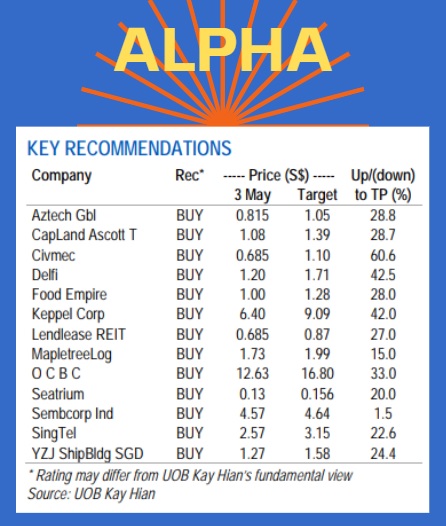

Food Empire is one of 13 stocks in UOB KH's alpha portfolio which has now beaten the STI in 13 out of the past 14 months.

| Food Empire – BUY (analyst: John Cheong) |

• Good entry point for a regional coffee mix player.  John Cheong, analystTrading at 8x 2023F PE vs peers’ average of >13x, Food Empire’s (FEH) valuation is due for a re-rating, in our view. John Cheong, analystTrading at 8x 2023F PE vs peers’ average of >13x, Food Empire’s (FEH) valuation is due for a re-rating, in our view.• Strong demand for consumer staple products. Despite rising inflationary pressures and ASPs, FEH does not see major changes in consumption patterns. Given the consumer-staple nature of FEH’s products, demand is relatively price inelastic. FEH’s products in the coffee segment continue to be affordable with mass appeal, leading to stronger demand in 2022. |

• We expect higher earnings and improved margins moving forward.

|

Higher margins |

|

|

2022 core earnings of US$45.1m (+134% yoy) outperformed our expectations.

Revenue grew 25% yoy mainly from both the Russia and Ukraine, Kazakhstan and Commonwealth of Independent States (CIS) markets, with each recording a 29% yoy increase on the back of strong demand and higher ASP despite currency volatilities.

Although revenue from the Southeast Asia segment fell 4% upon post-pandemic normalisation in Vietnam, the new capacity expansion of its non-dairy creamer facility is currently underway and expected to contribute in 4Q23.

Core net profit margin also expanded a substantial 5.3ppt to 11.3% in 2022, indicating the group’s successful cost-control measures and optimised operations. With further normalising of key costs, margins will likely improve in 2023.

• Maintain BUY. Our target price of S$1.28 is based on 10.5x 2023F EPS, or its long-term historical mean.

SHARE PRICE CATALYST

a) Better-than-expected earnings or dividend surprise, and b) improving net margin from better-than-expected ASPs and easing of key costs including freight and raw material costs. • Timeline: 3-6 months. |

||||

Full report here.