Rex International Holding Ltd (REXI SP): More catalysts for oil

- BUY Entry – 0.330 Target – 0.365 Stop Loss – 0.310

- Rex International Holding Limited operates as an independent oil exploration and production company. It operates through Oil and Gas, and Non-Oil and Gas segments. The company offers Rex Virtual Drilling, a liquid hydrocarbon indicator, which uses seismic data to search for oil. The company is involved in the oil and gas exploration and production activities with a focus in Oman and Norway.

- Russian oil ban. Yesterday, European Union leaders agreed to pursue a partial ban on Russian oil, paving the way for a sixth package of sanctions to punish Russia and its president, Mr Vladimir Putin, for the invasion of Ukraine.

The sanctions would forbid the purchase of crude oil and petroleum products from Russia delivered to member states by sea but include a temporary exemption for pipeline crude. This immediately covers more than two-thirds of oil imports from Russia, cutting a huge source of financing for its war machine. Officials and diplomats still have to agree on the technical details and the sanctions must be formally adopted by all 27 nations.

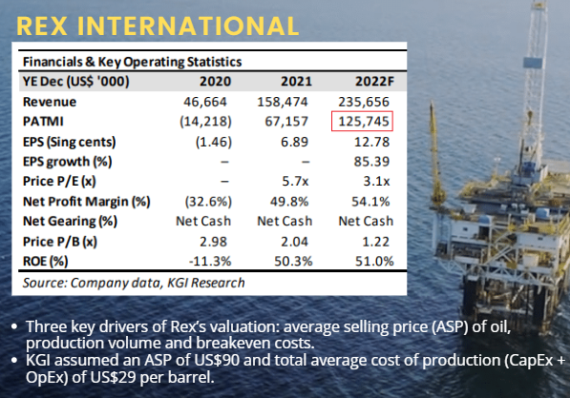

Harvest time for oil & gas companies. On 28 Feb, Rex reported FY2021 net profit of US$78.9mn, a significant turnaround from the US$15.2mn loss in FY2020. This was on the back of US$67 per barrel average realised oil price in FY2021, almost double compared to US$34 it realised in FY2020. - Positive consensus estimates. According to Bloomberg consensus estimates, the company currently has a rating of 3 BUYS, 0 HOLD and 0 SELL, with a 12M TP of S$0.58, representing approximately a 70.6% potential upside as of 31 May 2022.

- While we have a technical buy TP of S$0.365, we have a fundamental outperform rating and TP of S$0.54 based on DCF-backed valuations. Read our fundamental report here.