Excerpts from UOB KH report

Analysts: Heidi Mo & John Cheong

3Q22 core earnings of US$12m (+274% yoy/+45% qoq) was above expectations, while 9M22 core earnings of US$31m formed 97% of our full-year estimates.

We believe earnings growth will continue as demand in all markets remains strong. We raise 2022 and 2023 core earnings by 14% and 12%. Maintain BUY. Target price: S$0.78.  |

||||

RESULTS

• Results above expectations due to higher average selling prices and one-off gain.

| "The record-high revenue was mainly driven by higher average selling prices (ASP) across most of the Group’s business segments and a favourable sales mix of products with higher margins." |

Food Empire Holdings’ (FEH) 3Q22 core earnings of US$12m (+274% yoy, +44% qoq), excluding disposal and forex gain, outperformed our expectations, with 9M22 forming 97% of our full-year estimates.

The record-high revenue was mainly driven by higher average selling prices (ASP) across most of the Group’s business segments and a favourable sales mix of products with higher margins.

Additionally, there was a one-off gain of US$15m from the disposal of non-core assets.

With the easing of commodity prices, record-high ocean freight rates, supply chain delays and start-up costs arising from the commencement of the group’s new freeze dry coffee plant in India, gross margin improved by a significant 3.3ppt yoy to 29%.

Also, selling and marketing expenses declined 22% for 9M22, as lesser marketing was required, given the stronger-than-expected demand for FEH’s products. Examples of Food Empire's instant coffee products sold in Ukraine. Sales of Food Empire's products in the country have risen this year despite the war with Russia.

Examples of Food Empire's instant coffee products sold in Ukraine. Sales of Food Empire's products in the country have risen this year despite the war with Russia.

• Revenue growth across all markets. Revenue for 9M22 grew 26.5% yoy mainly from the South-Asia market, which recorded a 190.7% yoy increase. Its largest market, Russia, reported revenue growth of 15.5%, while the second largest market, Southeast Asia recorded an 8.4% rise in revenue. The third largest market which consists of Ukraine, Kazakhstan and Commonwealth of Independent States (CIS) also achieved a 27.7% yoy revenue growth despite ongoing supply chain disruptions amid geopolitical tensions.

This indicates that the group’s optimised operations and maintenance of adequate inventory levels has successfully mitigated the impact of market challenges faced.

STOCK IMPACT

• Demand remains resilient. Despite rising inflationary pressures and ASPs, the business does not see major changes in consumption patterns. Given the consumer-staple nature of FEH’s products, they are relatively price inelastic. For instance, the group’s products in the coffee segment continues to be affordable enough for mass appeal, leading to sustainable or even stronger demand in the nine months that ended. Hence, we see that sales volumes are more sheltered from the market volatilities. With supply chain disruptions easing in some markets, we forecast higher earnings and improved margins moving forward.

• Positive brand equity built. Despite challenges in 9M22 including geopolitical tensions in its core markets and rising inflation, the group has managed to generate record-level profits.

Additionally, the group is once again recognised as the Top 100 “Most Valuable Singaporean Brands” by Brand Finance for the twelfth consecutive year, with estimated brand value increasing 17% yoy to US$101m. We believe this is a testament to its strong brand equity. FEH also continues to look toward market expansion, such as its plans to scale its operations in Malaysia with a new factory expected to be completed in 2024.

EARNINGS REVISION/RISK

• We raised our 2022/23/24 core earnings estimates by 14%/12%/8% to S$36m/37m/40m, up from S$32m/33m/37m to reflect the better-than-expected core earnings for 9M22 and improving net margins from the successful increase of products’ ASPs as well as easing freight and raw material costs.

Also, we raised our revenue estimates for 2022/23/24 by 19%/16%/12% to reflect the better-than-expected product demand.

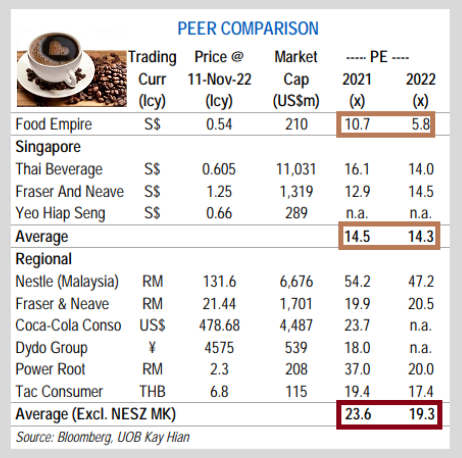

VALUATION/RECOMMENDATION John Cheong, analyst• Maintain BUY with a PE-based target price of S$0.78 (S$1.30 previously), as we lower our P/E Peg to 8.4x 2023F EPS, or 1SD below its long-term historical mean. John Cheong, analyst• Maintain BUY with a PE-based target price of S$0.78 (S$1.30 previously), as we lower our P/E Peg to 8.4x 2023F EPS, or 1SD below its long-term historical mean. Previously, we were valuing FEH at 16.6x 2022F EPS, or 1SD above its long-term historical average. The reduction in the PE peg is to reflect the political uncertainties in Russia and Ukraine, which are the key markets of FEH. |

SHARE PRICE CATALYST

• Better-than-expected sales volumes across all business segments.

• Improving net margin from better-than-expected ASPs and easing of key costs including

freight and raw material costs.

Full report here.