Excerpts from CGS-CIMB report

Analyst: Ong Khang Chuen, CFA

Riverstone Holdings

Staying nimble during challenging times

■ 3Q22 net profit of RM63m (-76% yoy) in line with expectations; RSTON commenced quarterly dividend payout to return excess cash to shareholders.

■ Reiterate Hold. While competitive environment for glove industry is unlikely to improve near term, downside could be capped by generous div. yield of 8%.  |

||||

3Q22: Commencement of quarterly dividend payout

Riverstone Holdings’ (RSTON) 3Q22 net profit fell to RM63m (-37% qoq, -76% yoy), with further normalisation of ASPs, but continues to outperform larger scale Malaysian-listed peers (Hartalega: RM28m; Kossan: RM23m), given its differentiated focus on cleanroom gloves.

Results were in line with expectations, with 9M22 net profit coming in at 85%/80% of our/Bloomberg consensus’ FY22F.

With the recent adoption of voluntary quarterly reporting, RSTON declared a second interim dividend of 6 sen. YTD, its DPS totalled 16 sen, translating into a dividend payout ratio of 87% or a dividend yield of 8.1%.

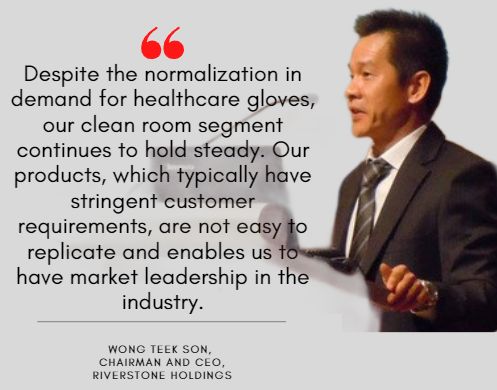

Cleanroom expected to hold steady

Despite recent headlines on a semiconductor industry slowdown, RSTON continues to see a steady outlook for its cleanroom segment and expects glove ASPs to remain resilient at c.US$100 (per 1k pieces) for the next 12 months.

While cleanroom volumes dipped in 3Q22, RSTON notes that utilisation rate of its cleanroom processing facilities remained healthy at 85%-90%, helped by strong demand from the pharmaceutical industry and new customer wins. RSTON looks to further expand its cleanroom processing capacity by c.500m gloves p.a. by FY23F and is on the lookout for inorganic growth opportunities.

Focusing on being nimble amid healthcare glove weakness

Healthcare glove ASPs continue to be on the decline, with industry oversupply and overstocking during the pandemic, with no signs of easing in the near term. RSTON saw its capacity utilisation rate drop to c.50% in 3Q22 and believes competition could remain intense, especially in the production of generic nitrile gloves. It is actively modifying its production lines to increasingly cater for specialty/customised products, which are usually in smaller order volumes and require nimble manufacturing capabilities.

Currently,specialty products make up c.30% of RSTON’s healthcare revenue, helping it achieve higher ASPs vs. peers, at US$26 (per 1k pieces) in 3Q22.

Reiterate Hold Ong Khang Chuen, CFA, analystReiterate Hold. While we think that fundamentals may remain weak in FY23F, given the competitive environment in the glove industry, we believe downside risks can be capped with its FY23-24F c.7.5% dividend yields as RSTON plans to distribute excess cash on its balance sheet (end-Sep 22: net cash of RM1.26bn). Ong Khang Chuen, CFA, analystReiterate Hold. While we think that fundamentals may remain weak in FY23F, given the competitive environment in the glove industry, we believe downside risks can be capped with its FY23-24F c.7.5% dividend yields as RSTON plans to distribute excess cash on its balance sheet (end-Sep 22: net cash of RM1.26bn).We lower our FY23-24F EPS by 2.1-3.8% to account for lower production volume assumptions. Our TP is lowered to S$0.62, pegged to 14.5x CY23F P/E (1 s.d. below RSTON’s 5-year pre-Covid historical mean). |

Upside risks include higher dividend payout and continued resilience in cleanroom demand; downside risks include a prolonged weakness in healthcare glove ASPs.

Full report here.