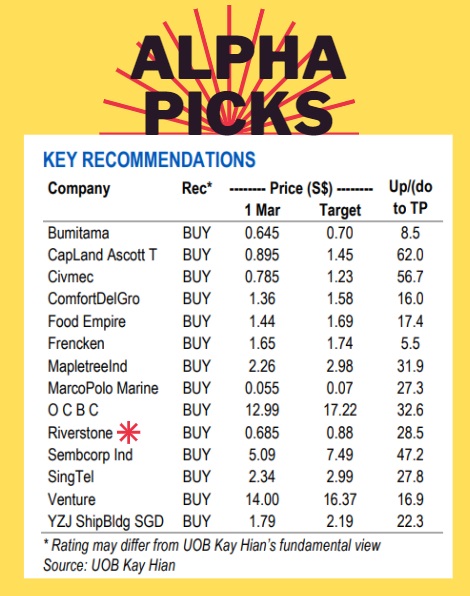

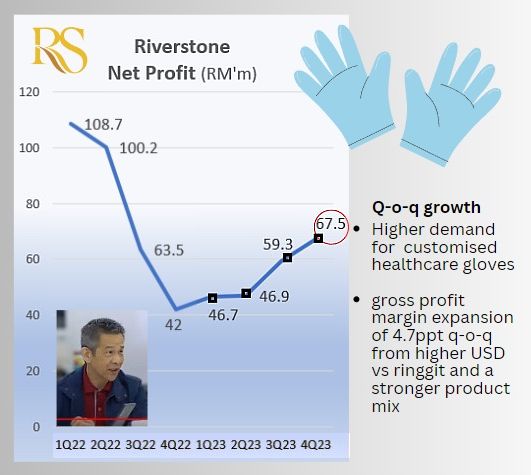

| • UOB Kay Hian puts out the monthly performance of its "alpha picks" portfolio. It has done decently, outperforming the FSSTI frequently. • In the latest report, UOB KH adds Riverstone Holdings to its portfolio while removing SATS and Valuetronics. • Riverstone, as we have said recently, has seen 4 consecutive quarters of profit growth, adding up to a profit that was higher than pre-pandemic levels. (See: While its peers continue to bleed, this company makes lots of profit -- & pays dividends). • There's some magic sauce that Riverstone has -- otherwise it wouldn't have consistently done well, especially post-pandemic when its peers have stumbled badly in the face of an industry oversupply of gloves.  • Read what UOBKH says about Riverstone below -- and its alpha picks portfolio .... |

Excerpts from UOB KH report:

| Alpha Picks: Outperformance Led By Small/Mid-Caps; Add RSTON; Remove SATS And VALUE Although the FSSTI recorded a decline of 0.4% mom in Feb 24, more than half of our picks, especially the small/mid-caps (Frencken, Marco Polo Marine and Food Empire), recorded decent gains. Our Alpha Picks portfolio rose 1.6% mom on an equal-weighted basis, outperforming the FSSTI by 2.0ppt. For Mar 24, we add Riverstone, and take profit on SATS and Valuetronics. |

• Reviewing our picks in February. Frencken and Marco Polo Marine delivered solid returns of 23.1% mom and 11.8% mom respectively, both of which still trade at attractive valuations.

Food Empire rose 6.7% mom as it reported record-high earnings last week and continues to see robust consumer demand.

Our underperformers include SembCorp Industries (-10.1% mom), which saw profit-taking after the results announcement on 20 February and Mapletree Industrial Trust (-5.2%), which was impacted by general market weakness in REITs.

ACTION

• Take profit on SATS and Venture; add Riverstone. For Mar 24, we include RSTON in our portfolio with expected sequential earnings growth and potential attractive dividend yield of 10% for 2024.

We remove SATS as it enters a seasonally quiet quarter, as well as Valuetronics due to lack of near-term catalysts.

Inset: Executive Chairman & CEO Wong Teek Son Inset: Executive Chairman & CEO Wong Teek Son• Riverstone’s cleanroom gloves, which contribute about 80% of earnings, are expected to see a recovery in demand, driven by new clients onboarded in the preceding year and improvement in the semiconductor industry in 2024. According to International Data Corporation (IDC), the semiconductor sales market is expected to recover with a 20% growth rate in 2024. This is also supported by the SEMI World Fab Forecast reporting 42 new projects in 2024, up from 11 in 2023.  John Cheong, analyst• Benefitting from higher-margin customised healthcare gloves. Riverstone is demolishing its 10-year-old production lines to build six newer lines for customised products that will be operational from 2H24. John Cheong, analyst• Benefitting from higher-margin customised healthcare gloves. Riverstone is demolishing its 10-year-old production lines to build six newer lines for customised products that will be operational from 2H24. This has allowed it to expand its gross margin substantially, as customised gloves fetch approximately 30% gross profit margin, around six times that of generic gloves. Moving forward, higher demand for customised healthcare gloves will drive higher margins for Riverstone. • Potential dividend increase backed by strong balance sheet. Pending approval, Riverstone declared a special interim dividend of 5.0 sen and a final dividend of 7.5 sen. Together with the first two interim dividends of 10.0 sen, 2023 total dividend totals to 22.5 sen (vs 34.0 sen in 2022), implying a payout ratio of 151.3% and dividend yield of 9% for 2023. Backed by its healthy cash balance of S$875.4m (about 87.5% of market cap) and operating cash flow, we expect 2024-26 payout ratio to be maintained at 140% to reward shareholders. This translates to an attractive dividend yield of 10% for 2024. • Maintain BUY with a 7% higher PE-based target price of S$0.88, pegged to 17.6x 2024F PE, or 1SD above the long-term historical mean. We think that Riverstone stands to benefit from its higher-margin customised glove offerings and the improving cleanroom glove demand-supply dynamics. SHARE PRICE CATALYSTS • Events: a) Higher-than-expected demand for cleanroom and healthcare gloves, b) higher dividend payouts. • Timeline: 3-6 months. |

Full report here.