Excerpts from Maybank KE report

Analyst: Jarick Seet

| Initiate BUY with a 12-month TP of SGD1.20 |

Instant beverage maker Food Empire (FEH) trades at just 7.4x core FY22 P/E compared to its global peer average of c.27x P/E.

We believe FEH is an attractive takeover target given its low valuations and market leadership position in the 3-in1 beverage space. With an expected record FY22E and the sale of its industrial unit in 2022, we anticipate the group to reward shareholders with a special dividend for a total FY22E payout of SGD0.04. We initiate coverage with a BUY and 12-month TP of SGD1.20, based on an undemanding 11x FY23E P/E. |

||||

| Resilient business + Ukraine ceasefire a catalyst |

Food Empire's best-selling MacCoffee in markets such as Russia. NextInsight file photoAs of 9M22, revenue grew 27% YoY to USD286m driven by growth across all geographical segments, including Russia and Ukraine.

Food Empire's best-selling MacCoffee in markets such as Russia. NextInsight file photoAs of 9M22, revenue grew 27% YoY to USD286m driven by growth across all geographical segments, including Russia and Ukraine.

Net margins have also improved significantly from 6.4% in 9M21 to 17.4% in 9M22, aided by higher ASPs. This demonstrates that the Russia-Ukraine war is not hurting operations in FEH’s largest market.

A ceasefire or the end of the conflict could result in a major stock re-rating, in our view.

While FEH is not subject to sanctions, its valuation took a huge hit when war broke out and could recover sharply on a truce, we believe.

| Special DPS likely and share buyback to continue |

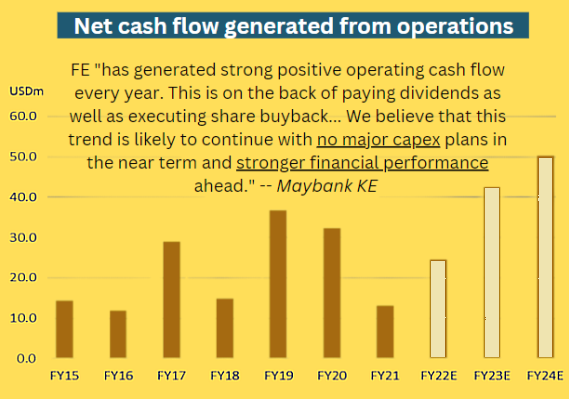

With record profits expected this year followed by the sale of its industrial building, we expect management to reward its shareholders handsomely with a special dividend.

We are forecasting FY22E DPS to total SGD0.04, which implies a decent yield of over 5%.

In addition, FEH has been and is still undertaking significant share-buybacks in the open market. Since Aug 2022, it bought back 5.95m shares and as high as SGD0.82/share in 2021.

| Potential takeover target given attractive valuations |

"We are forecasting FY22E dividend per share to total SGD0.04, which implies a decent yield of over 5%." "We are forecasting FY22E dividend per share to total SGD0.04, which implies a decent yield of over 5%."-- Jarick Seet, analyst |

FEH is currently trading at 7.4x core FY22E P/E, a steep discount versus both its private and listed valuations of global peers.

As such, we think that it could be an attractive target for bigger competitors given its strong presence in Russia and Vietnam.

Note that Super Coffee (not listed) was previously taken over by Jacobs Douwe Egberts (not listed) for SGD1.35b, 30x FY16 P/E in 2017.

Full report here.