timeline for dividend payments.

Nam Cheong's 1Q2024 financial statement (note 13) gives details of the repayment schedule.

• Vessel Deliveries and Shipbuilding Contracts

Q: How many vessels are outstanding from the China yards that Nam Cheong is to take delivery of? What is the delivery timeline? What about the financing? CEO Leong Seng Keat will be at the AGM on Thursday as well as meet investors for a 1Q2024 results briefing.The company said it had successfully managed its shipbuilding contracts with Chinese yards, with all remaining vessels either delivered or cancelled as of 31 March 2024.

CEO Leong Seng Keat will be at the AGM on Thursday as well as meet investors for a 1Q2024 results briefing.The company said it had successfully managed its shipbuilding contracts with Chinese yards, with all remaining vessels either delivered or cancelled as of 31 March 2024.

This resolution marks a significant milestone in Nam Cheong's efforts to restructure its liabilities and streamline operations.

• Shipbuilding Business Status

Q: What is the status of the shipbuilding business, which has had no revenue for several years already? Is there any opex & capex related to this segment?

Nam Cheong said it has maintained its shipyard at Kuala Baram in Sarawak with minimal operating costs and resources.

Despite a strong oil & gas industry, "the lack of long-term charters for new built offshore support vessels has made it difficult for potential buyers to obtain fresh funding from capital providers. As a result, the Group’s shipbuilding business has not found itself out of the woods and therefore has not received new orders for shipbuilding."

There is, however, a recent resurgence in demand for ships built with advanced technology, which makes Nam Cheong "optimistic about capturing new business opportunities in this sector."

• Revenue and Chartering Business

Q: What are the primary sources of revenue when chartering vessels?

Nam Cheong says it mainly serves national oil companies and oil majors in Malaysia on a time charter basis.

The short-term nature of these contracts allows the company to potentially benefit from higher rates in favorable market conditions.

The company's fleet, with an average age of about seven years, has contributed to a steady increase in revenue, from RM365.7 million in FY2022 to RM475.3 million in FY2023.

|

• Market Conditions and Strategic Outlook Q: How does Nam Cheong see market conditions evolving in the next few years? |

Recent times have been good for Nam Cheong so, barring another black swan event, will it finally sail through, progressively unload its debt, and leave its turbulent past behind?

There's still some overhang of Nam Cheong shares from creditors, who are eyeing an exit -- but perhaps it's a matter of time before they are gone?

That will allow the stock price more room for upward moves, assuming all goes well in the operating business, of course.