|

• It's 22 years since China Aviation Oil listed on the Singapore Exchange. It's the largest physical jet fuel trader in the Asia Pacific region and a key supplier of imported jet fuel to China's civil aviation industry. |

Excerpts from CGS-CIMB report

Analysts: Kennth Tan & Lim Siew Khee

China Aviation Oil: Expecting clearer skies

■ We attended CAO’s investor briefing held on 23 Aug. Management expects more trading opportunities in 2H23F, which should offer h-o-h GPM uplift.

■ Reiterate Add at an unchanged TP of S$1.14, based on 10x FY24F P/E. |

||||

| Looking forward to a better 2H23F |

We attended China Aviation Oil’s (CAO) investor briefing on 23 Aug, where management provided insights into the group’s outlook.

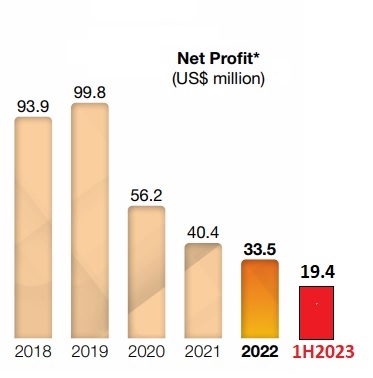

Management, led by Mr. Lin Yi (Chief Executive Officer), acknowledged that 1H23 results were dragged by

| 1) slow pace of international air traffic recovery in China, and 2) fewer trading opportunities when compared to a yoy basis. |

Based on comments from Ms Elizza Ding (Head of Trading), CAO is optimistic that the 2H23F trading environment will be better, led by increased jet fuel transportation opportunities between Asia and US/Europe/Middle East.

That said, the group still expects jet fuel markets to remain in backwardation over the near term (we note that CAO has historically enjoyed better GPM in contango as opposed to backwardation).

| Staying positive on the back of acceleration in flight volumes |

CAO is optimistic that China’s international air traffic volumes will pick up in 2H23F as the Chinese government is actively pushing for increased outbound tourism. Recent supportive policies announced include:

| 1) removal of all pre-entry Covid-19 testing for travellers entering China (announced on 28 Aug), and 2) resumption of outbound tour groups to 78 countries (announced on 10 Aug). |

Improved tourism activities from China’s National Day holiday (1-6 Oct) could spur outbound flights further, in our view.

According to flight data provider CAPA, forward booking data (Fig 1) indicates that China’s international flight capacity (measured by seats) could recover to c.58% of pre-Covid-19 levels by end-Oct 23 (c.52% as of end-Aug 23).

As such, we reaffirm our view that accelerated recovery in outbound flight volumes in 2H23F should lead to better jet fuel supply volumes for CAO’s core China business and increased contribution from 33%- owned associate SPIA.

Management said it is still on the lookout for M&A opportunities and in discussions with some parties but these are still in the preliminary stages; sustainable aviation fuel (SAF) was highlighted as a potential expansion opportunity.

We expect CAO to enjoy sustained earnings recovery over FY23-25F from continued travel recovery, and we reiterate Add at an unchanged TP of S$1.14, still based on 10x FY24F P/E (FY10-19 average). |

Full report here.