| From time to time, investors may come across stocks trading at their cash value plus having a large untapped resource asset. Often the reaction, at least initially, is: This is too good to be true. Rex International Holdings (RIH) currently trades at its cash value and net asset value. Its US$114 million total cash (including cash equivalents and quoted investments) per share as at end-2023 works out to be 9 US cents. That's 12.5 Singapore cents per share, which is what the stock recently traded at.  Its Net Asset Value per share was also 12.5 Singapore cents. Cash aside, what Rex has is 9 million barrels of oil reserves -- in the ground. |

Rex has borrowings in the form of issued bonds. As at end-2023, the outstanding amount was approximately US$101 million.

Amortisation - ie repayment -- in 2024 will total approximately US$36.1 million, says the company.

Shareholders of Rex are disappointed at where the stock price has been trading: It's down 60+% over the past 2 years.

At the recent AGM, one of them asked for the estimated inherent value of Rex.

The Executive Vice Chairman responded that an oil & gas company is typically valued on its reserves and resources. The Rex Group had about 9 million barrels of oil reserves.

| "The Company had taken the opportunity to ‘clean house’ and should be in a more robust situation going forward." |

"Taking the current oil price of US$90 a barrel and the current production volume of about 10,000 barrels per day (“bpd”), the potential value of Rex could be estimated."

That's reported in the just-released minutes of the AGM held in April 2024.

The vice-chairman further said the daily production by Rex would be improved through its investments in Norway and Africa.

Another shareholder commented that the Company had oil & gas activities in several countries and yet its share price was not performing well like another Singapore-listed oil & gas firm, which was producing oil only in Indonesia. (Read: RH Petrogas).

He asked what could have caused the Rex share price to fall substantially. Despite high oil prices, Rex’s profits were very lumpy.

He also asked what was to be expected from Rex in 2024, in terms of outlook and strategies.

The Chairman replied that that it may not be entirely fair to compare Rex with the said company as Rex had a larger shareholder base of over 4,000 shareholders and free float of 56.13%.

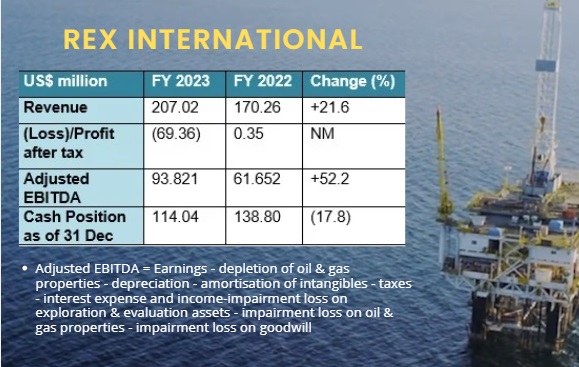

A larger free float could lead to more volatility in the stock price, in tandem to changing market sentiments, he said. The Company had a strong cash position but negative results because of substantial write-offs, reporting a loss after tax due to the impairment of oil and gas properties, exploration and evaluation assets, non-cash goodwill impairment and depletion from produced oil and gas.

The Company had a strong cash position but negative results because of substantial write-offs, reporting a loss after tax due to the impairment of oil and gas properties, exploration and evaluation assets, non-cash goodwill impairment and depletion from produced oil and gas.

Further, Rex had a more complex multinational portfolio (Norway, Oman and Benin in West Africa).

Rex is the only international oil & gas exploration & production company listed in Singapore, but has no research analyst coverage in Singapore.

"Despite that, RIH posted a strong positive EBITDA and good cash position for FY2023. Efforts had been made to increase the production and reserves in Norway and Oman."

Executive chairman Dan Brostrom bought 1 million Rex shares in March 2024. His total holding: 12.3 million. Details here. (Aged 80, he retired after the AGM) |

The Chairman added that he had bought 1 million Rex shares a month ago.

The CEO shared that Rex’s EBITDA was four times higher than the other Singapore-listed oil & gas company.

However, the Company faced challenges in getting research coverage and investor understanding of the Group’s business in the local market.

The AGM minutes said: "The Company had a strong cash position but negative results as there had been substantial write-offs, reporting a loss after tax due to the impairment of oil and gas properties, exploration and evaluation assets, non-cash goodwill impairment and depletion from produced oil and gas."

"The Company had taken the opportunity to ‘clean house’ and should be in a more robust situation going forward," according to the AGM minutes.

For the full AGM minutes including Q&A, click here.