• There are several Singapore stocks that are perceived to be at inflexion points in their industry cycles, or at a turning point of sorts in their journey. • There are several Singapore stocks that are perceived to be at inflexion points in their industry cycles, or at a turning point of sorts in their journey. • Lim & Tan Securities mentioned examples in a client event last Friday evening. A Lim & Tan note this morning contains concise notes about these stocks, as excerpted below. • What's striking is that, except for Innotek, these stocks have not made big moves at all year-to-date: Venture (+3.2%), Innotek (+22%), CSE (0%), and Civmec (-2%). |

By Lim & Tan Securities

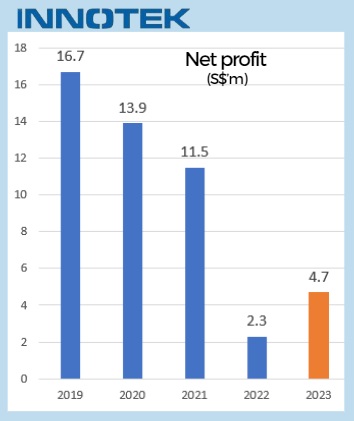

| • After a 10% decline in semiconductor sales in FY2023, Gartner and IDC Dataquest are both expecting the semiconductor industry to bounce back strongly in FY2024 by an estimated 13-17%. This is expected to benefit our technology & manufacturing stalwarts such as mega cap Venture Corp and mid-cap Innotek Ltd. Both companies have very strong and robust balance sheets with net cash accounting for 25% of Venture’s market cap and 50% of Innotek’s market cap. |

Venture’s business is very diversified and we expect the cyclical upturn of the tech/semiconductor sector to see a 10-15% growth of their net profit over the next 2 years, bringing last year’s PE ratio of 15x down to 14x and 12x respectively by 2025.

Dividend yield is attractive at just under 6%. • For Innotek Ltd, their existing businesses is expected to see a ramp up from Sony and Ricoh on the back of new product launches while the GPU server business from a major international Artificial Intelligence company is expected to see their Dongguan facility ramp up strongly to fulfill their robust backlog in orders from high end servers.

• For Innotek Ltd, their existing businesses is expected to see a ramp up from Sony and Ricoh on the back of new product launches while the GPU server business from a major international Artificial Intelligence company is expected to see their Dongguan facility ramp up strongly to fulfill their robust backlog in orders from high end servers.

Mgmt is targeting to turnaround their loss making overseas businesses in Thailand and Vietnam as they ramp up new orders.

Their other new businesses such as medical equipment, gaming, EV charging stations and semiconductor will also be contributing positively to FY2024’s performance.

Finally with their improving financial performance, their dividends have room for improvement from their usual 2 cts level.

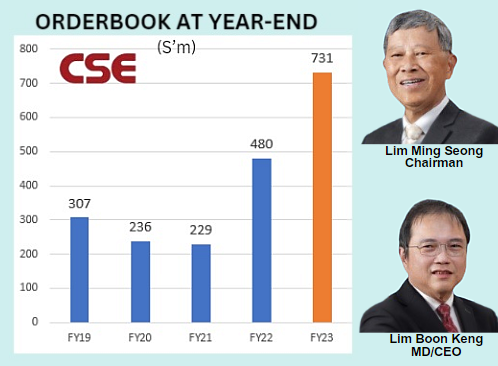

• CSE Global is expected to benefit from their record order wins towards the end of last year as Mgmt believes that the normalization of their supply chain should allow them to execute and deliver their orders.

Their businesses are also plugged into the current “Hot” sectors such as data centers, oil & gas, mining & minerals and serving the governments in Singapore & Australia (infrastructure segments).

Mgmt is confident that 2024 will be a growth year and consensus is expecting another 25-30% growth this year after last year’s 100% growth rate.

Div yield is an attractive 6.6%.

| • Finally, Civmec is in the midst of transferring their domicile from SG to AU and this change in domicile is expected to be completed by June’24. We believe this will be the catalyst for the company to be securing a lot more defense contracts from the Australia government as Civmec is only 1 of 2 companies in Australia to be approved to manufacture Naval Patrol Vessels for the Australia government.  Civmec’s order books have consistently exceeded the $1bln level which provides them with revenue visibility until as far as 2029. Its current forward yield of 7%, PE of 7x and PB of 1x is undemanding compared to its peer in Australia (Monadelphus) of 21x and 3x. We see a potential for significant re-rating once Civmec’s domicile is successfully transferred to Australia. |