|

Firstly, what does CAO do? CAO is the largest physical jet fuel buyer in the Asia Pacific region and the key supplier of imported jet fuel to the civil aviation industry of the PRC. The CAO Group engages in international trading of jet fuel and other oil products and owns investments in various strategic oil-related businesses including |

| What’s interesting about CAO? |

a) Analysts are positive; total potential return around 28.6%

Notwithstanding the limited coverage of CAO, Philip Securities and CGS-CIMB have ascribed a target price of $1.01 and $1.14 respectively.

OCBC also covers CAO with a target price $1.10 but it is not captured in Bloomberg.

Hence, average target price on CAO is $1.08.

Consensus estimates CAO’s FY24F dividend yield to be around 3.7%. All in, total potential return is around 28.6%.

Readers can refer to CAO’s analyst reports HERE for more information.

b) CAO trades in a tight range $0.840 – 0.885 for almost two months, before staging an upside breakout

For more content on the techicals, click here.

c) 30% increase in weekly international passenger flights in 2024 may bode well for CAO

Based on an article on Bloomberg dated 4 Jan, the Civil Aviation Administration of China projects international passenger flights may rise to 6,000 per week, up from the current 4,600.

At the start of 2023, there were fewer than 500 flights per week. This approximate 30% jump in weekly international passenger flights should bode well for CAO.

d) Strength in other travel-related Chinese stocks

One interesting company Trip.com (9961.HK), China-based company mainly engaged in the operation of one-stop travel platform has formed a bullish double formation and breached its neckline of around HKD281 on 4 Jan.

An eventual technical measured target is around HKD310. Amid the weakness in the Hong Kong market, Trip.com has seen some profit taking and is now testing its support around 273.60 – 273.80.

Although it has fallen below its neckline, this stock seems to have buying interest. Trip.com closed at HKD 278.80.

Hope that this buying interest will gradually filter down to other stocks which benefit from increase in outbound travelling from China.

|

e) Backed by net cash of around S$0.820 / share, 94.8% of its market cap CAO sits on a large pile of cash and cash equivalents amounting to around US$534.35m and zero net interest-bearing debt. |

| Risks |

a) Usual business risks

Slower-than-expected recovery in China’s international flight volumes, reduction in global travel (due to recession, another pandemic etc) may have an adverse impact on CAO.

b) Net cash per share may change depending on business requirements

As of 1HFY23, CAO had net cash US$534.35m. This amount may vary as sometimes, CAO may require funds for trading activities or other business activities.

c) Difficulty in predicting profitability for its trading business

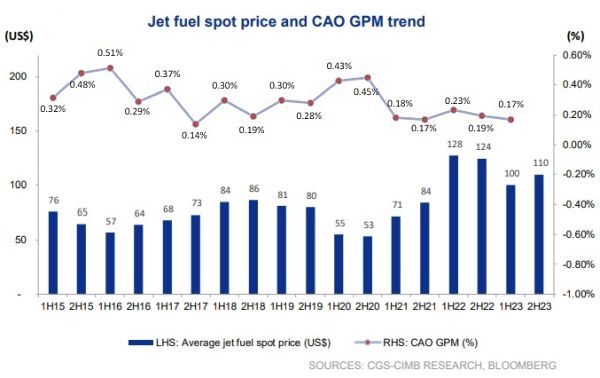

It is noteworthy that CAO has a small gross profit margin (GPM) in its trading of jet fuel.

A small change in GPM can have a material impact on CAO’s trading profits. [Based on CGS-CIMB report, CAO typically enjoys better margins when oil markets are in contango (forward price is higher than the spot price)].

This segment is difficult to successfully predict on a consistent basis.

d) Illiquidity

Although liquidity has improved in the past two weeks, average 30-day volume is only 351K shares traded per day. This is still not a liquid stock where we can get in or out easily.

|

Conclusion

Nevertheless, readers have to take note of the above risk factors, such as unpredictability in its trading GPM; illiquidity; and its exposure to China’s outbound travel. |

P.S: I have informed my clients about CAO approximately two weeks ago when it was trading around $0.855.

Disclaimer

Please refer to the disclaimer HERE